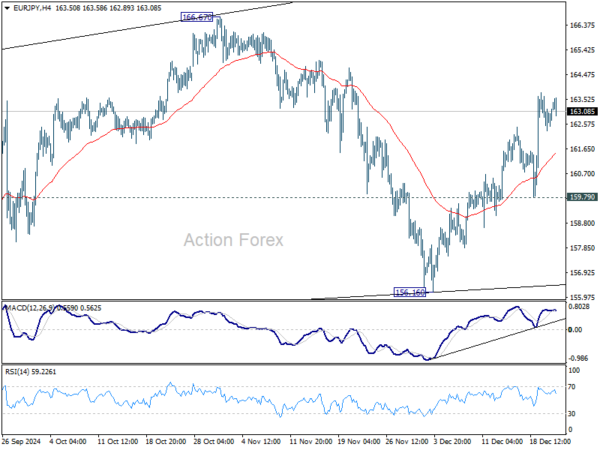

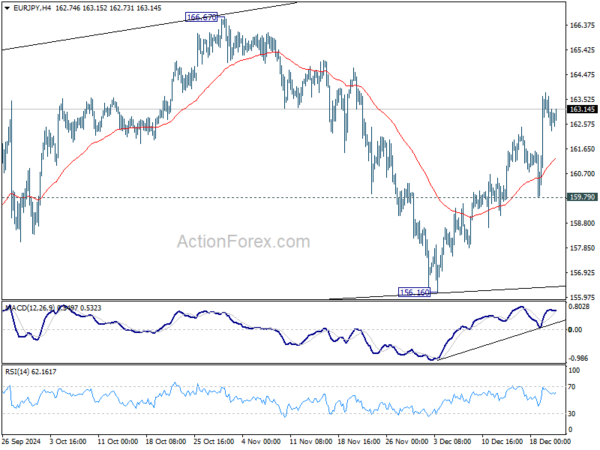

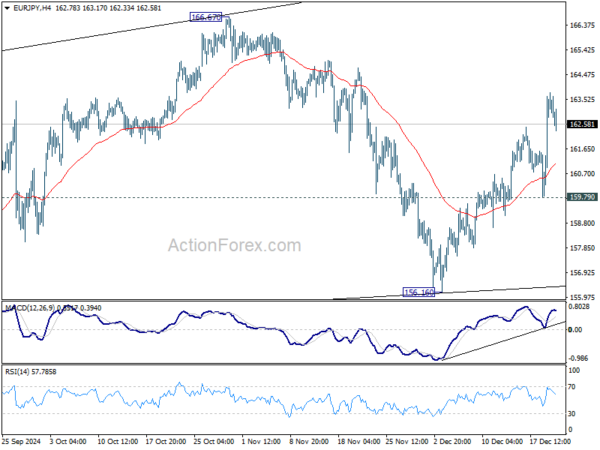

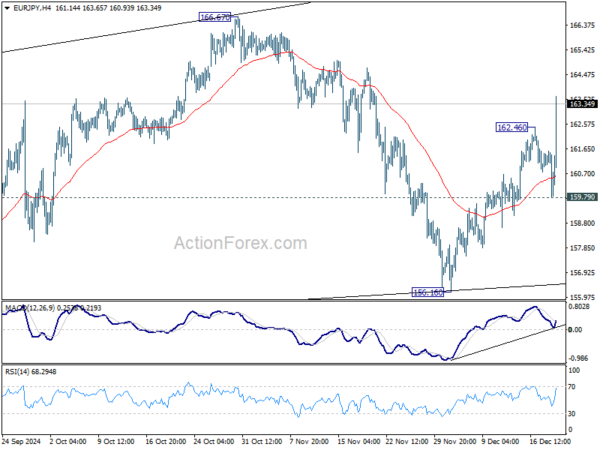

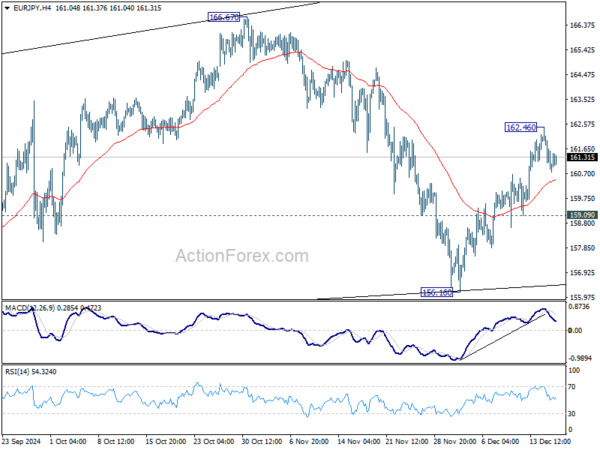

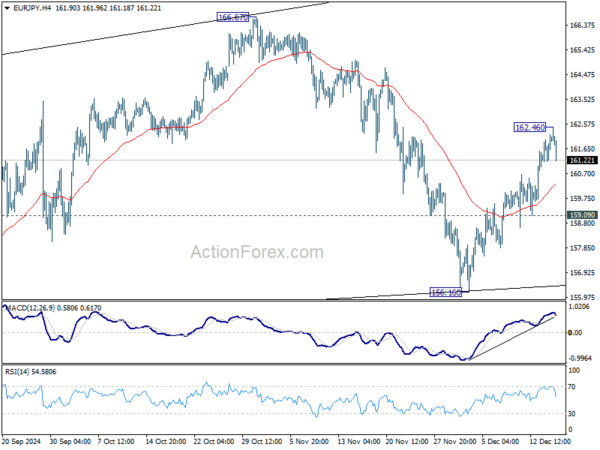

