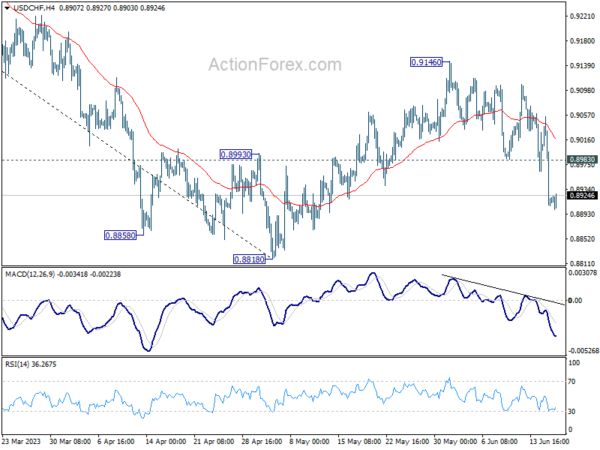

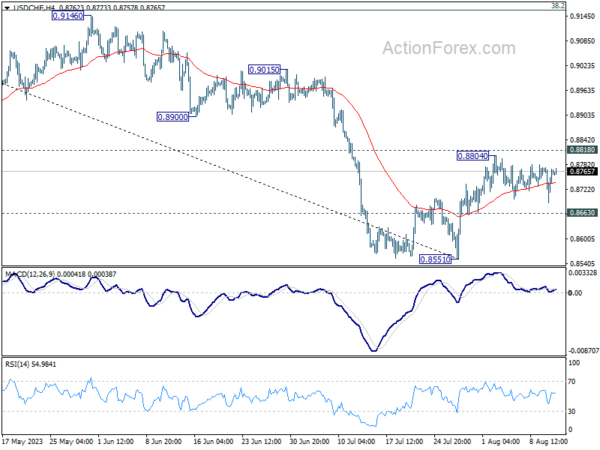

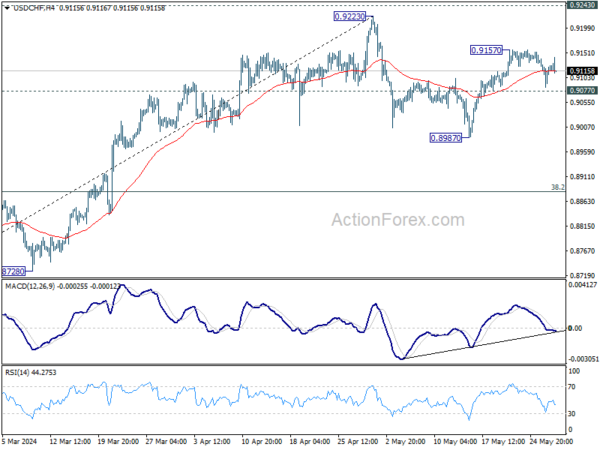

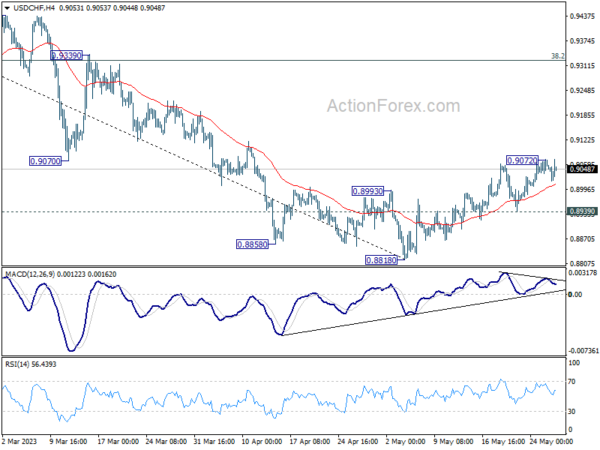

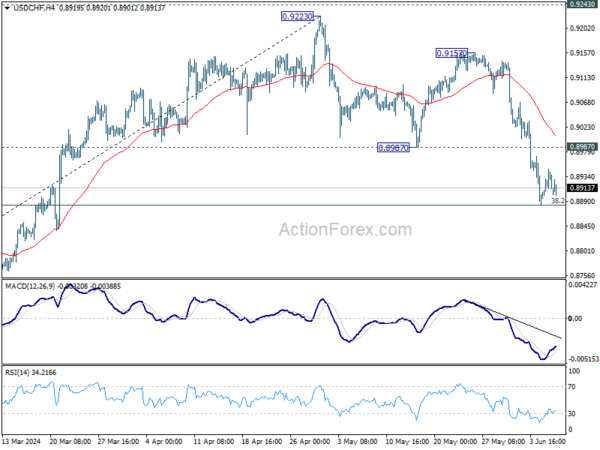

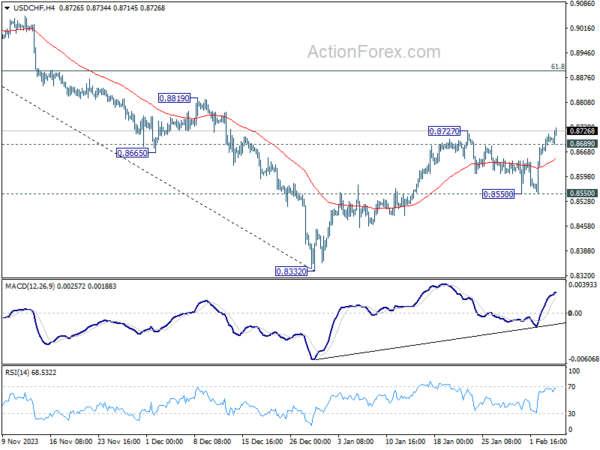

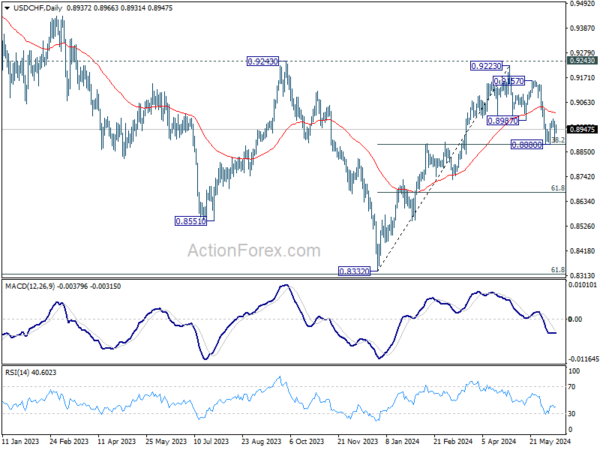

Daily Pivots: (S1) 0.8864; (P) 0.8960; (R1) 0.9013; More…

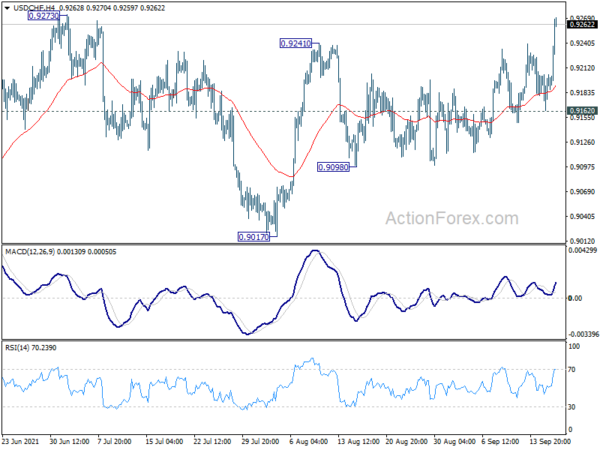

