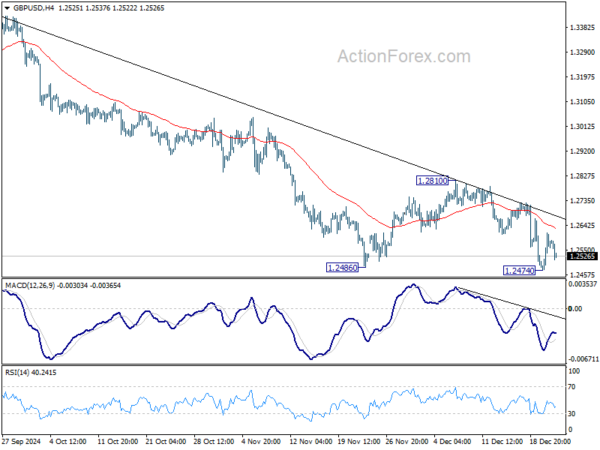

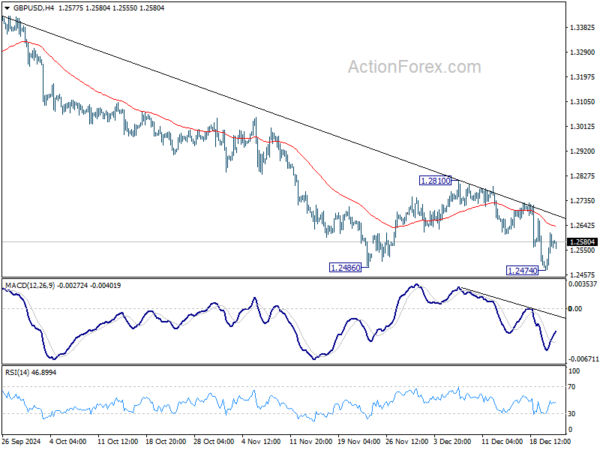

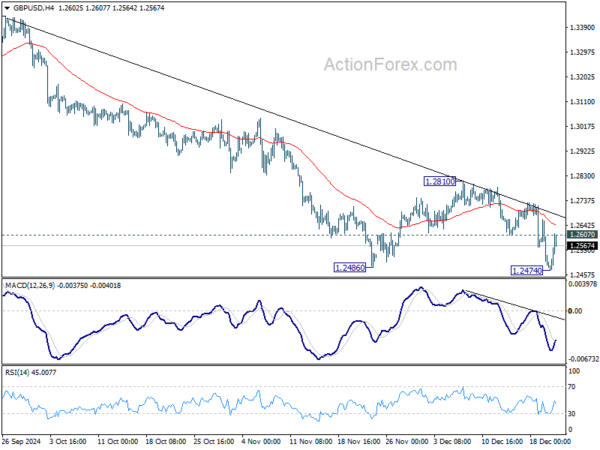

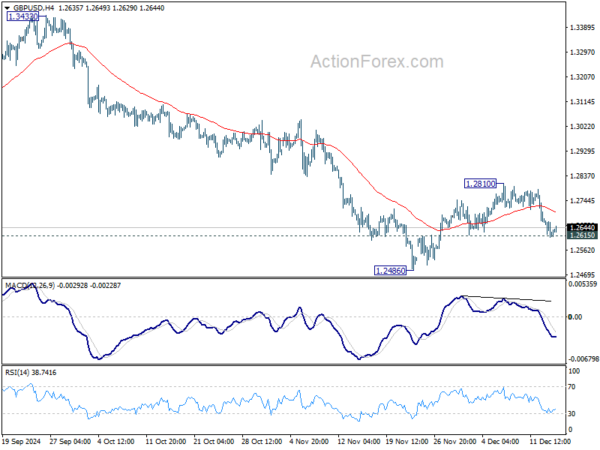

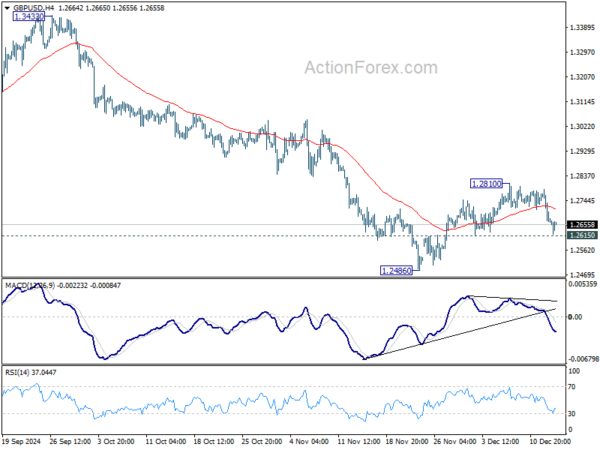

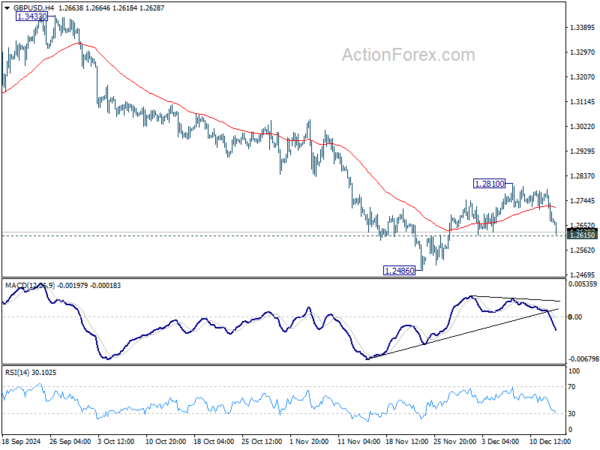