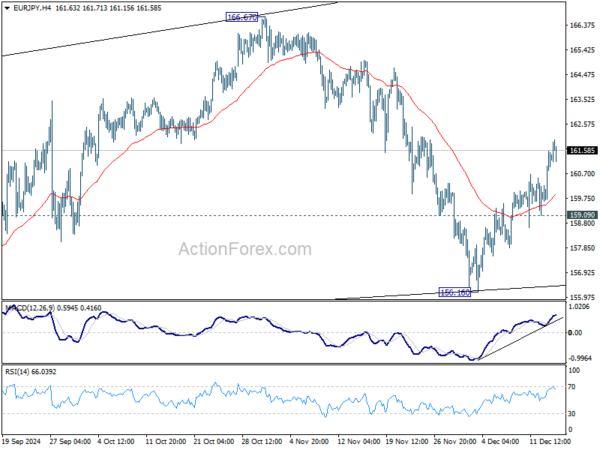

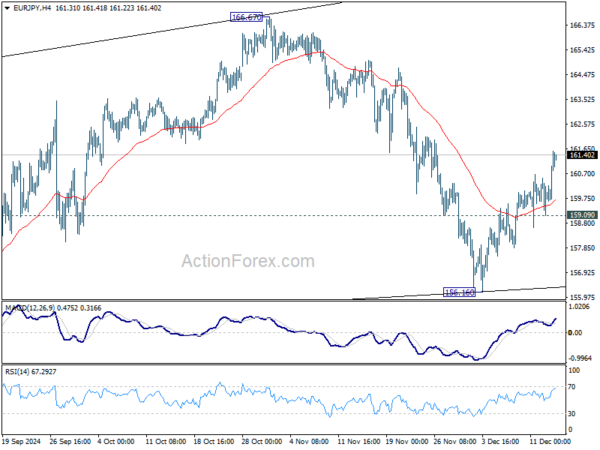

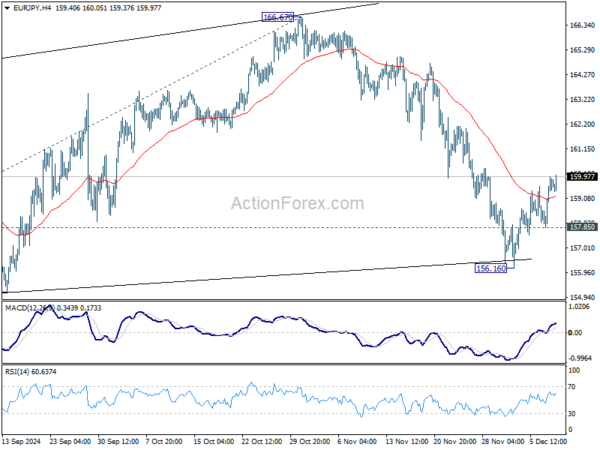

Daily Pivots: (S1) 162.42; (P) 163.04; (R1) 163.73; More…

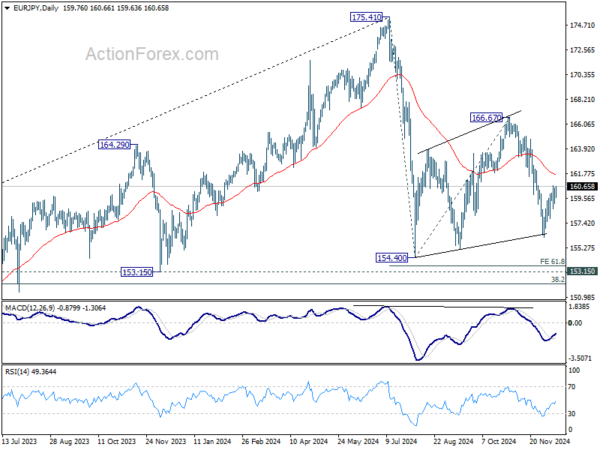

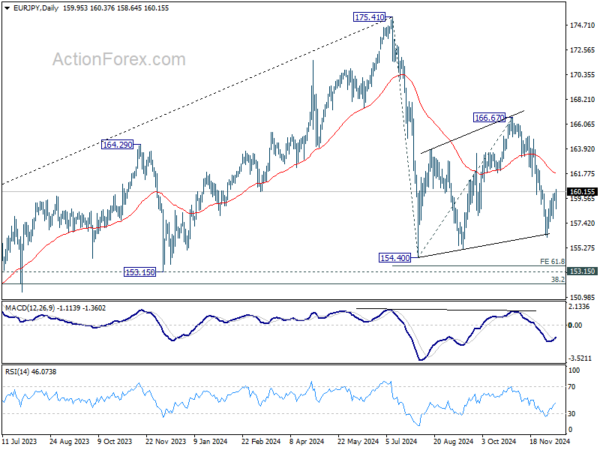

