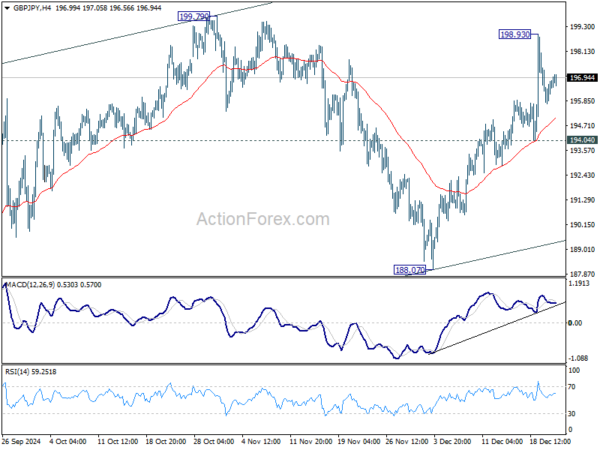

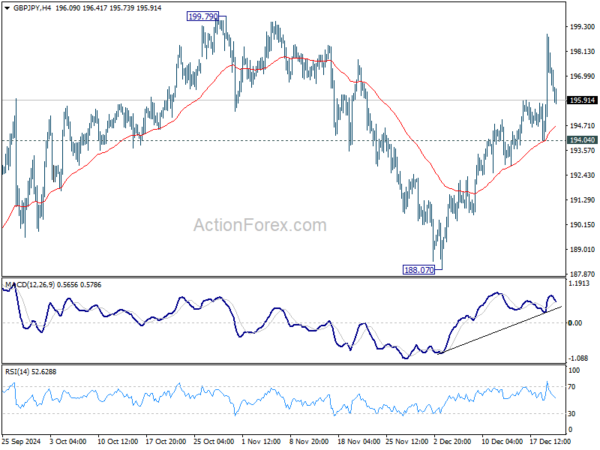

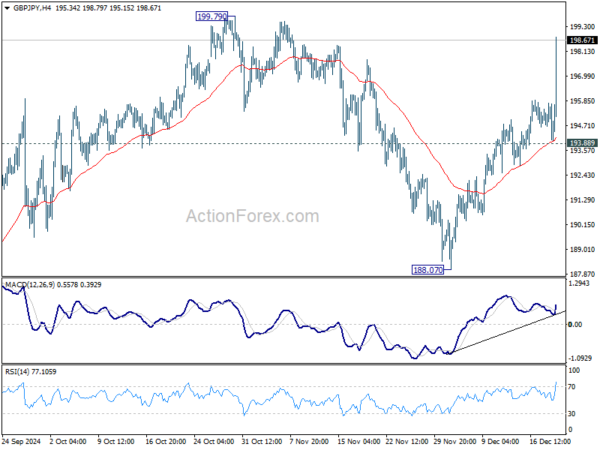

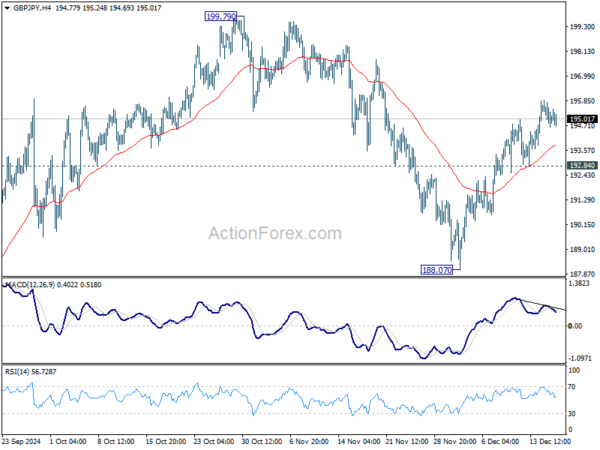

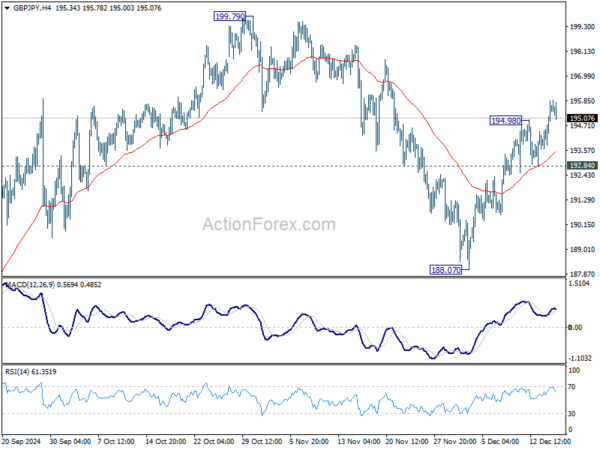

