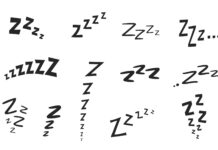

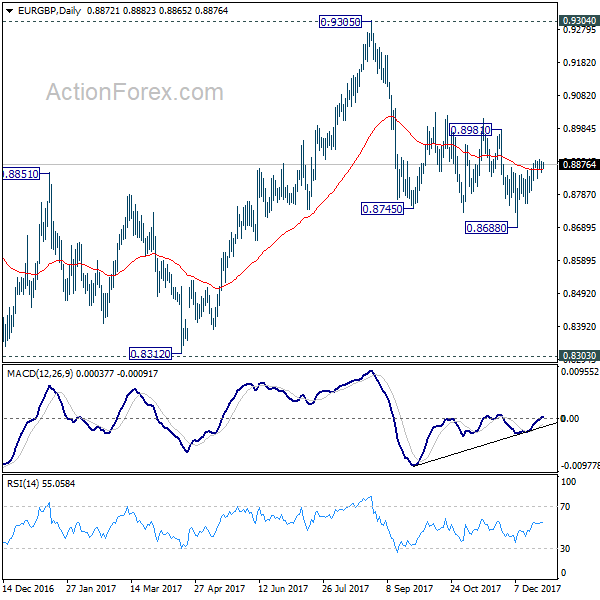

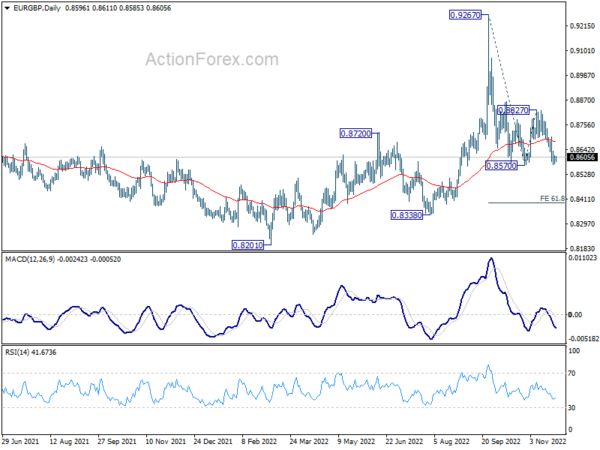

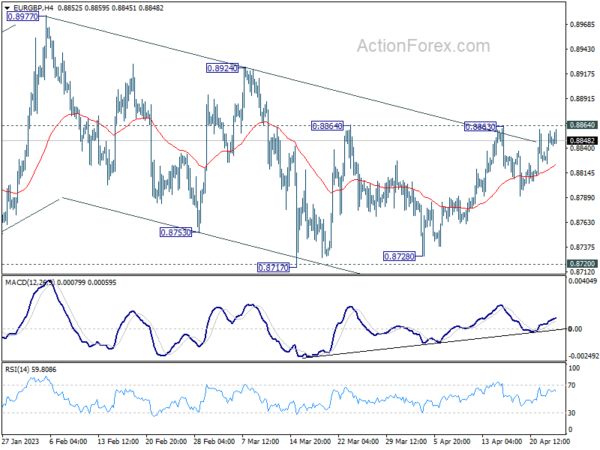

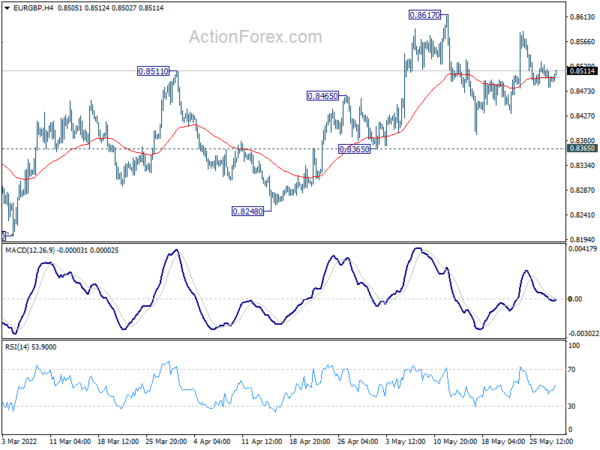

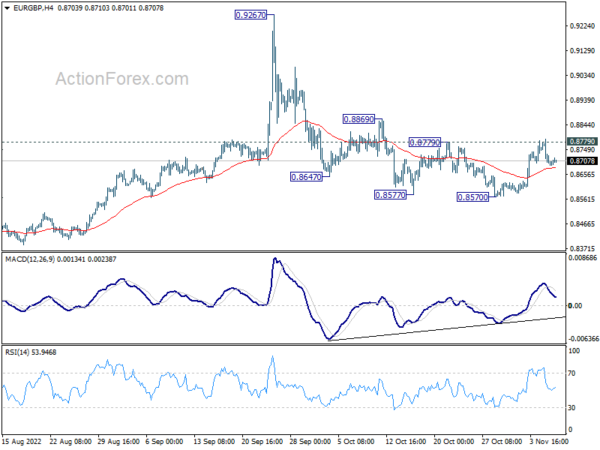