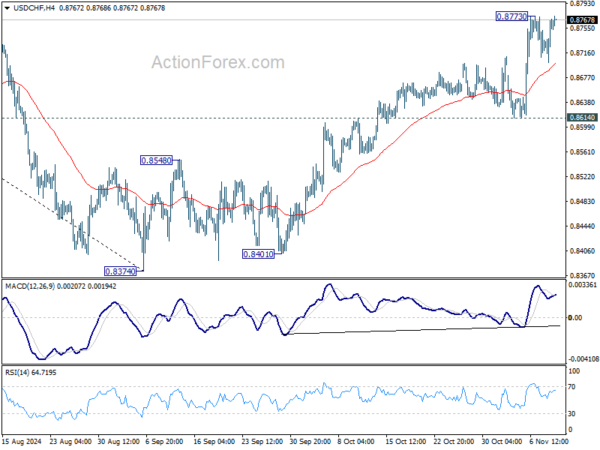

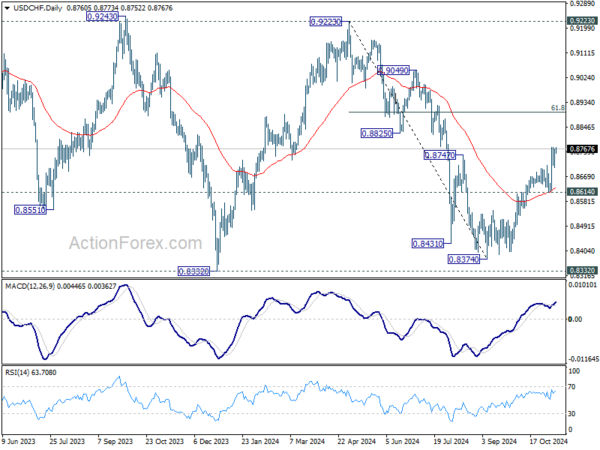

USD/CHF’s fall from 0.9146 is still in progress. Intraday bias stays on the downside for 0.8818 support and possibly below. Still, strong support is still expected from 0.8756 to bring reversal. On the upside, above 0.8983 minor resistance will turn intraday bias neutral first.