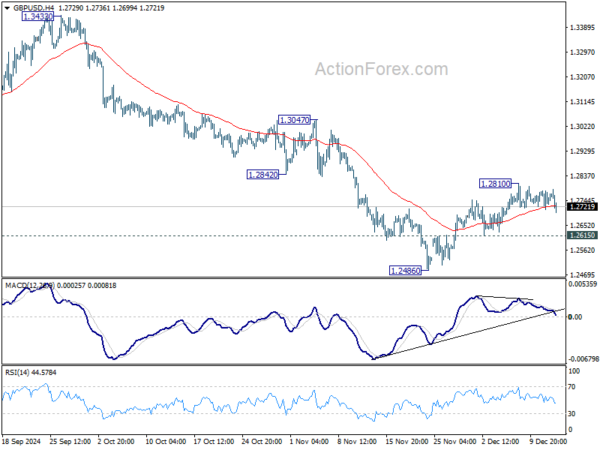

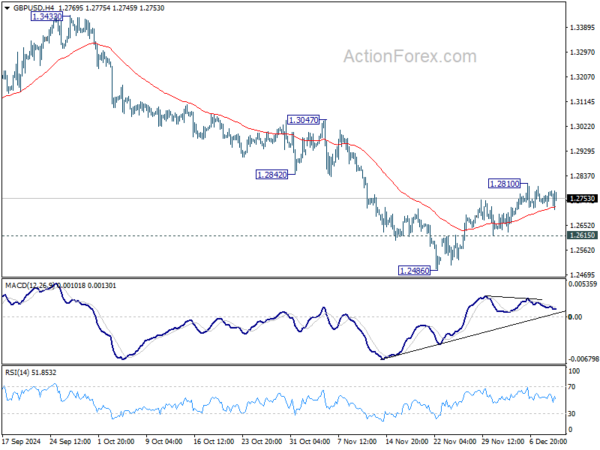

Daily Pivots: (S1) 1.2491; (P) 1.2553; (R1) 1.2630; More…

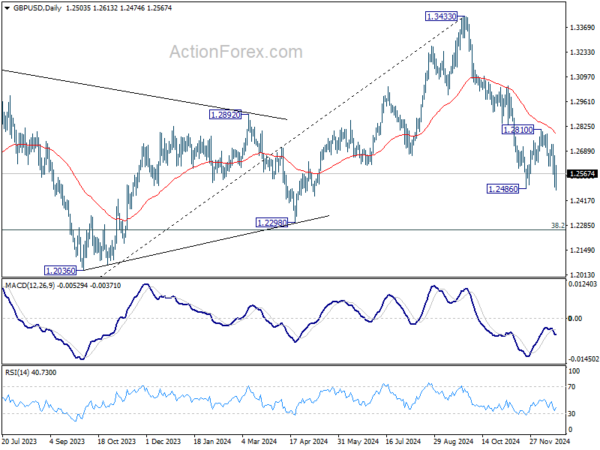

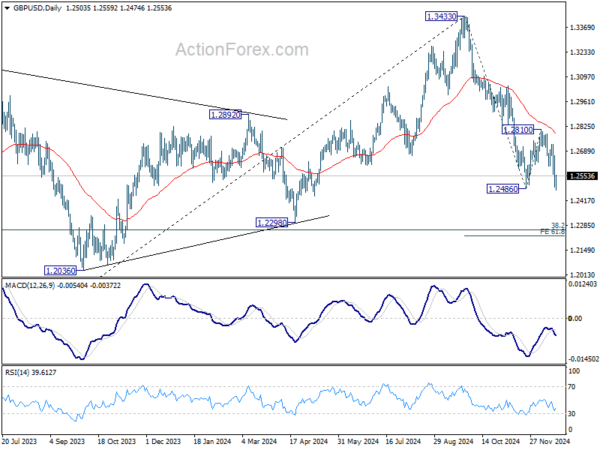

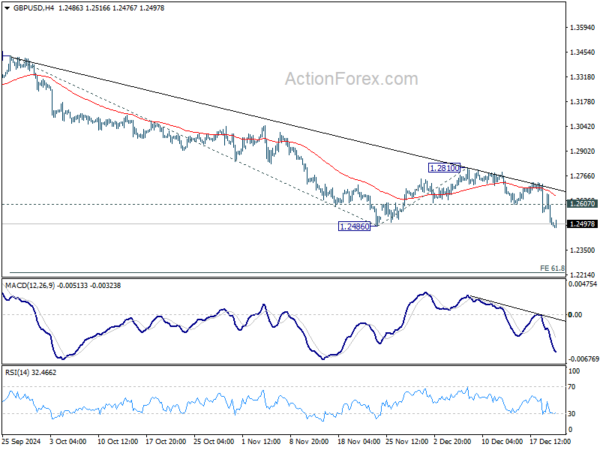