Daily Pivots: (S1) 0.8823; (P) 0.8852; (R1) 0.8889; More…

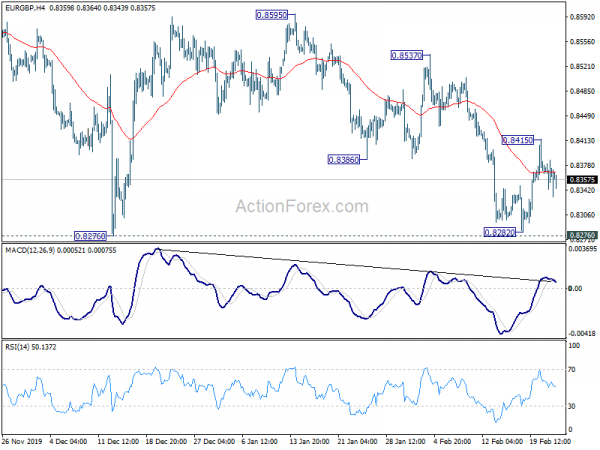

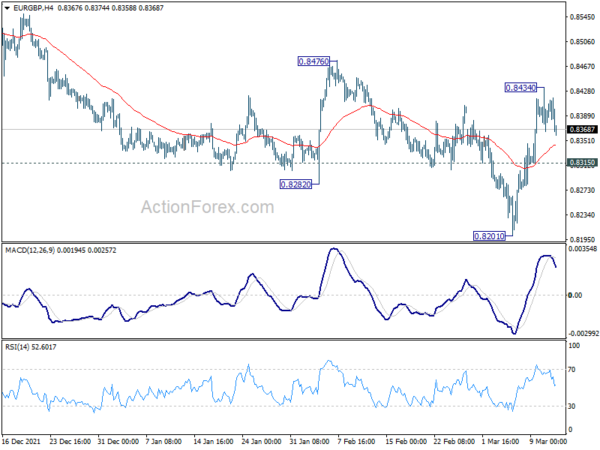

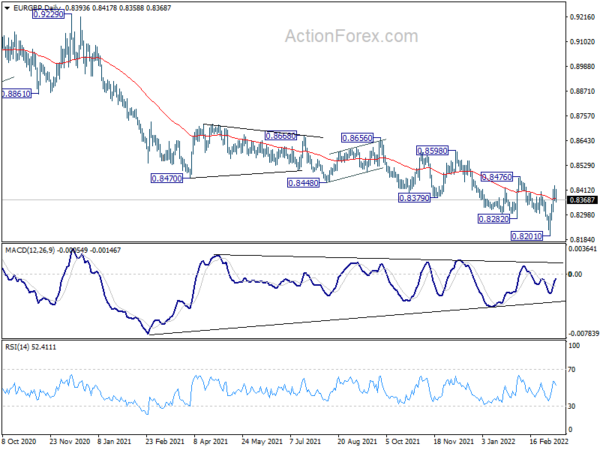

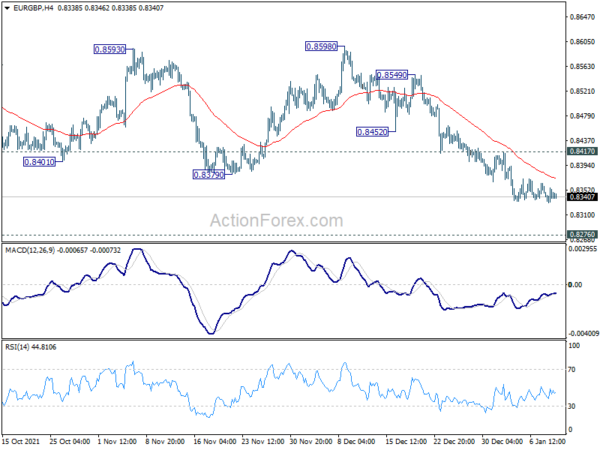

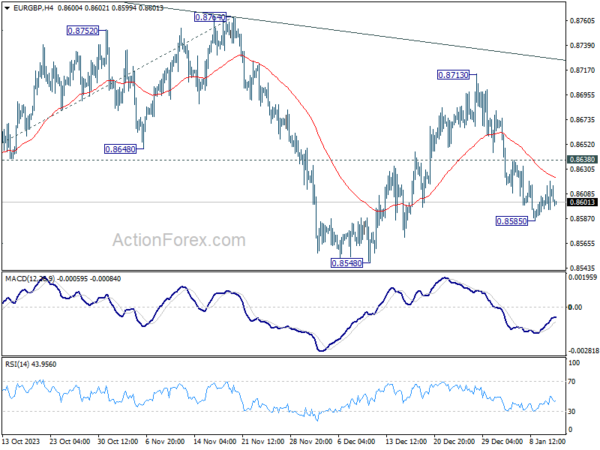

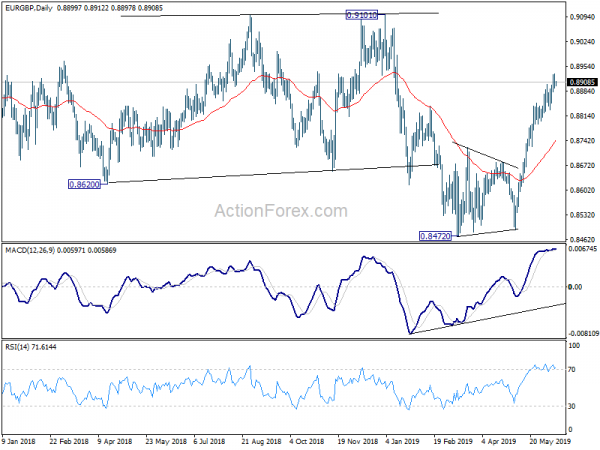