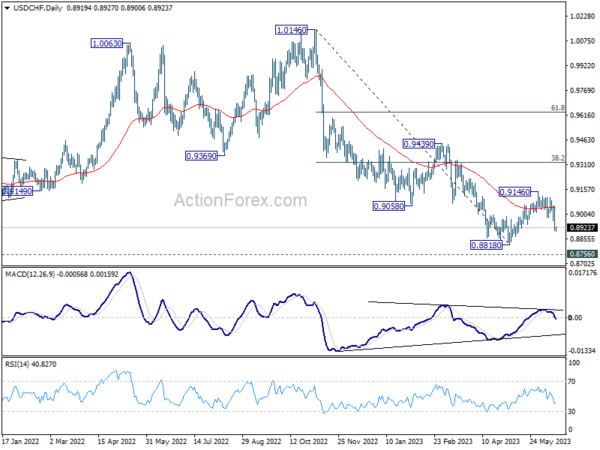

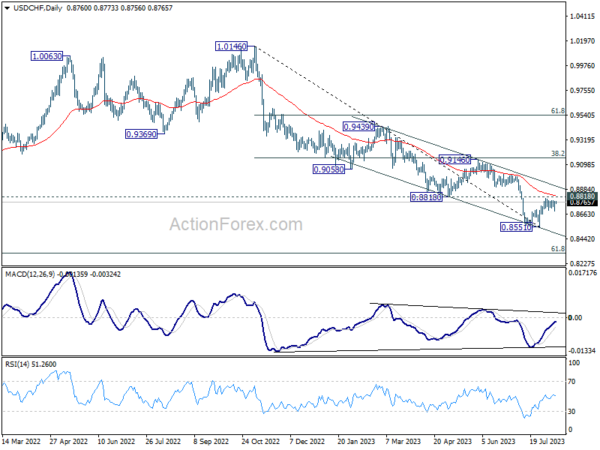

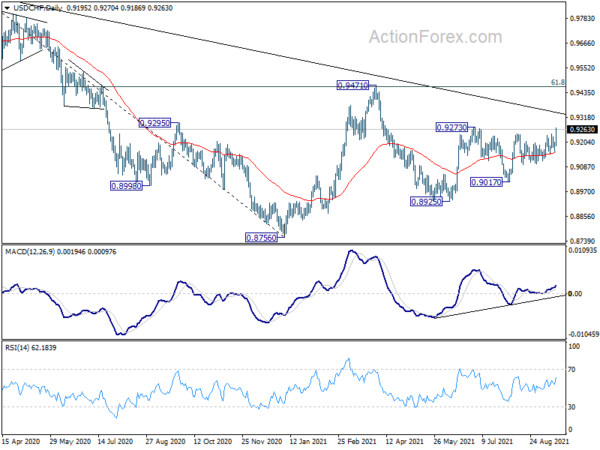

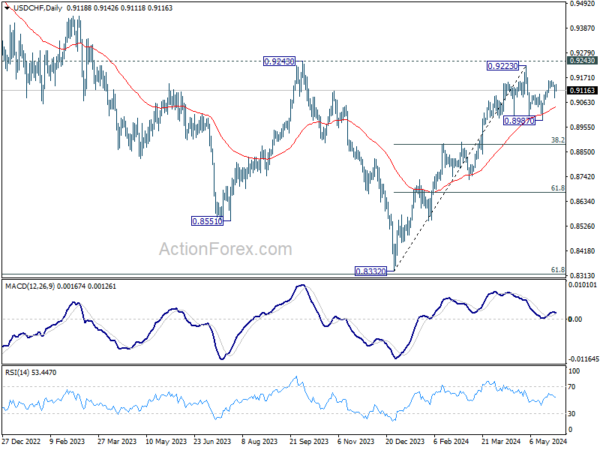

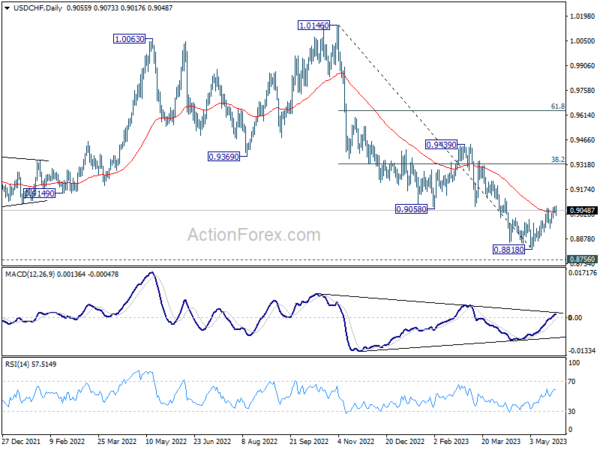

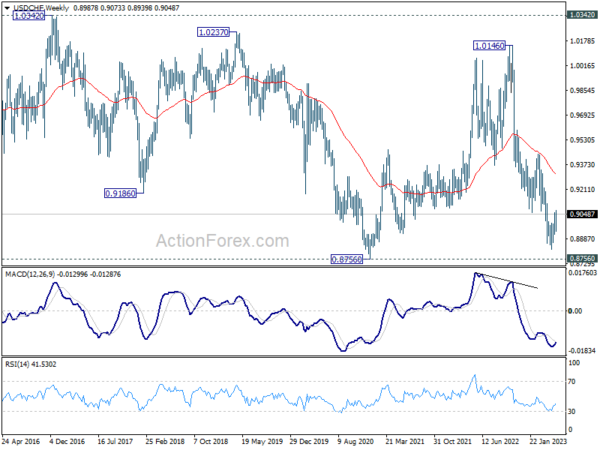

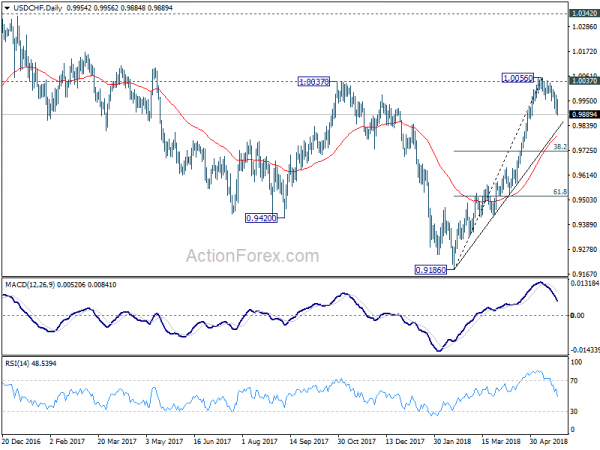