Daily Pivots: (S1) 195.79; (P) 196.55; (R1) 197.34; More…

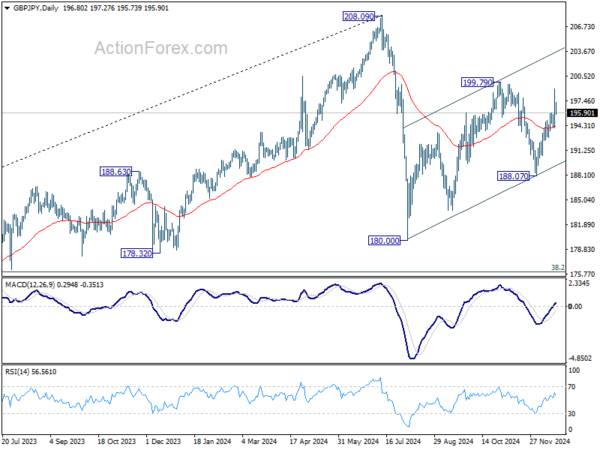

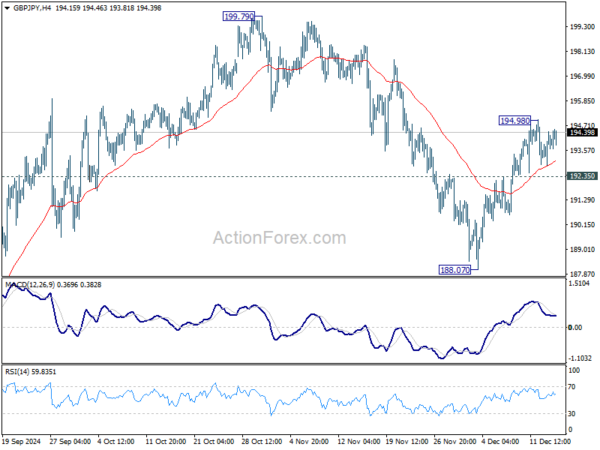

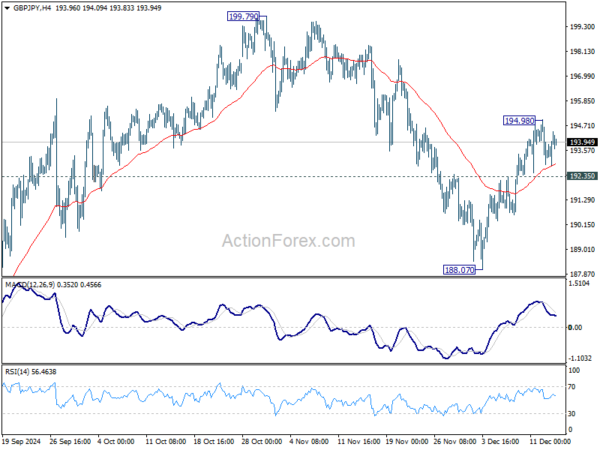

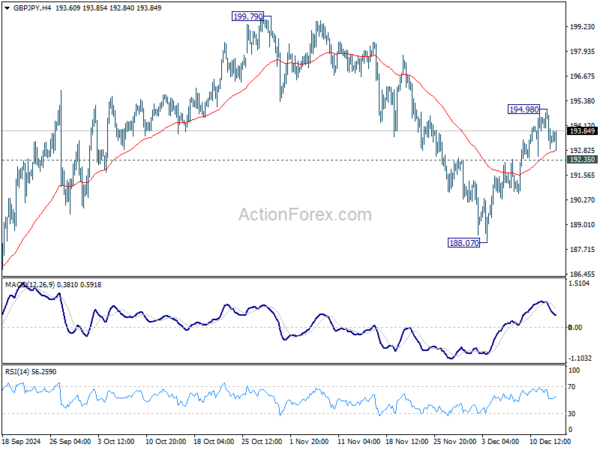

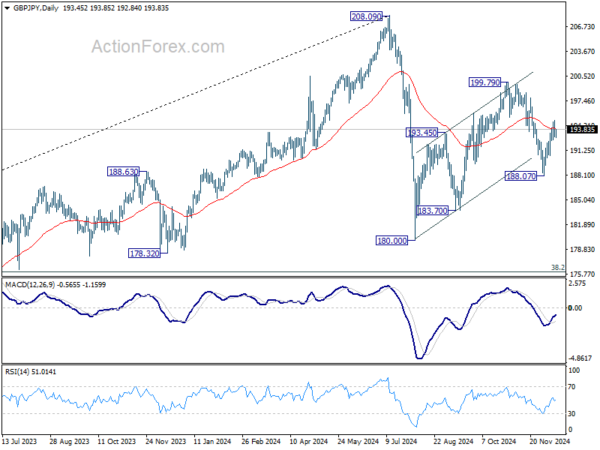