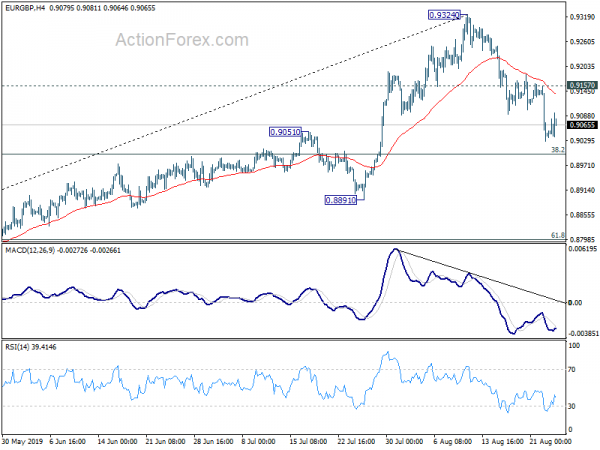

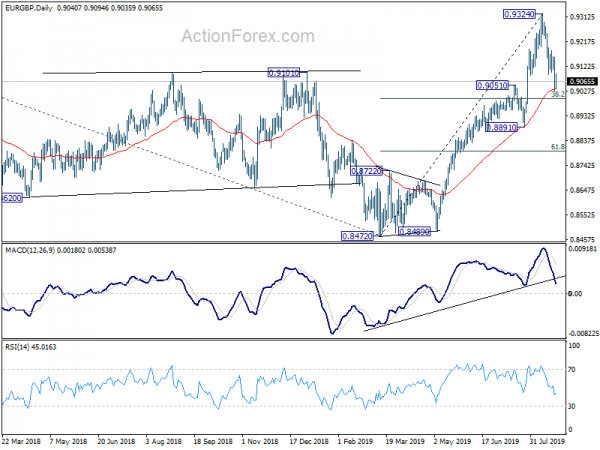

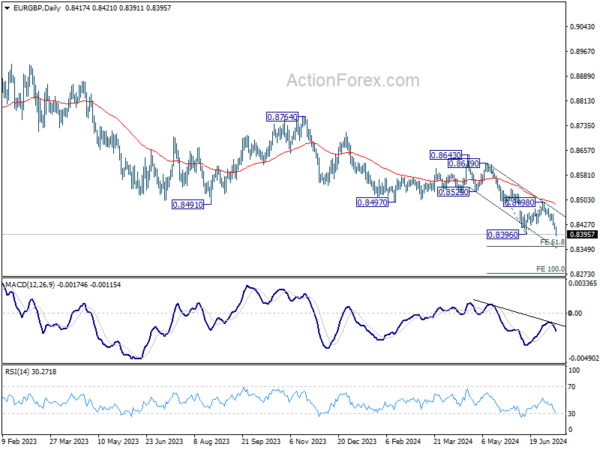

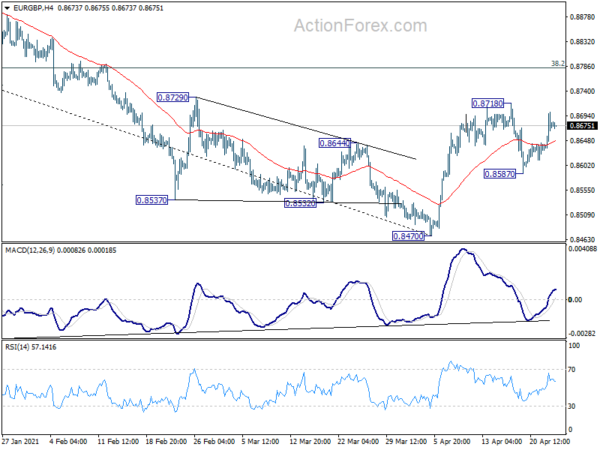

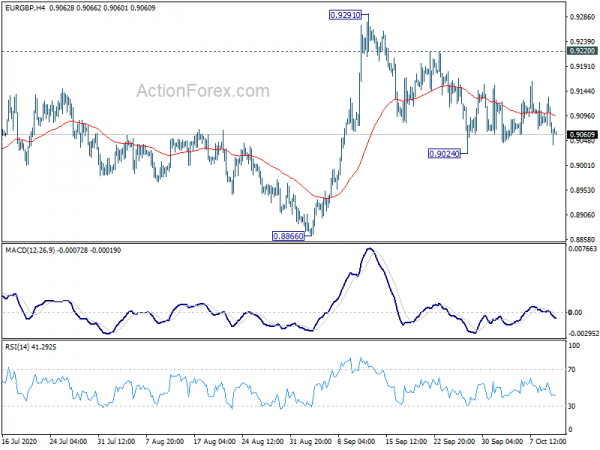

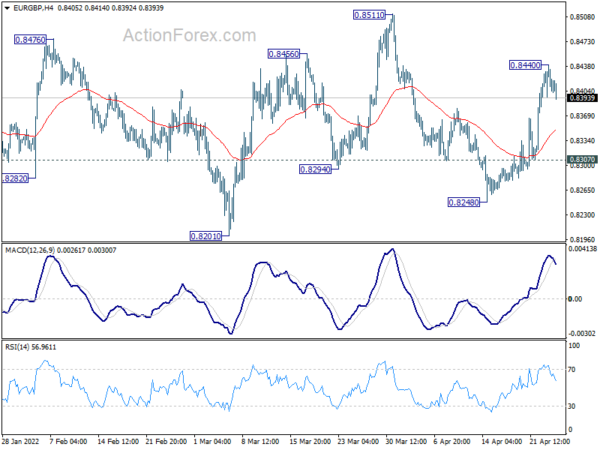