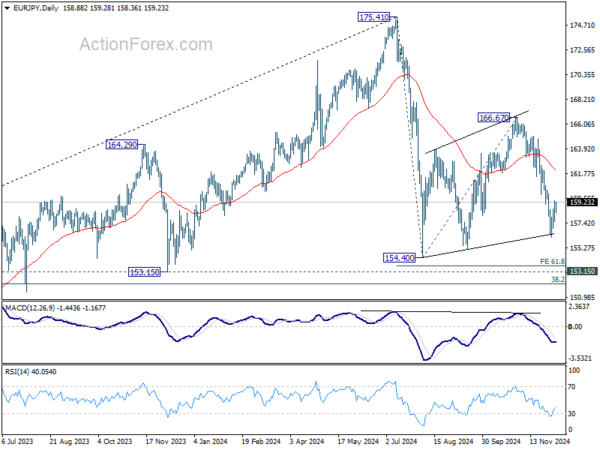

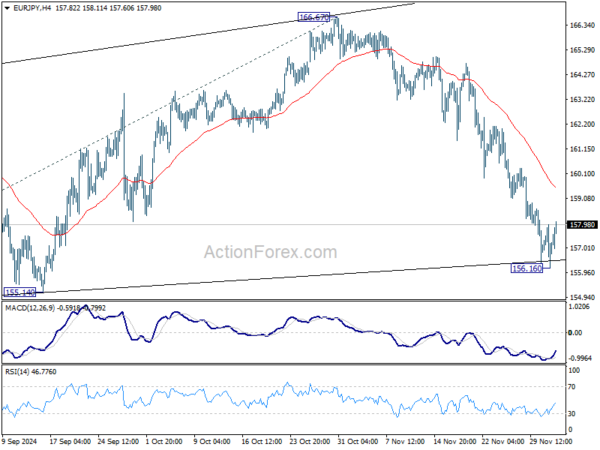

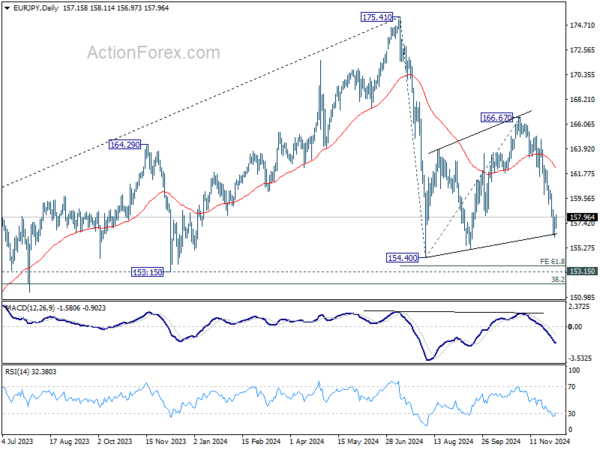

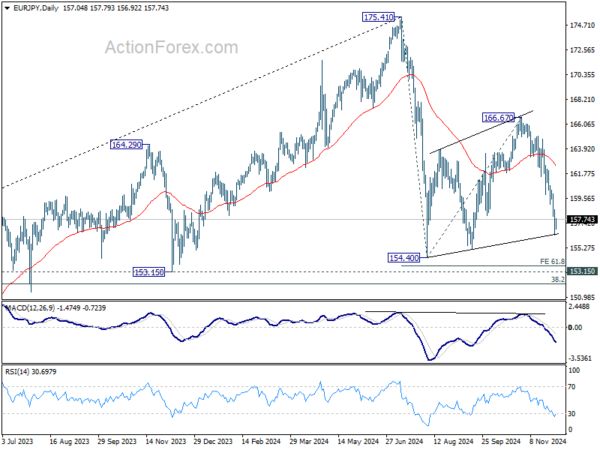

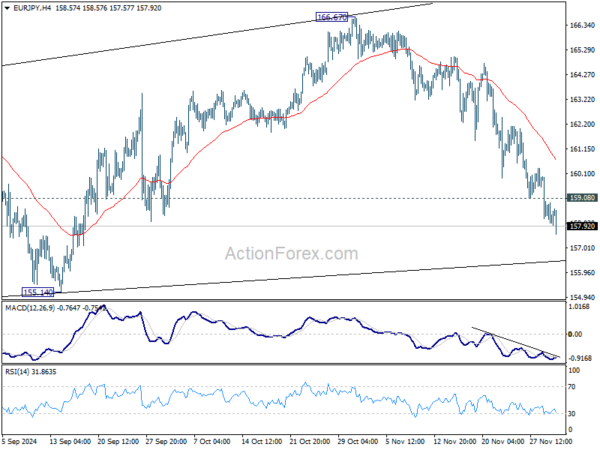

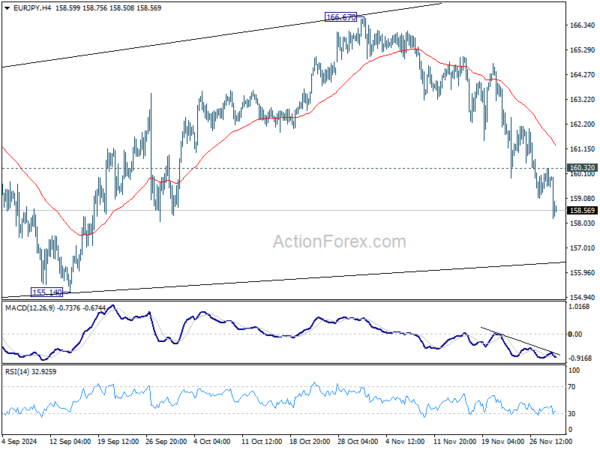

Intraday bias in EUR/JPY stays on the upside for the moment. Corrective pattern from 154.04 is extending with another rising leg. Further rise should be seen to 166.67 resistance next. For now, risk will stay on the upside as long as 159.79 support holds, in case of retreat.