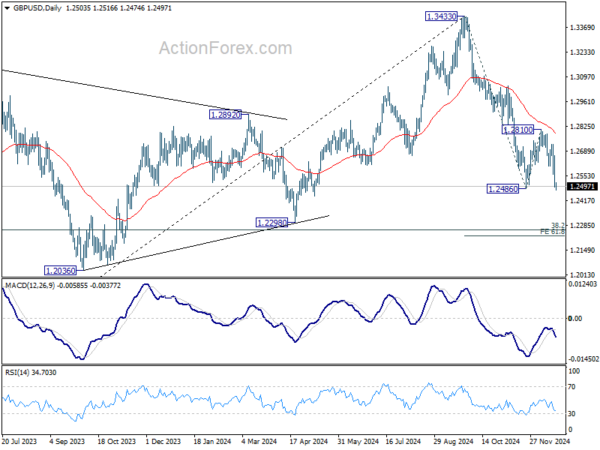

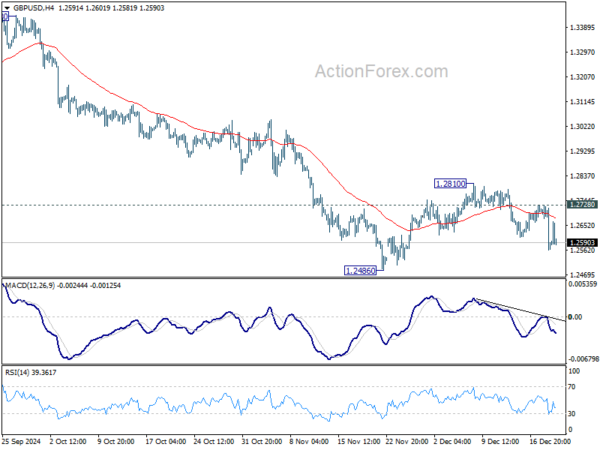

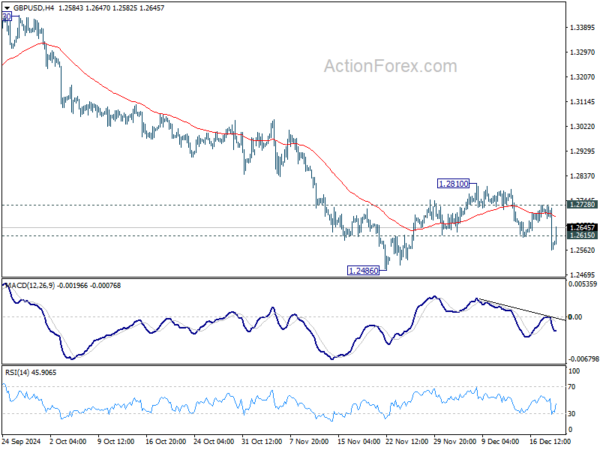

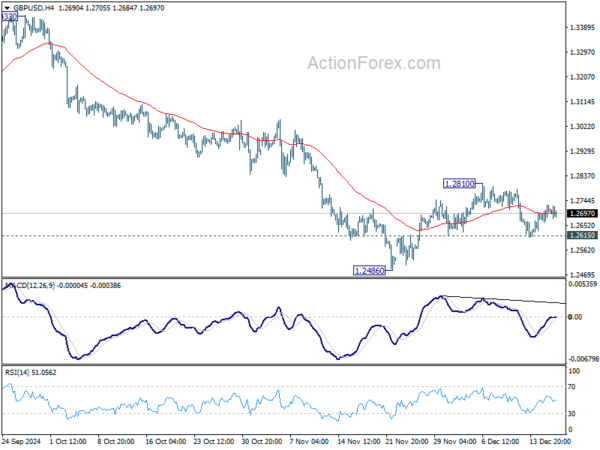

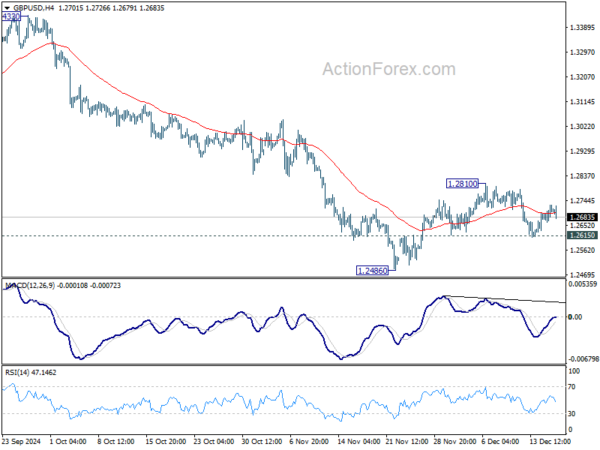

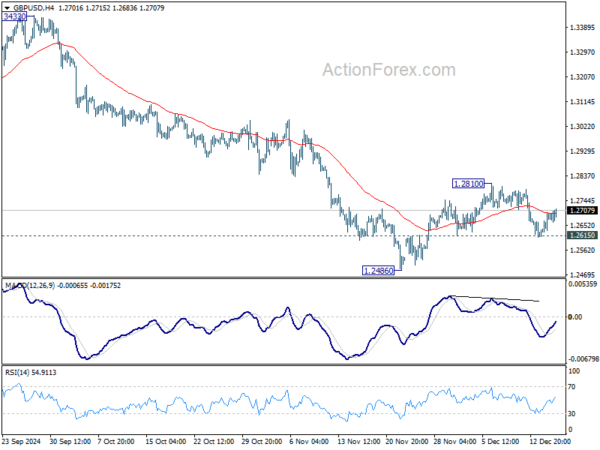

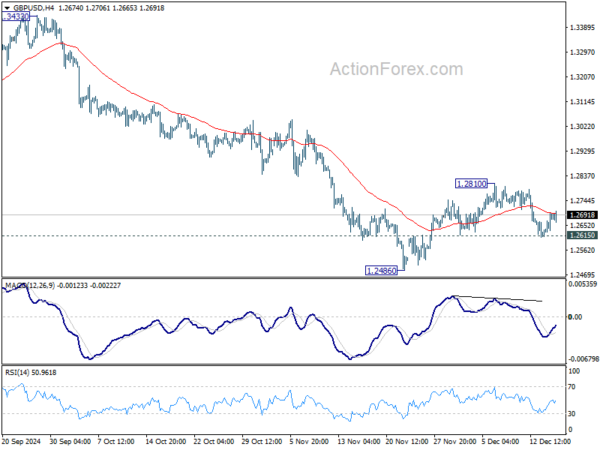