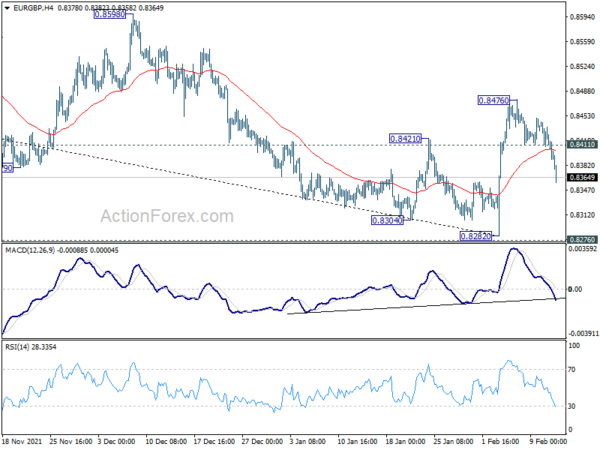

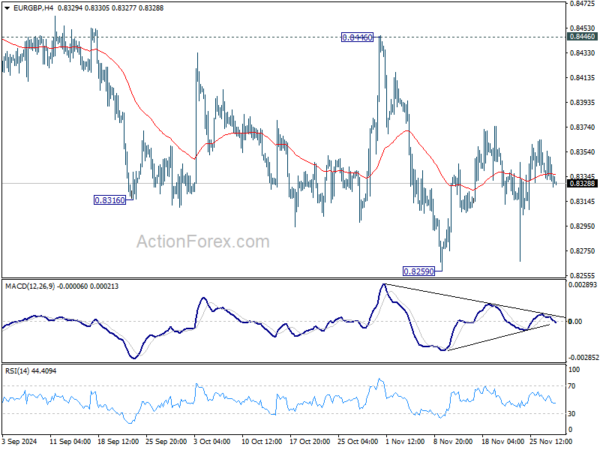

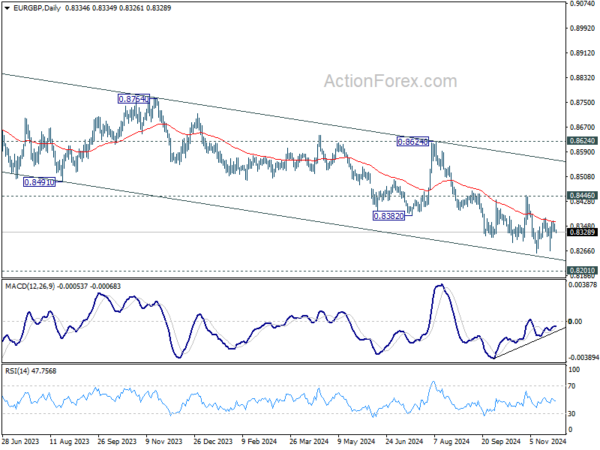

Intraday bias in EUR/GBP remains neutral at this point. On the downside, sustained break of 61.8% retracement of 0.8472 to 0.9324 at 0.8797 will extend the fall from 0.9324 towards 0.8472 key support next. However, considering bullish convergence condition in 4 hour MACD, break of 0.8894 minor resistance will indicate short term bottoming. Intraday bias would then be turned back to the upside for 55 day EMA (now at 0.8969).

