Key Highlights

- GBP/USD started a recovery wave above the 1.2550 resistance zone.

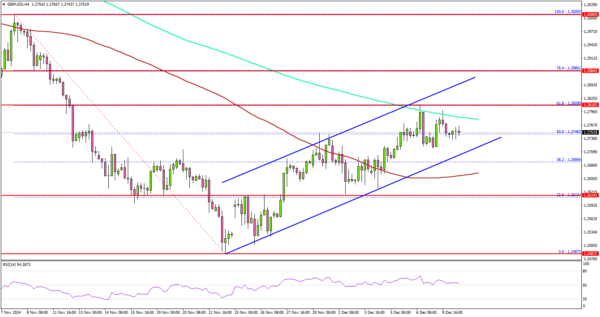

- A key rising channel is forming with support near 1.2720 on the 4-hour chart.

- Gold prices could accelerate higher toward $2,700 or even $2,720.

- USD/JPY is recovering losses and might test the 152.50 resistance.

GBP/USD Technical Analysis

The British Pound started a recovery wave above the 1.2450 and 1.2550 levels against the US Dollar. GBP/USD climbed above 1.2620 to move into a short-term positive zone.

Looking at the 4-hour chart, the pair surpassed the 50% Fib retracement level of the downward move from the 1.3009 swing high to the 1.2487 low. The pair recovered above the 1.2720 resistance level and the 100 simple moving average (red, 4-hour).

On the upside, the pair could face resistance near the 1.2800 level and the 200 simple moving average (green, 4-hour). It is close to the 61.8% Fib retracement level of the downward move from the 1.3009 swing high to the 1.2487 low.

The first major resistance is near the 1.2885 level. A close above the 1.2885 level could set the tone for another increase. The next major resistance could be the 1.2965 level, above which the price could climb higher toward the 1.3000 resistance.

On the downside, immediate support sits near the 1.2720 level. There is also a key rising channel forming with support near 1.2720 on the same chart. The next key support sits near the 1.2650 level. Any more losses could send the pair toward the 1.2580 level.

Looking at Gold, the price remained in a positive zone and the bulls could soon aim for a move above the $2,700 level.

Upcoming Economic Events:

- US Consumer Price Index for Nov 2024 (MoM) – Forecast +0.2%, versus +0.2% previous.

- US Consumer Price Index for Nov 2024 (YoY) – Forecast +2.7%, versus +2.6% previous.

- US Consumer Price Index Ex Food & Energy for Nov 2024 (YoY) – Forecast +3.3%, versus +3.3% previous.