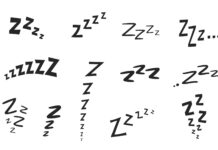

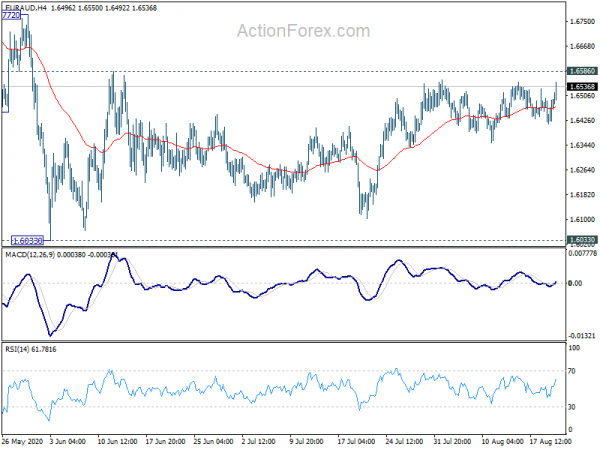

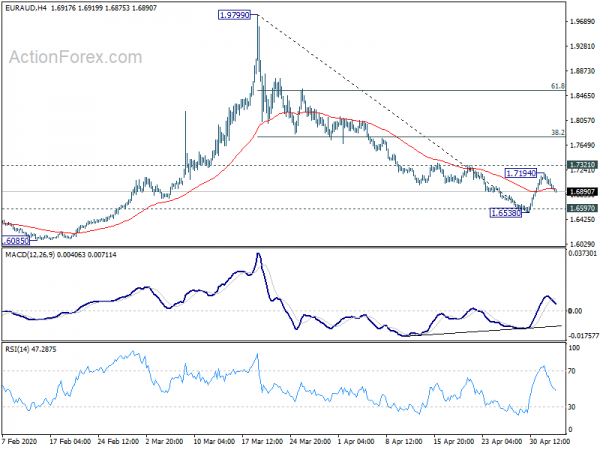

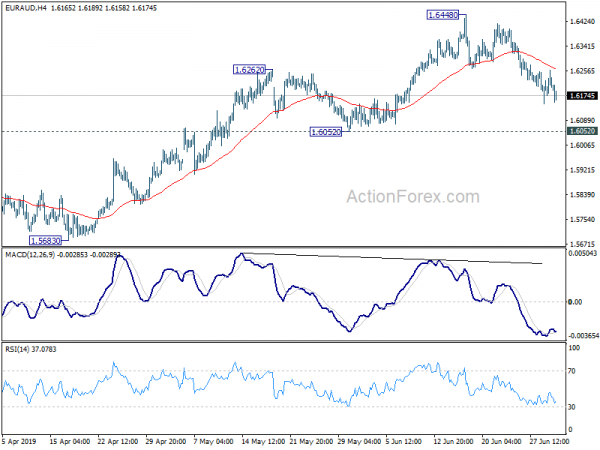

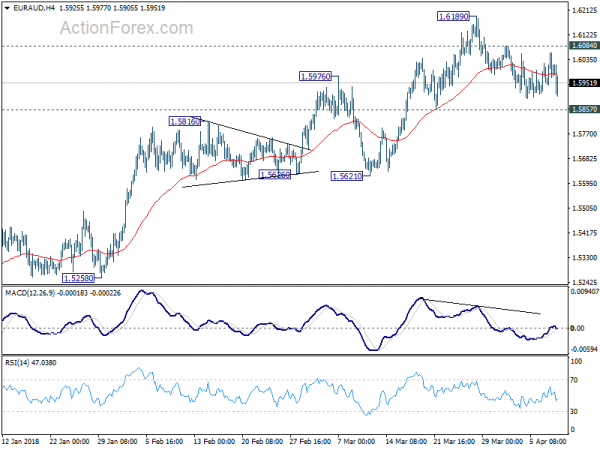

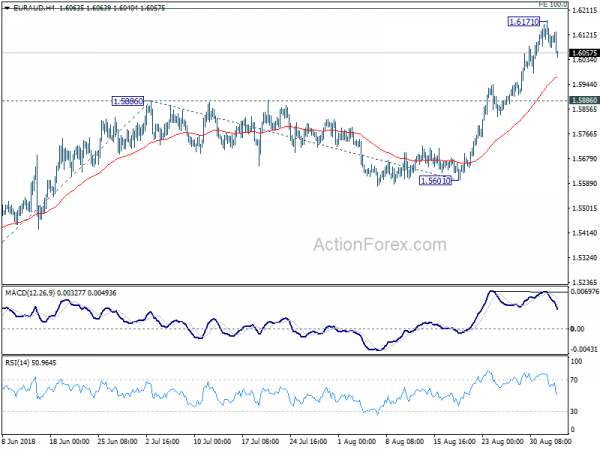

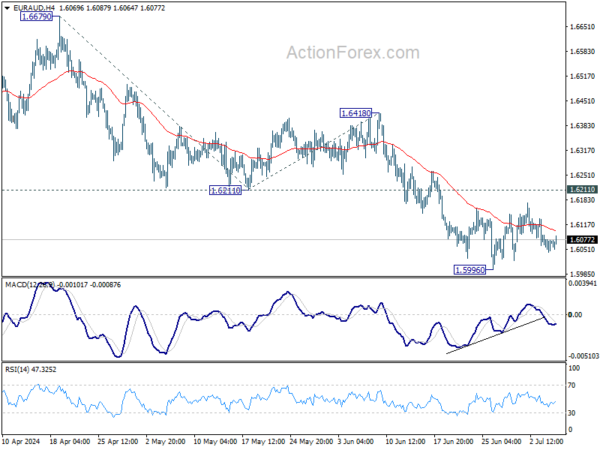

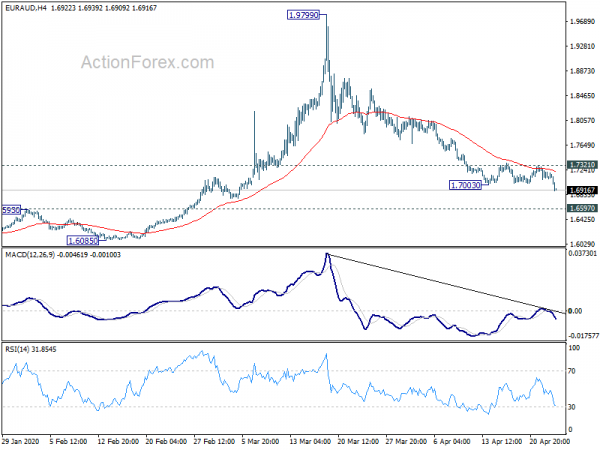

Daily Pivots: (S1) 1.6035; (P) 1.6059; (R1) 1.6093; More…

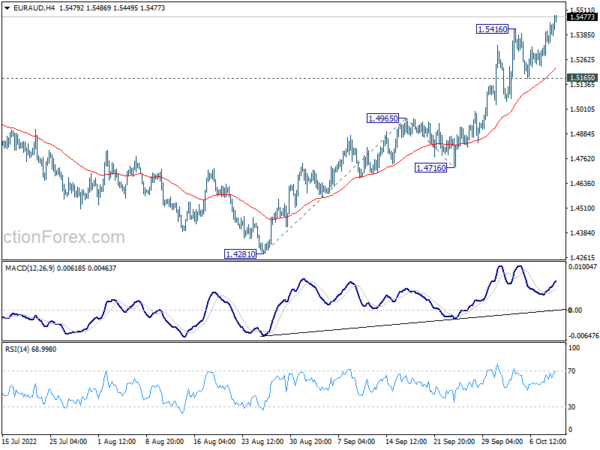