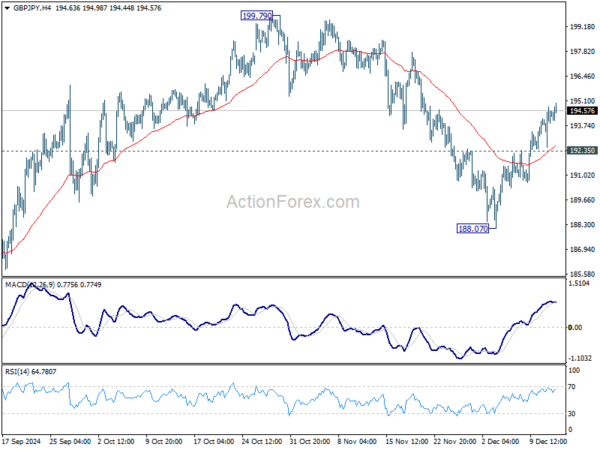

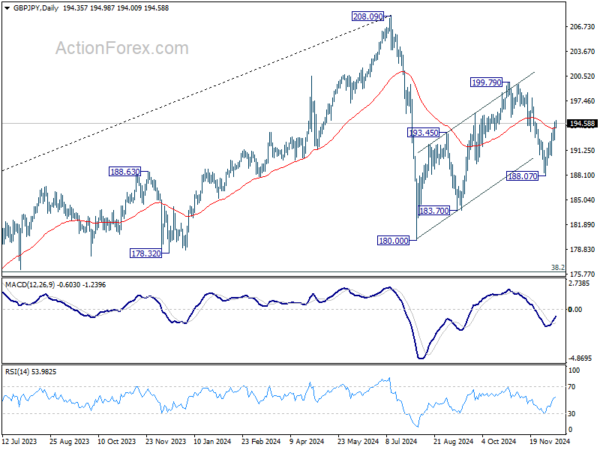

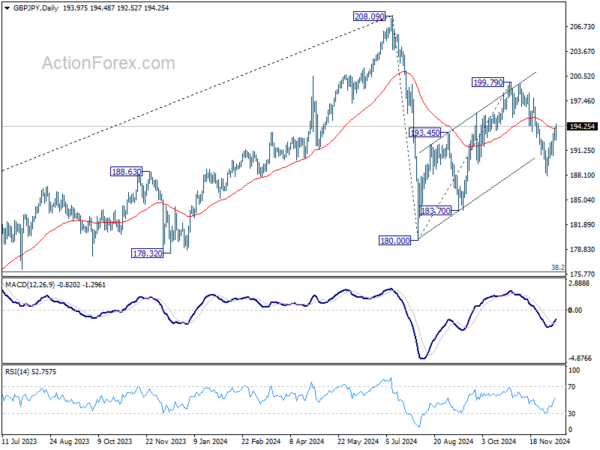

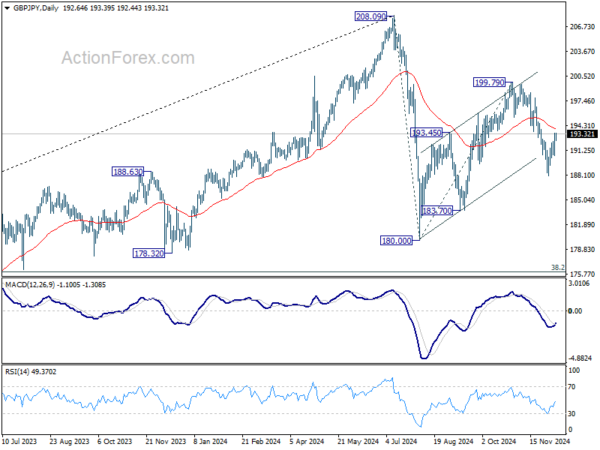

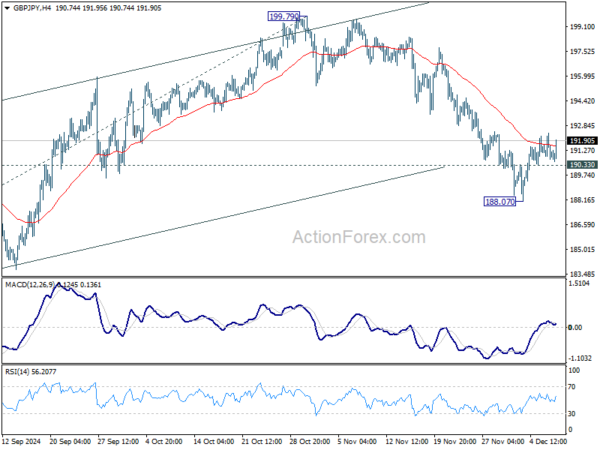

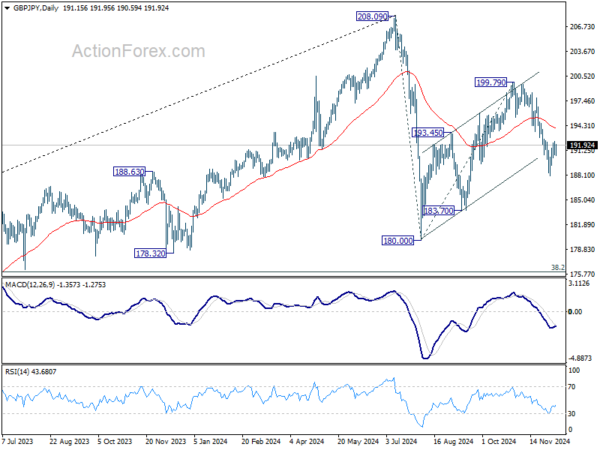