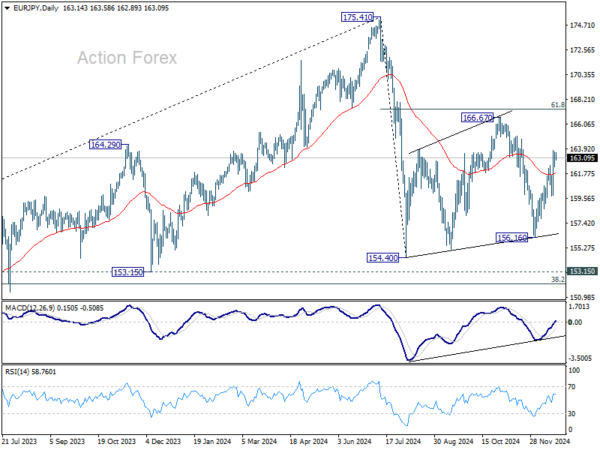

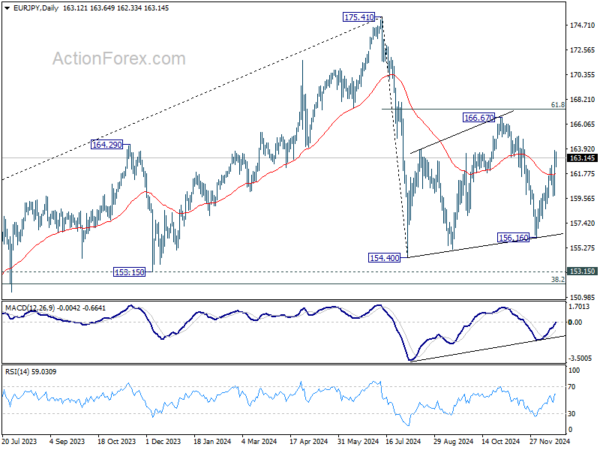

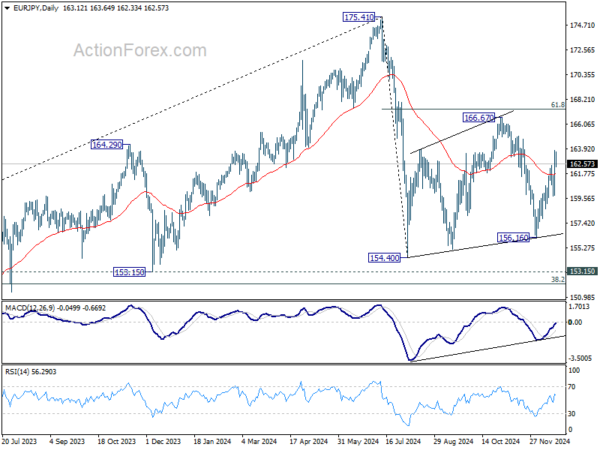

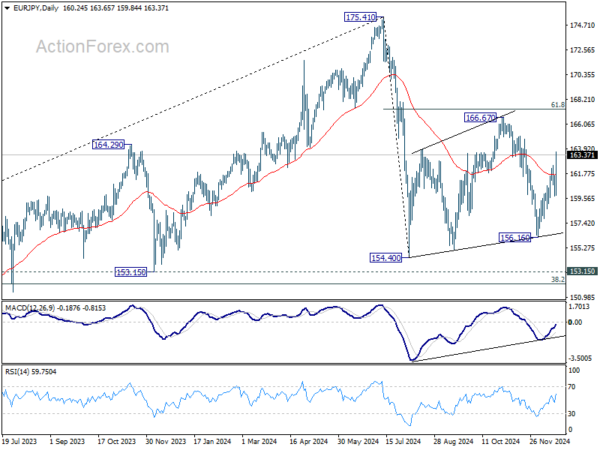

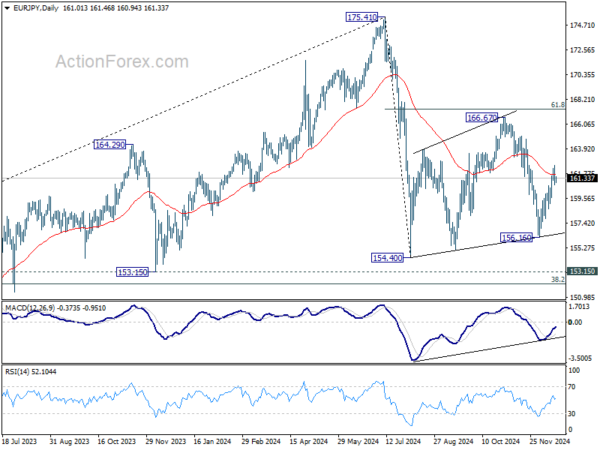