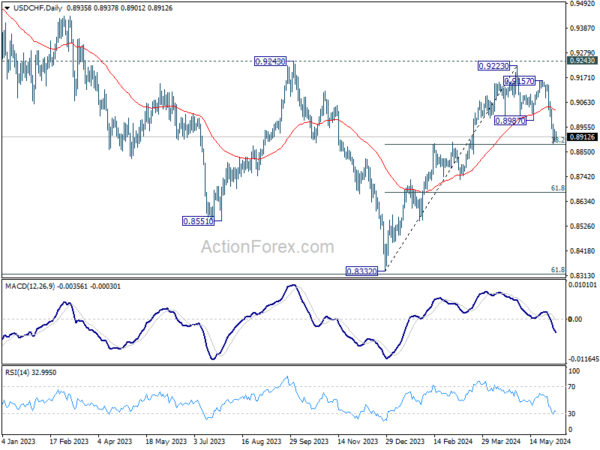

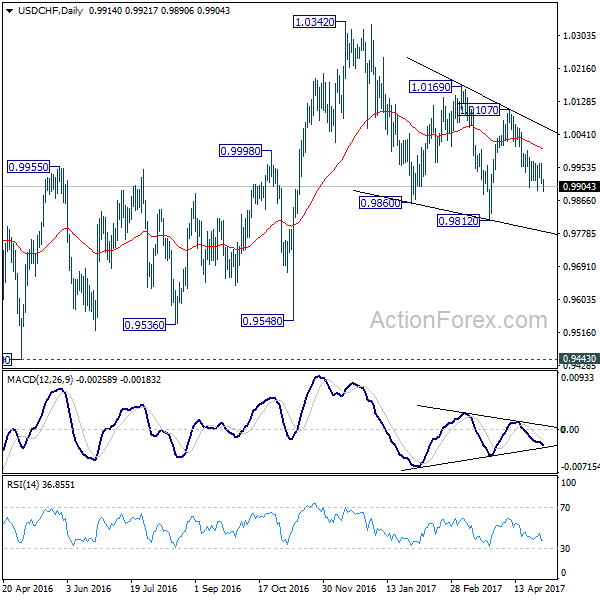

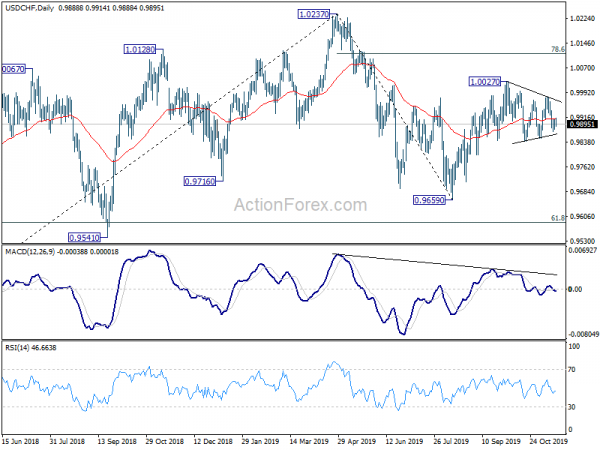

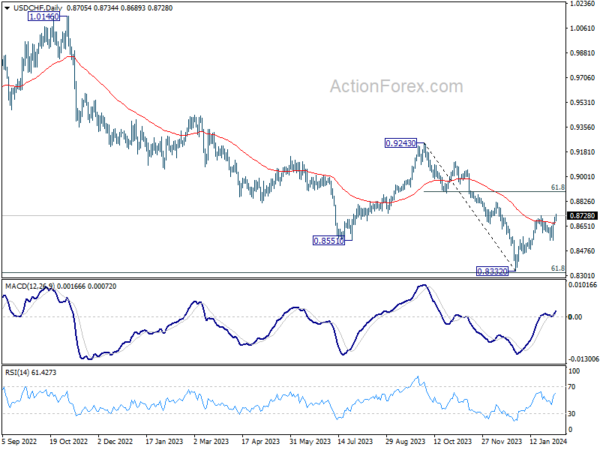

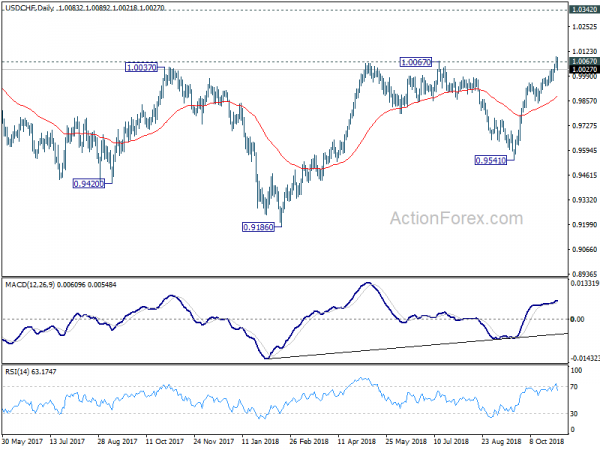

In the bigger picture, fall from 1.1046 (2022 high) is seen as a leg in the long term range pattern from 1.0342 (2016 high), which might have completed at 0.8818 already, just ahead of 0.8756 long term support. Sustained trading above 0.9058 support turned resistance should confirm medium term bottoming. Further break of 0.9439 resistance will confirm bullish trend reversal.