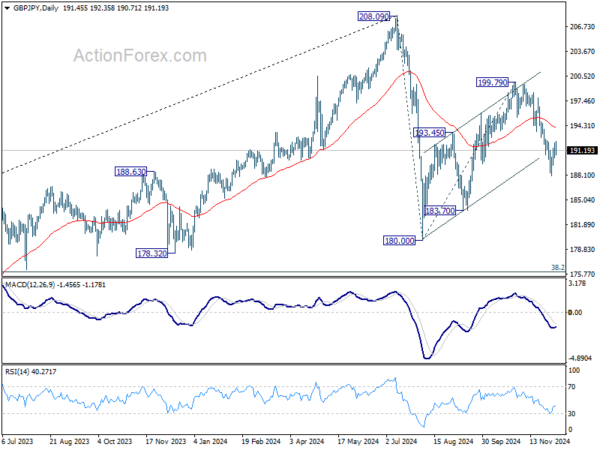

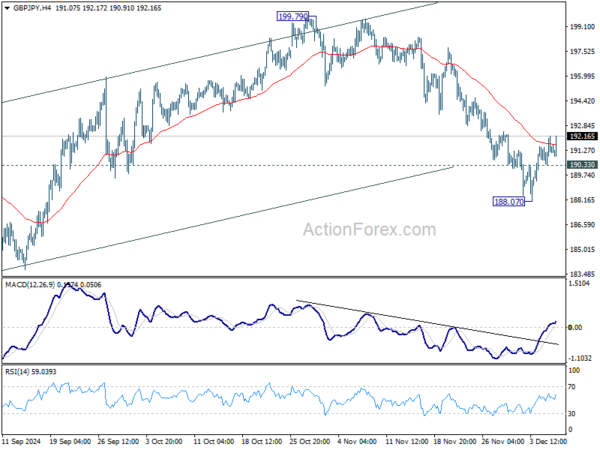

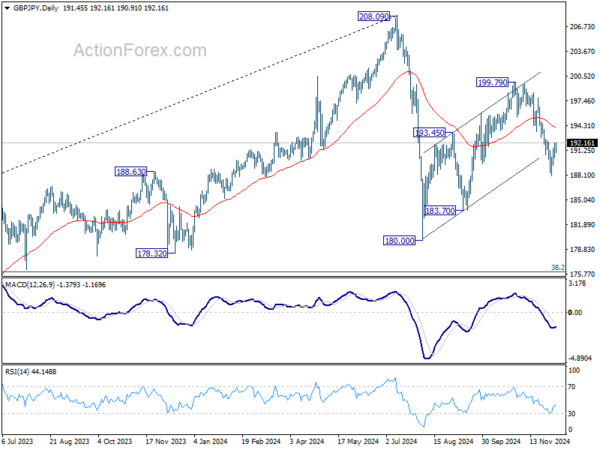

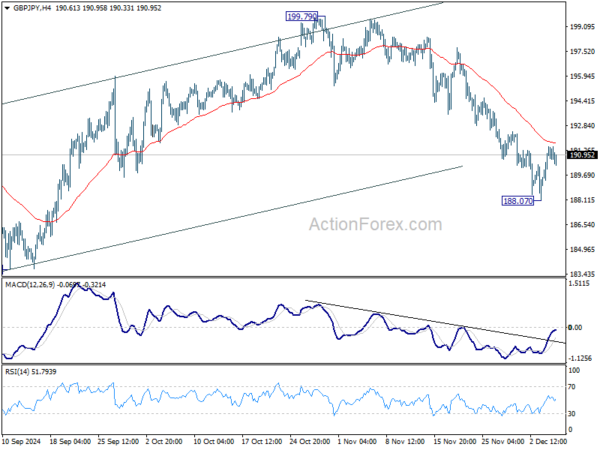

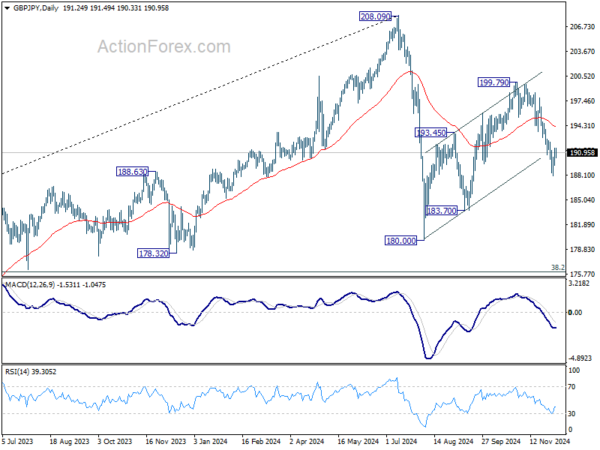