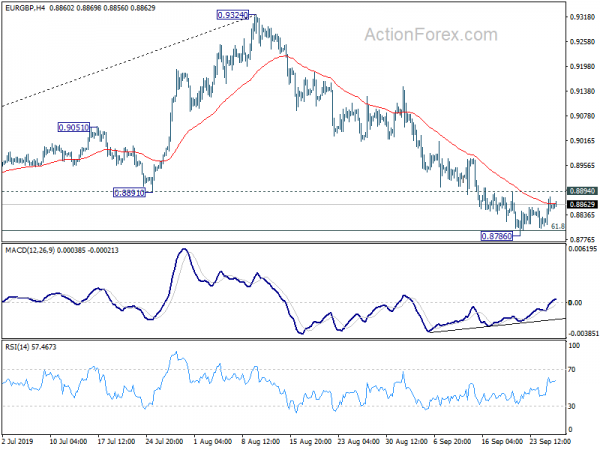

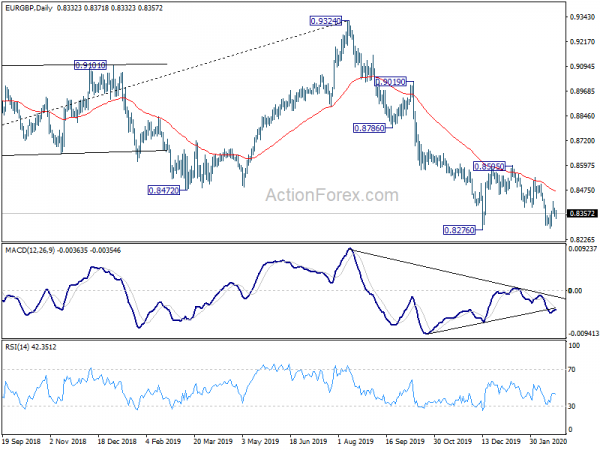

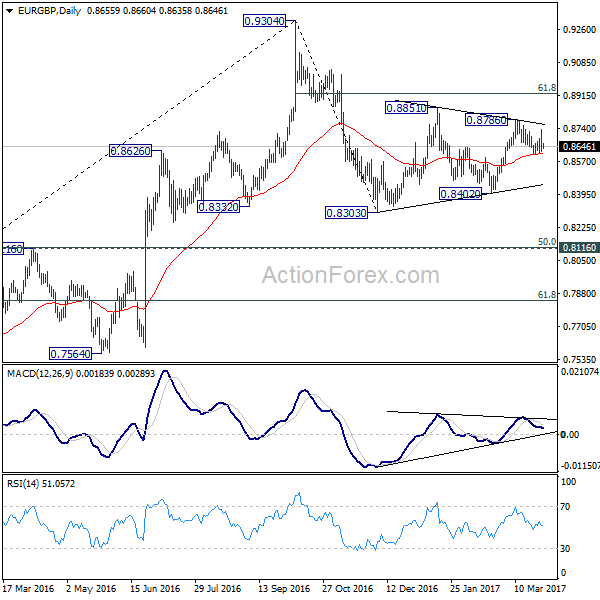

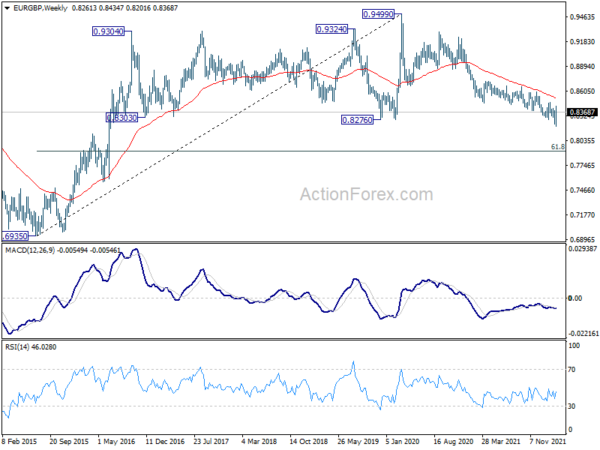

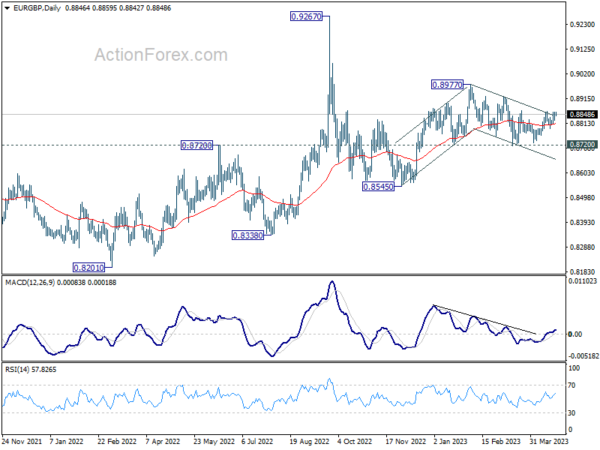

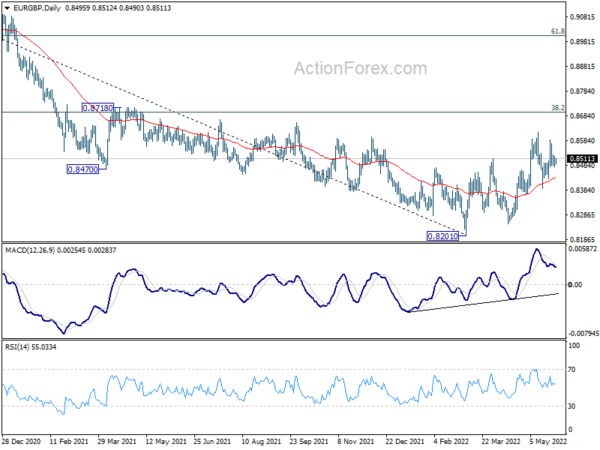

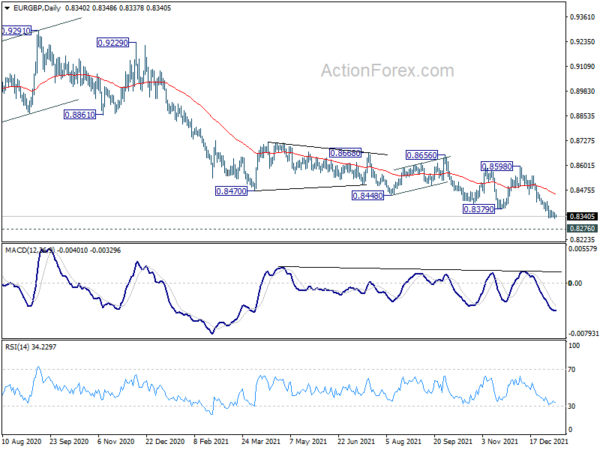