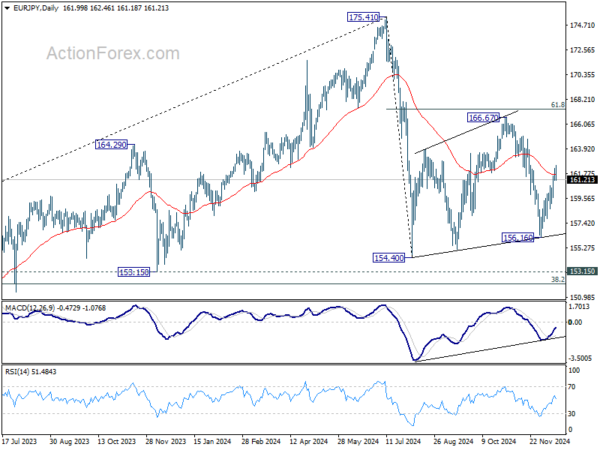

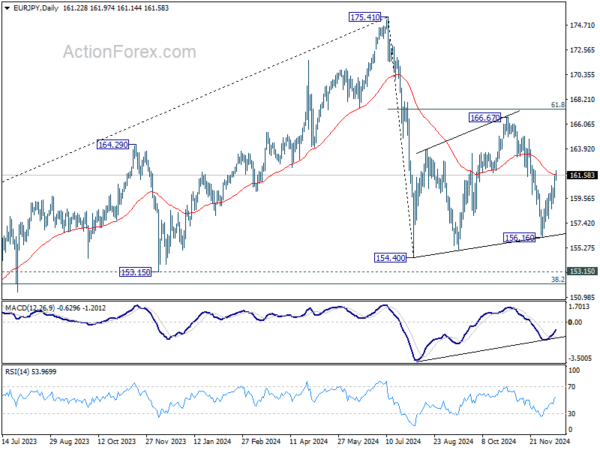

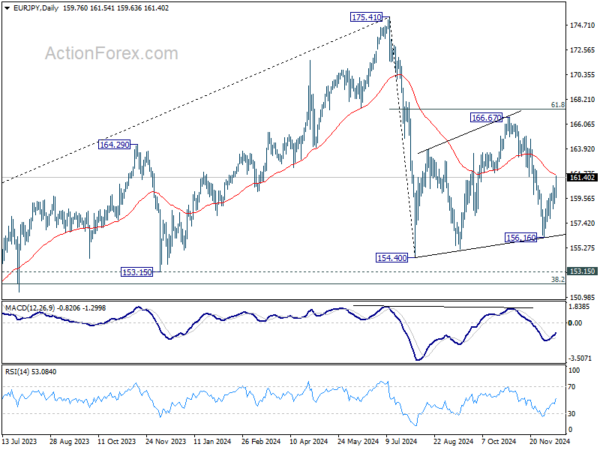

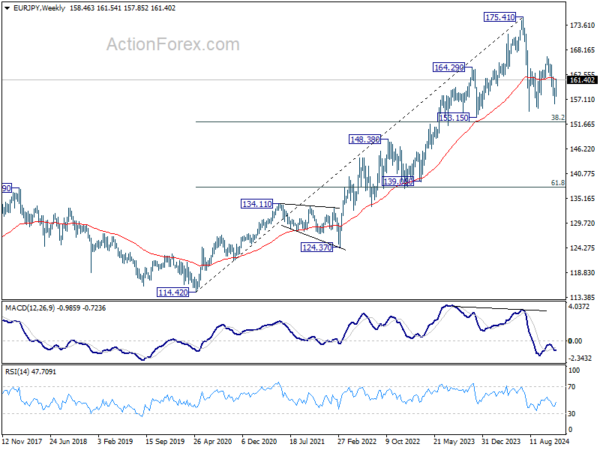

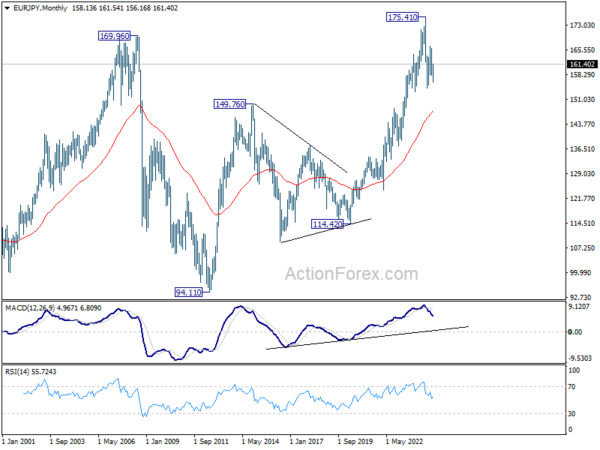