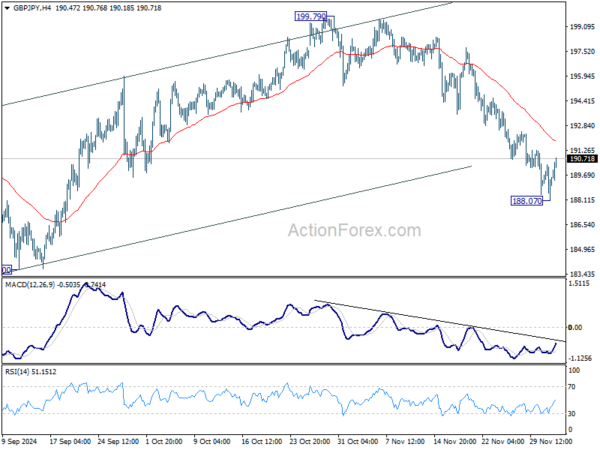

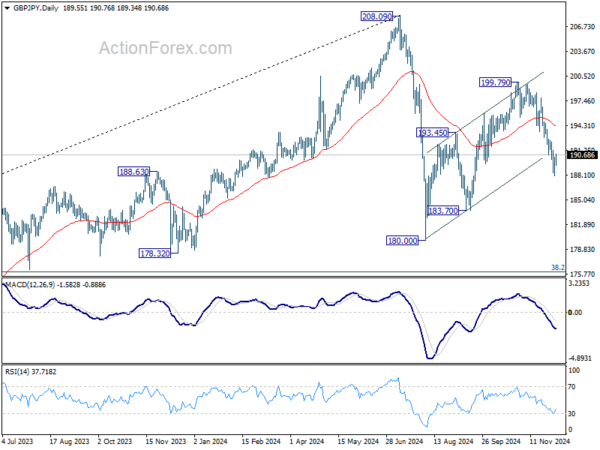

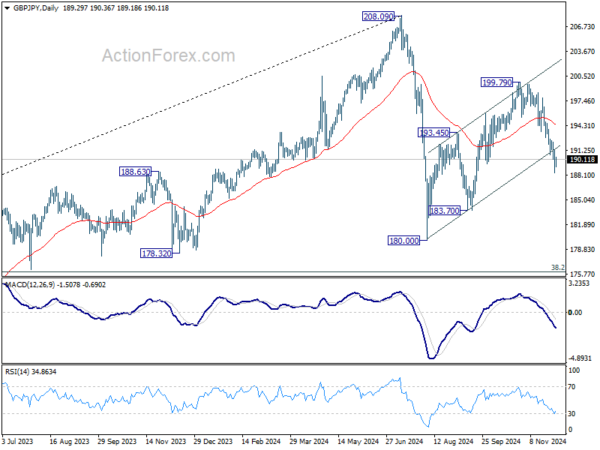

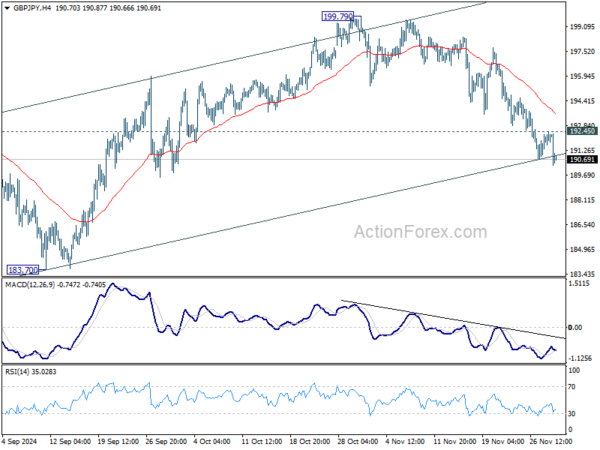

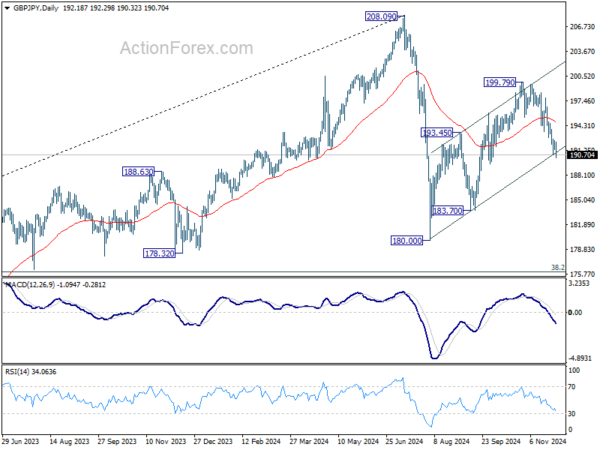

Intraday bias in GBP/JPY remains neutral at this point. As noted before, corrective pattern from 180.00 is extending with another rising leg. Further rise is expected as long as 194.04 support holds. On the upside, above 1999.79 will will target channel resistance (now at 203.19).