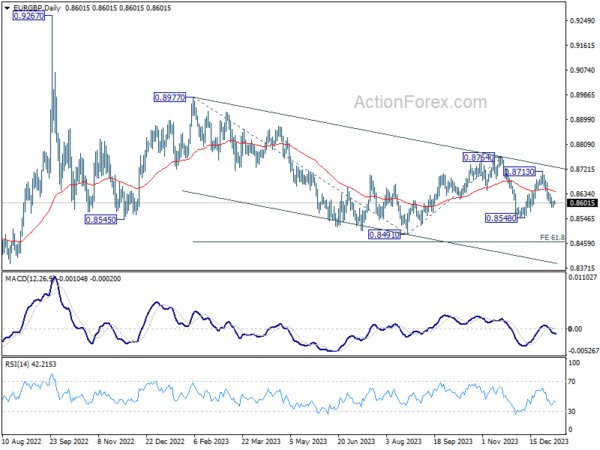

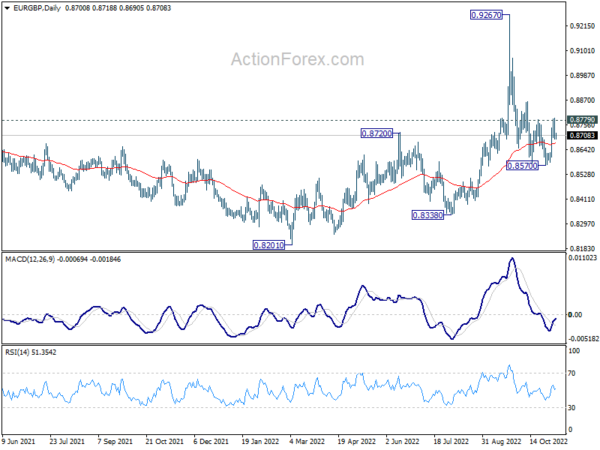

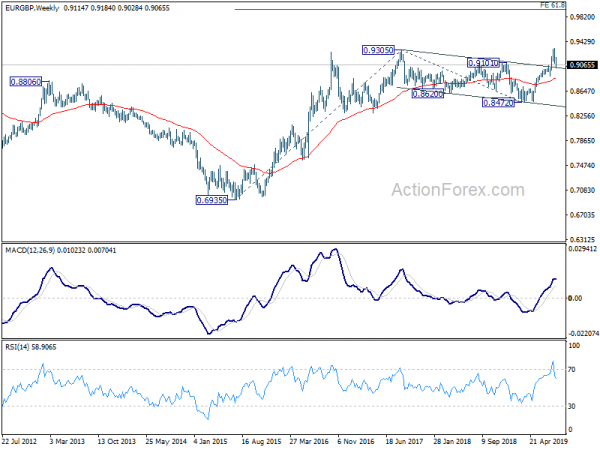

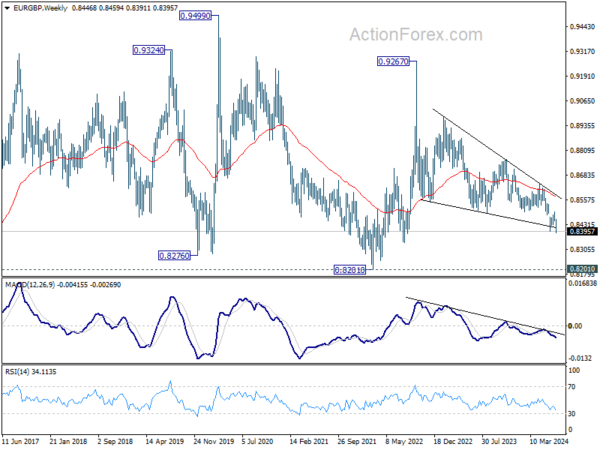

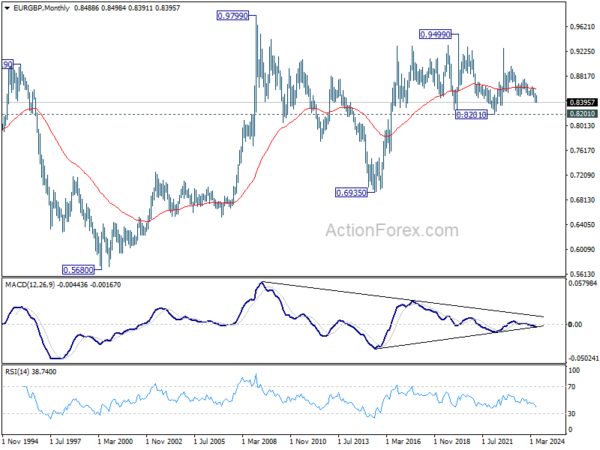

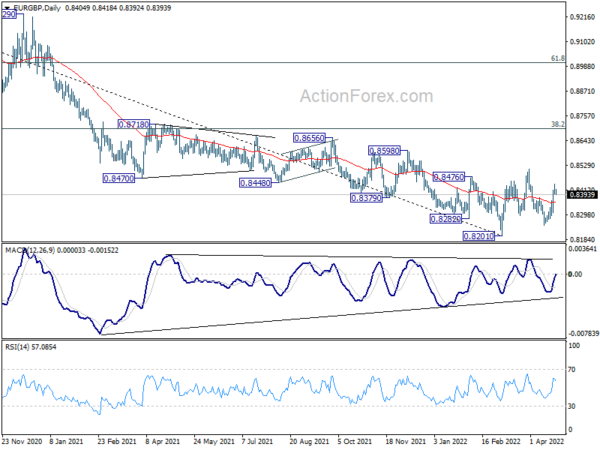

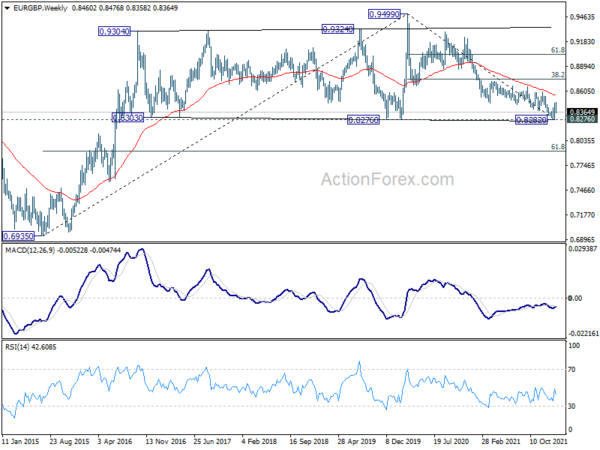

In the bigger picture, the failure to sustain above 0.9305 (2017 high) suggests that consolidation from there is extending. Breach of 0.8472 cannot be ruled out but downside should be contained by 38.2% retracement of 0.6935 (2015 low) to 0.9305 at 0.8400. On the upside, firm break of 0.9327 will confirm up trend resumption.