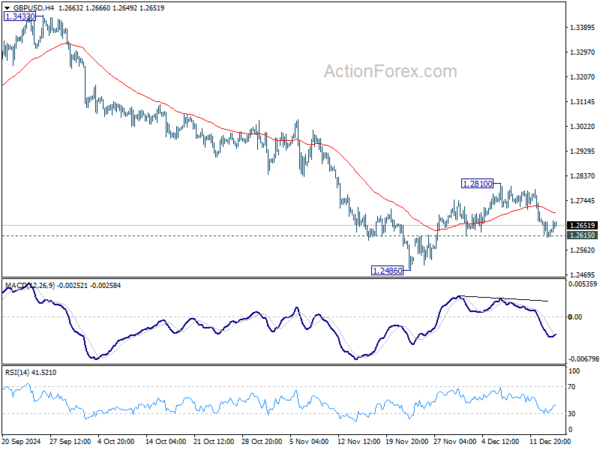

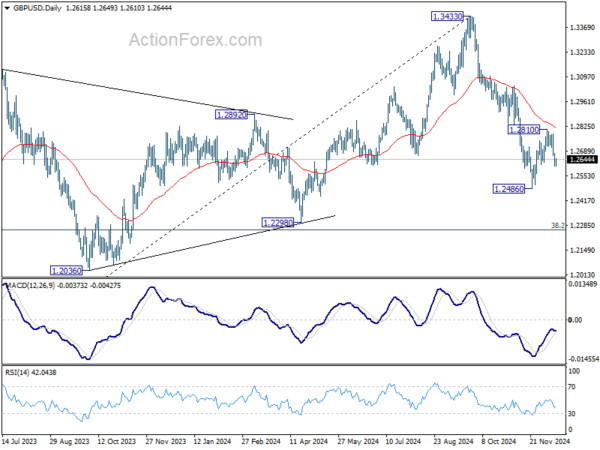

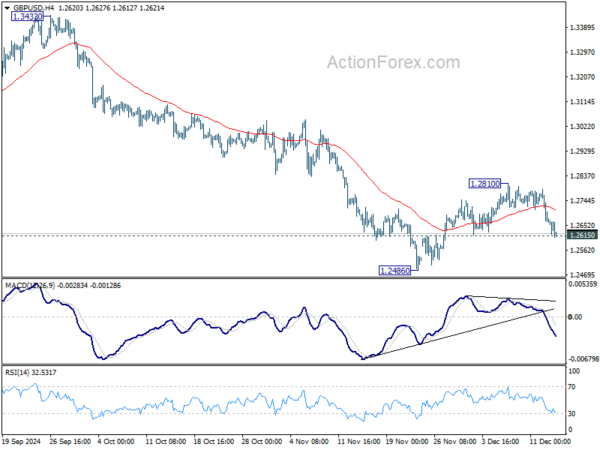

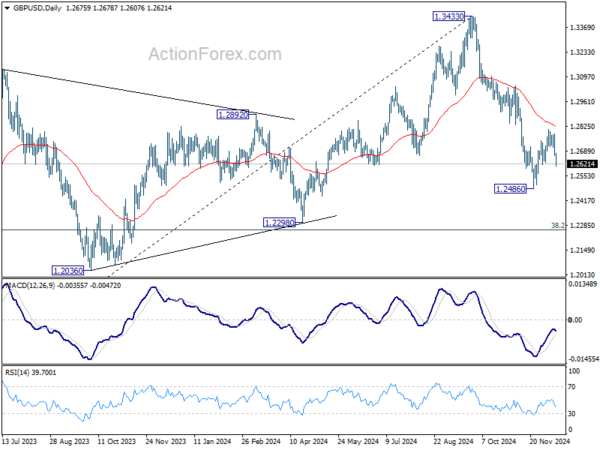

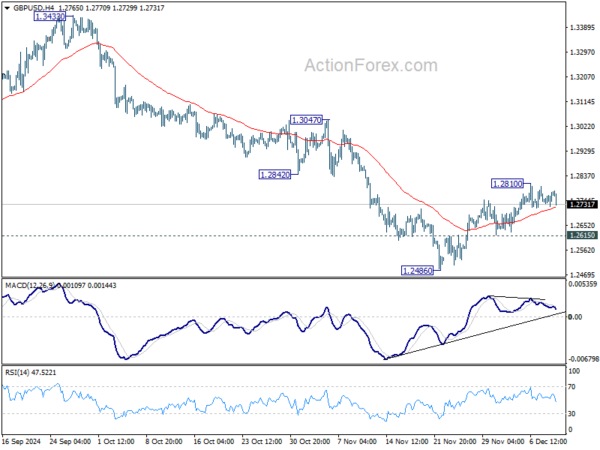

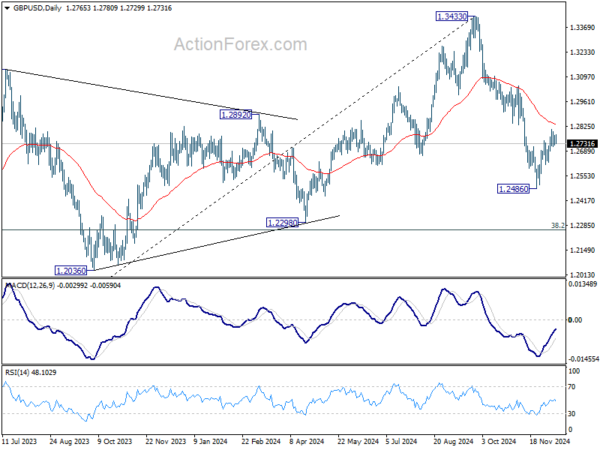

GBP/USD is staying in consolidations above 1.2474 temporary low and intraday bias remains neutral. Outlook will stay bearish as long as 1.2810 resistance holds. On the downside, break of 1.2474 will resume the fall from 1.3433 to 1.2298 cluster support zone.