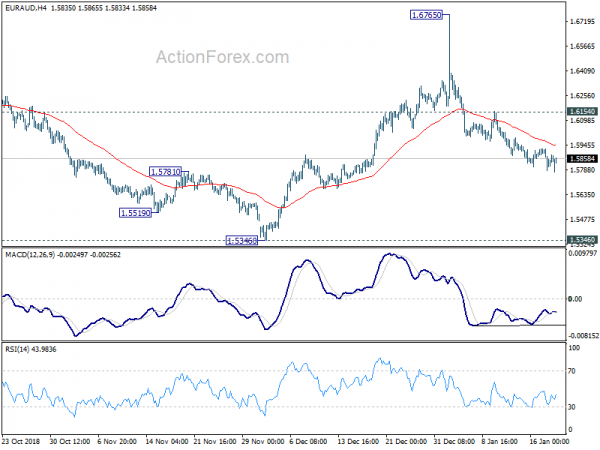

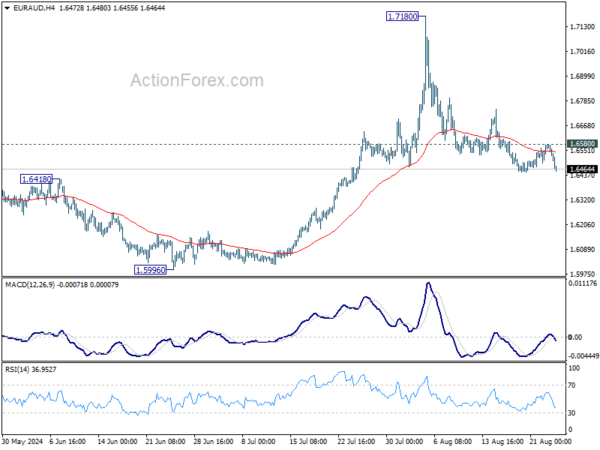

EUR/AUD is losing some downside momentum, but further fall is expected as long as 1.6143 minor resistance holds. Current development suggests that rebound from 1.5683 has completed at 1.6448. Further decline would be seen to retest 1.5683 next. On the upside, above 1.6143 minor resistance will turn bias back to the upside for rebound first.