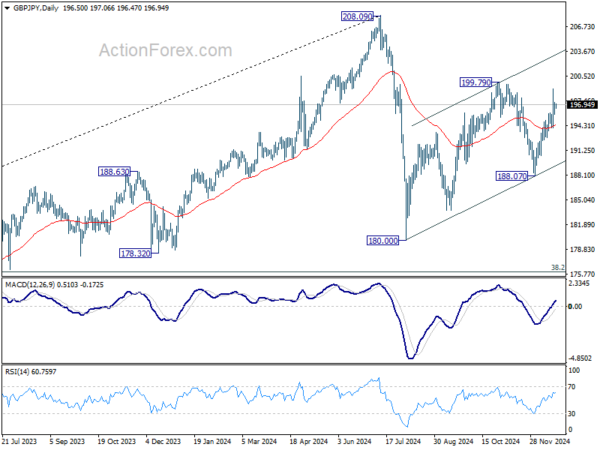

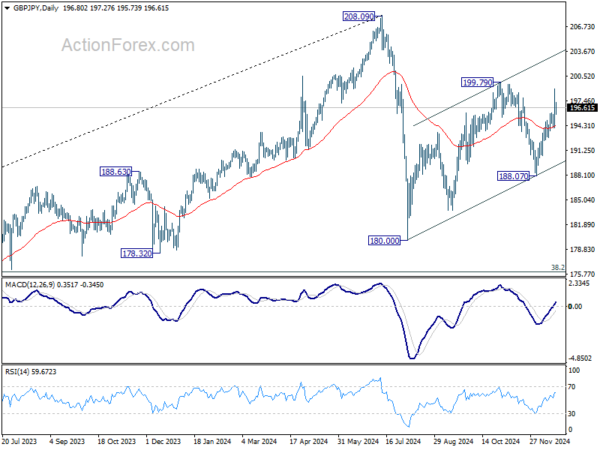

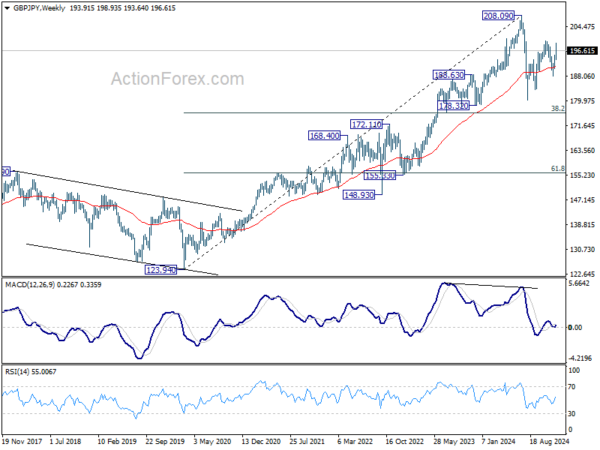

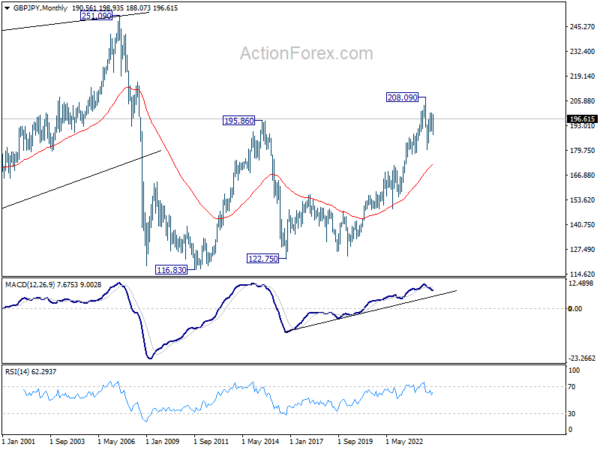