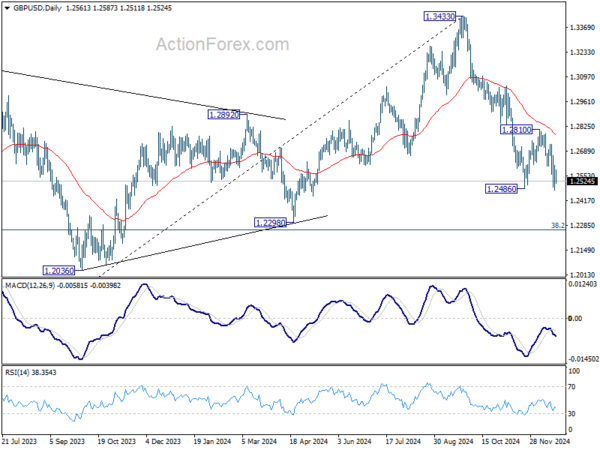

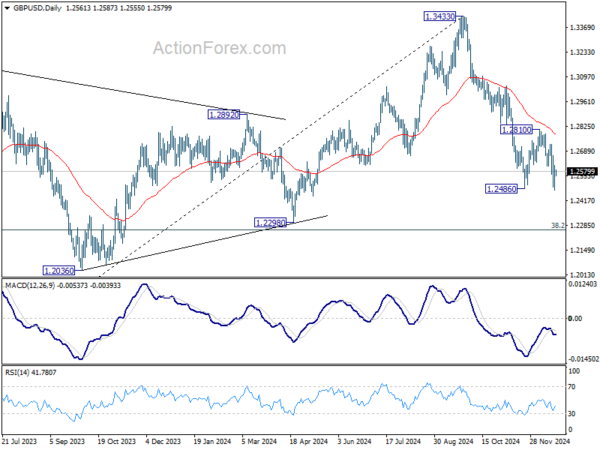

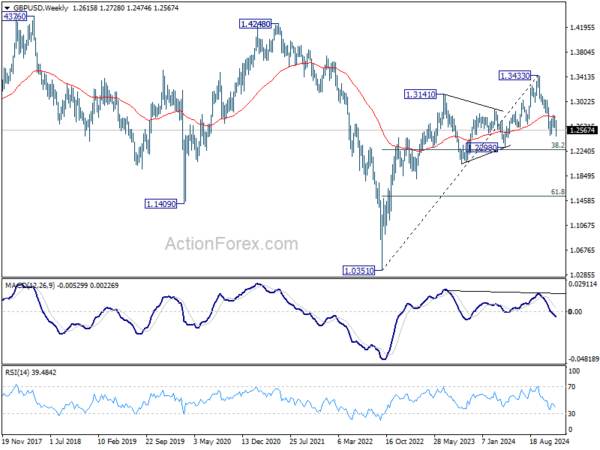

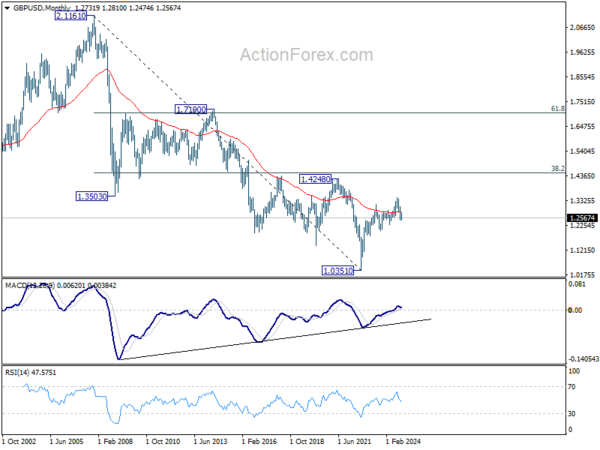

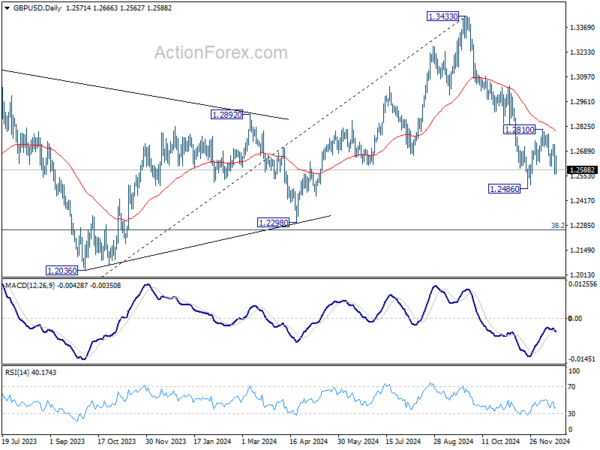

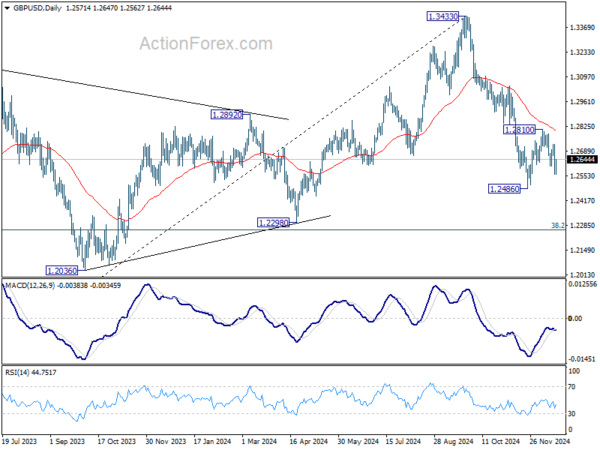

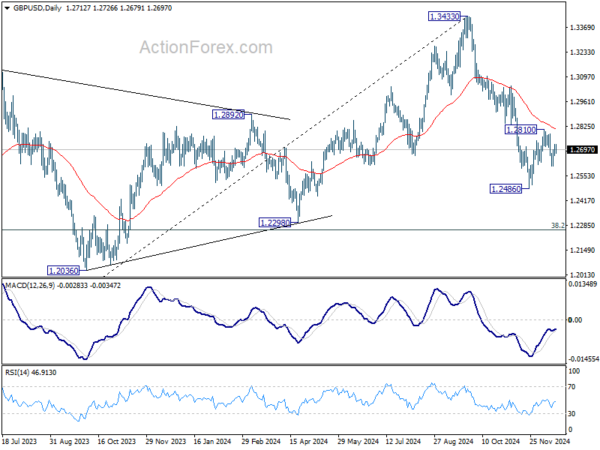