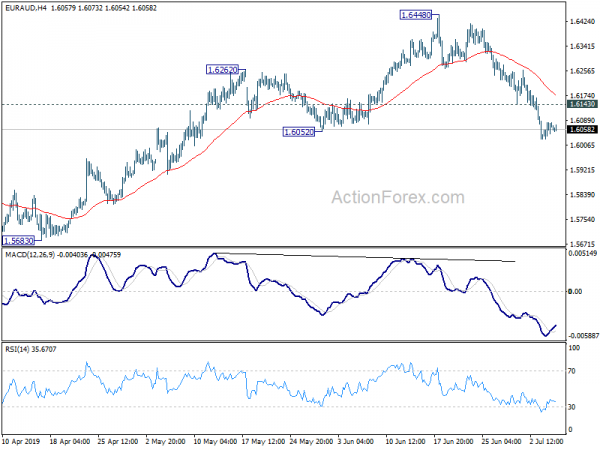

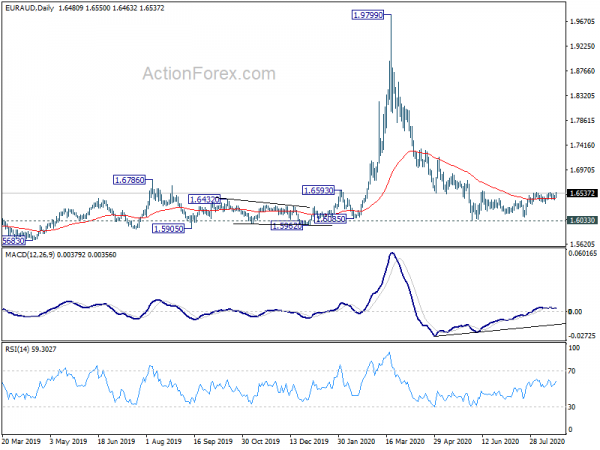

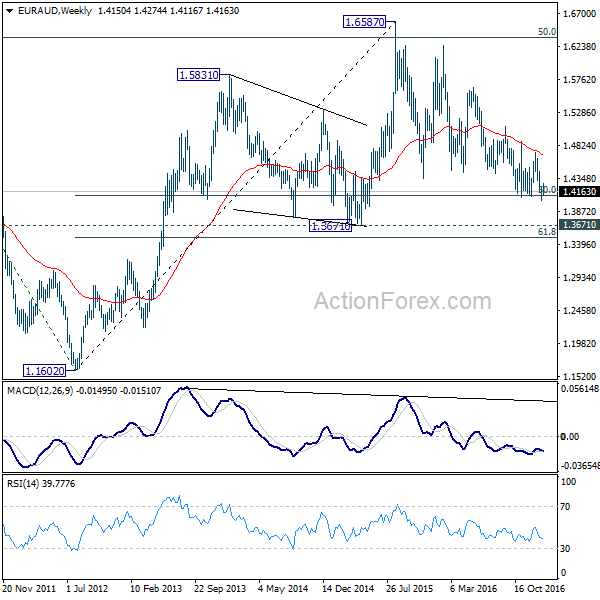

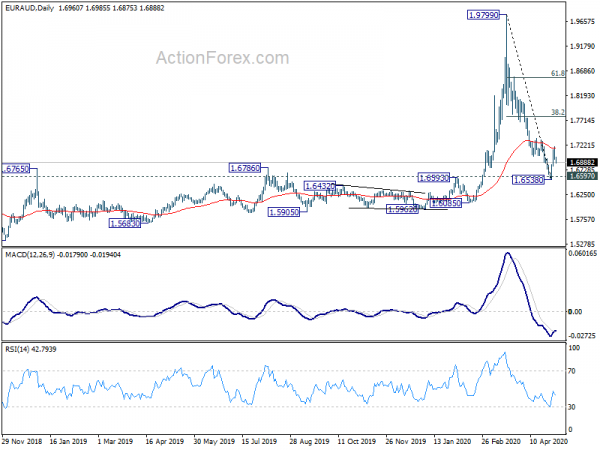

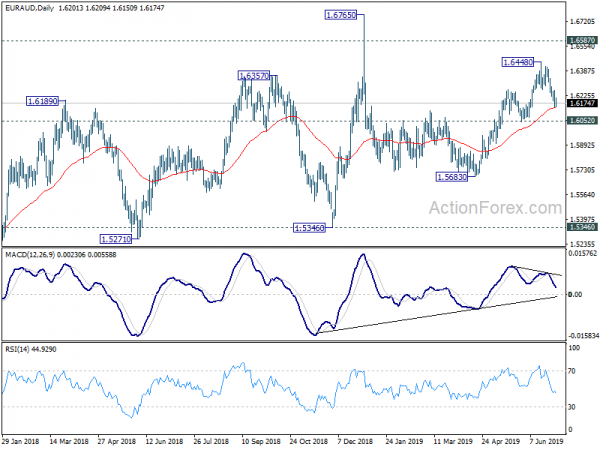

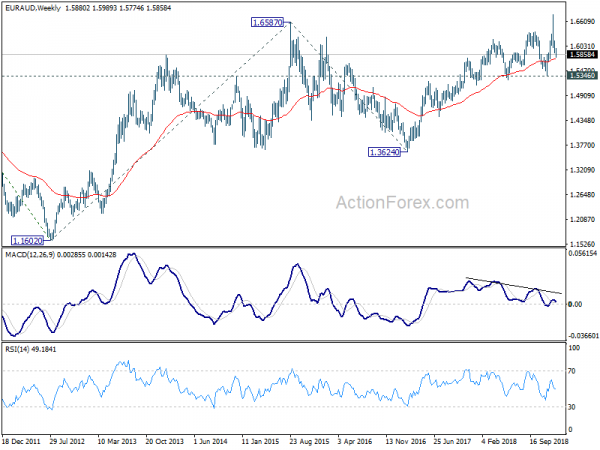

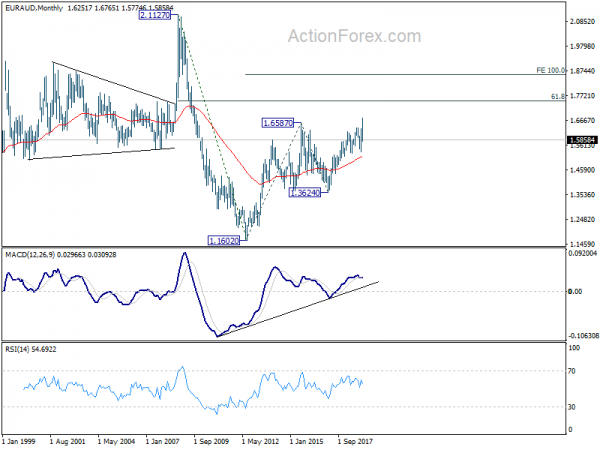