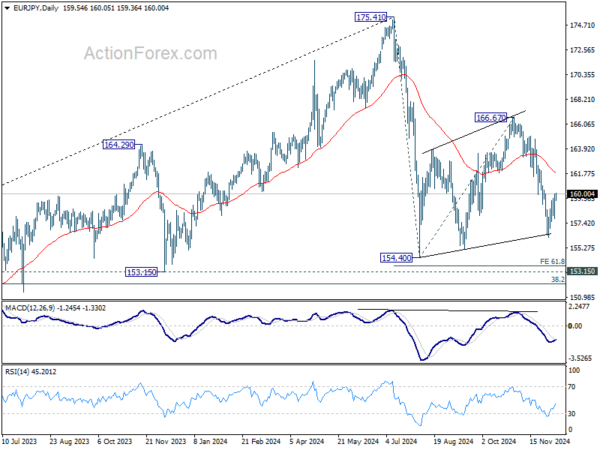

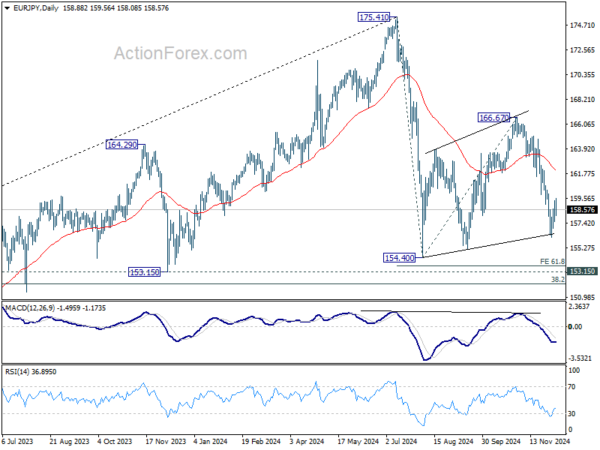

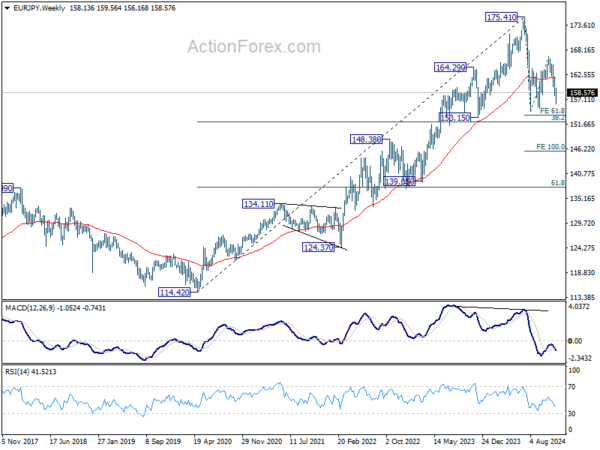

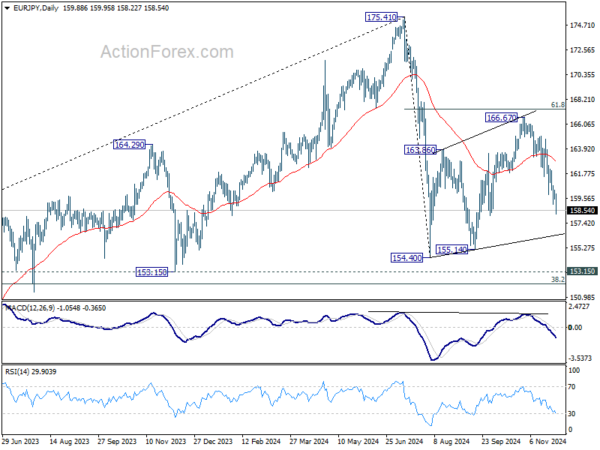

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.