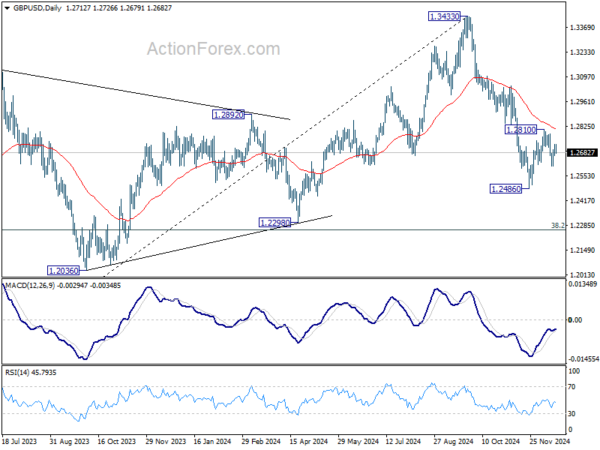

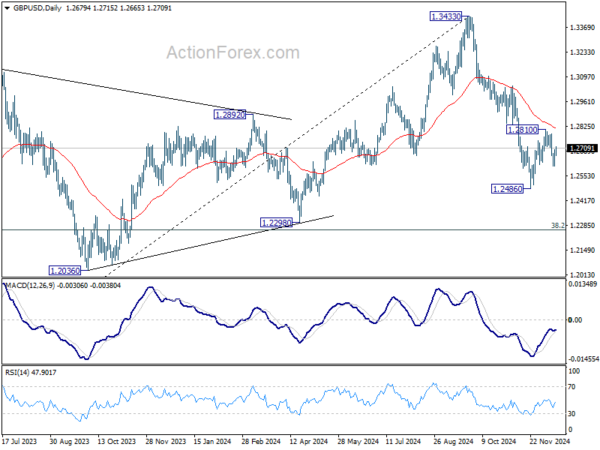

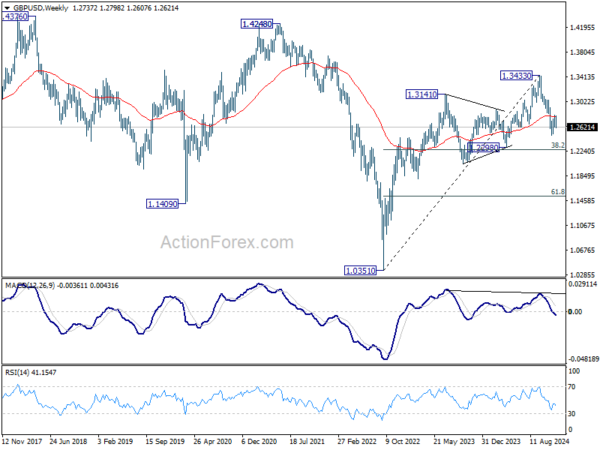

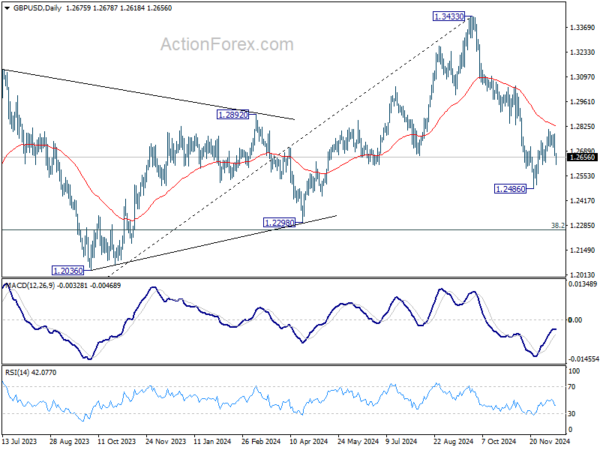

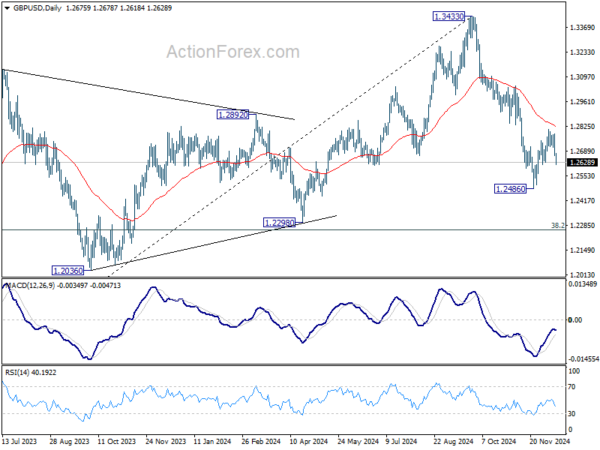

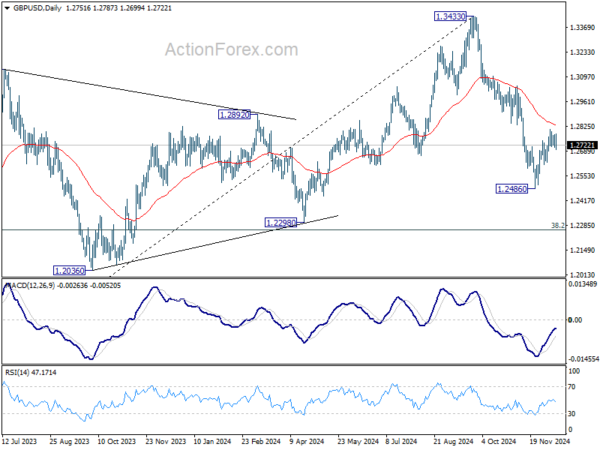

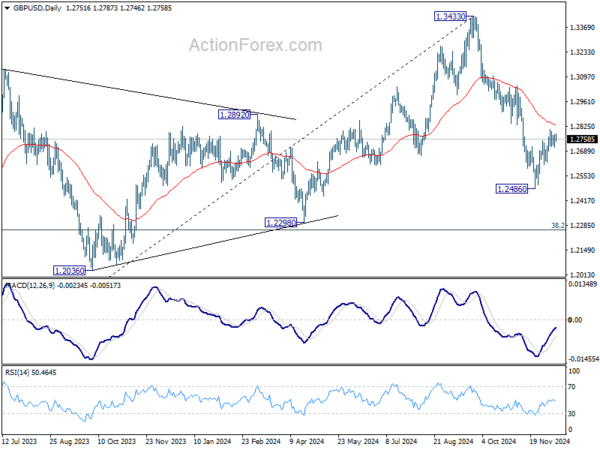

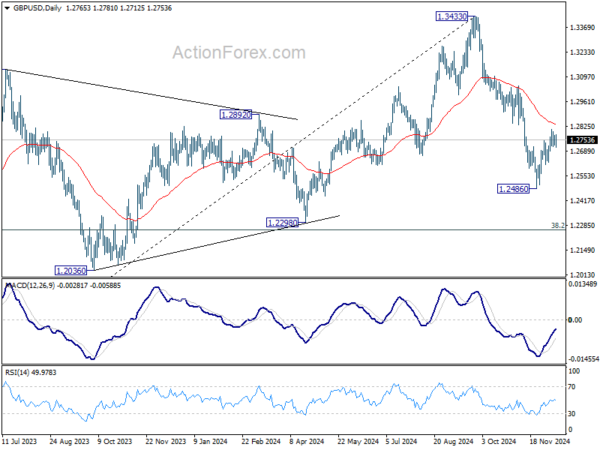

In the bigger picture, price actions from 1.3433 medium term are seen as correcting whole up trend from 1.0351 (2022 low). Deeper decline could be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. But strong support is expected there to bring rebound to extend the corrective pattern.