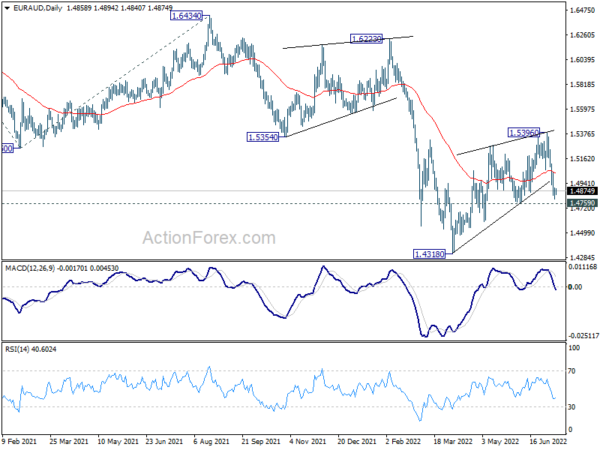

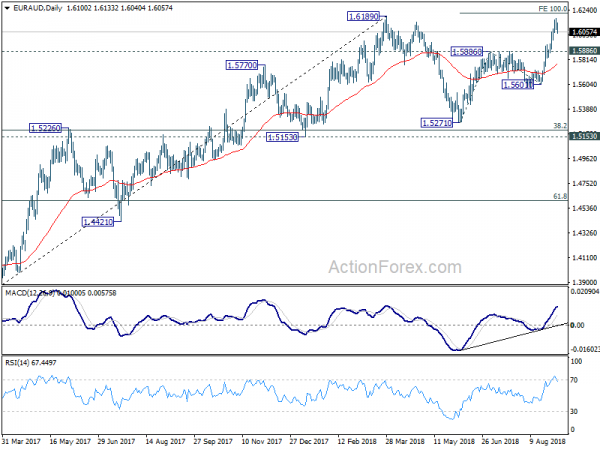

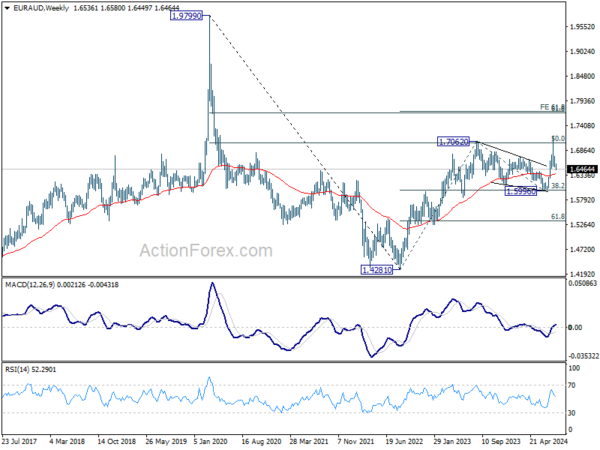

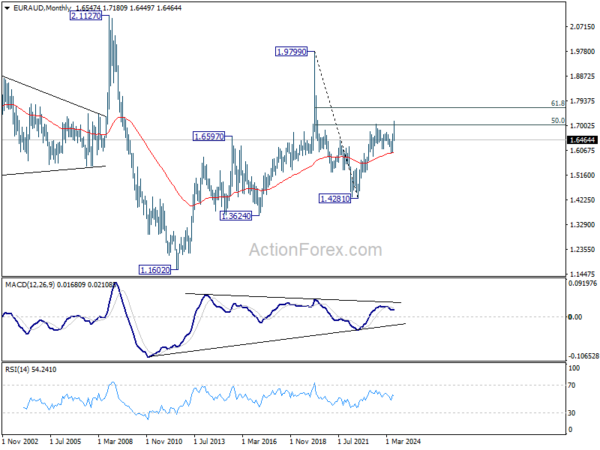

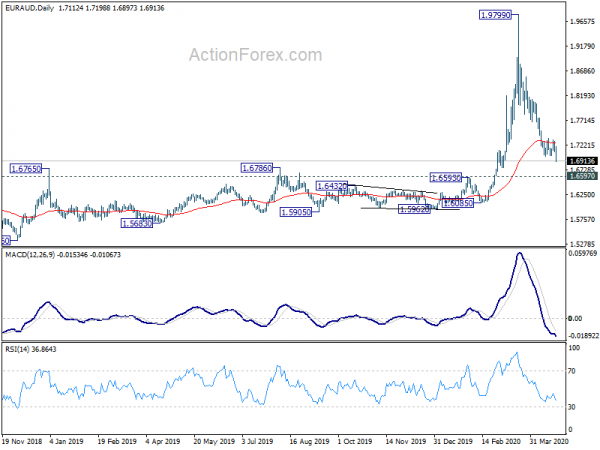

In the bigger picture, as long as 1.5346 support holds, outlook will still remain bullish. Up trend from 1.1602 (2012 low) is expected to resume sooner or later. Break of 1.6765 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488 next. However, firm break of 1.5346 key support will indicate trend reversal and turn outlook bearish.