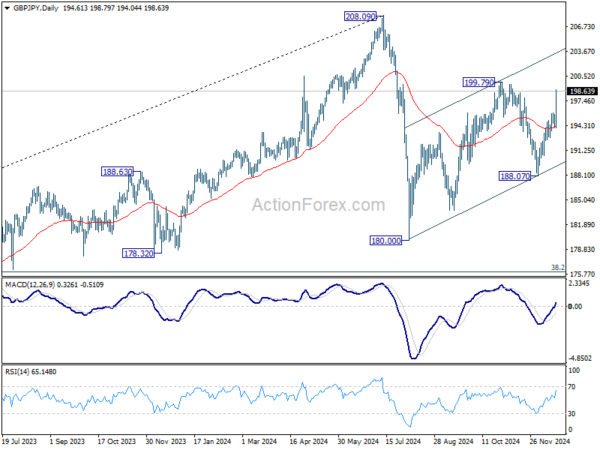

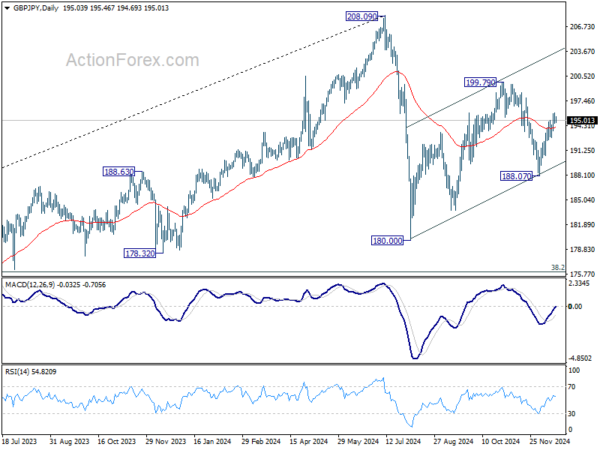

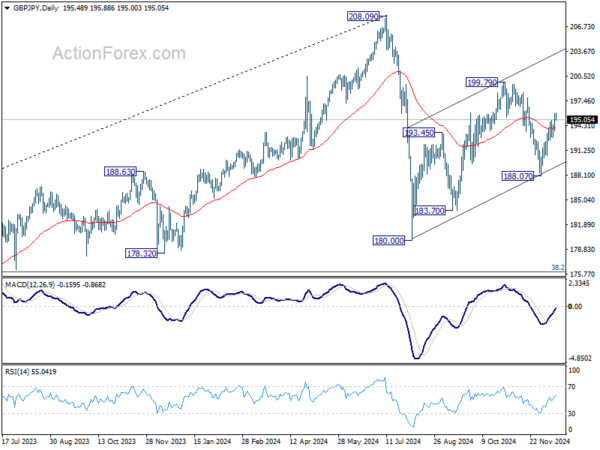

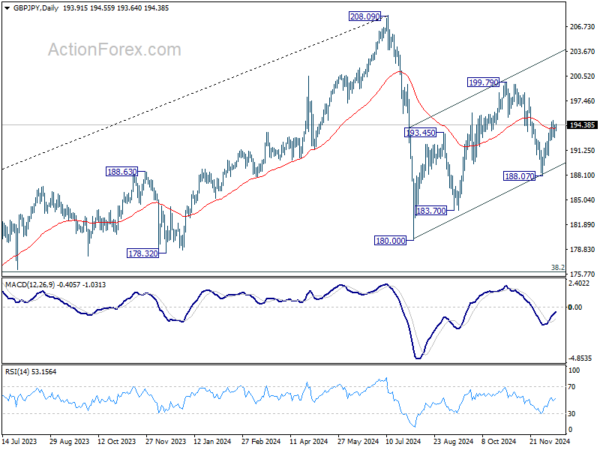

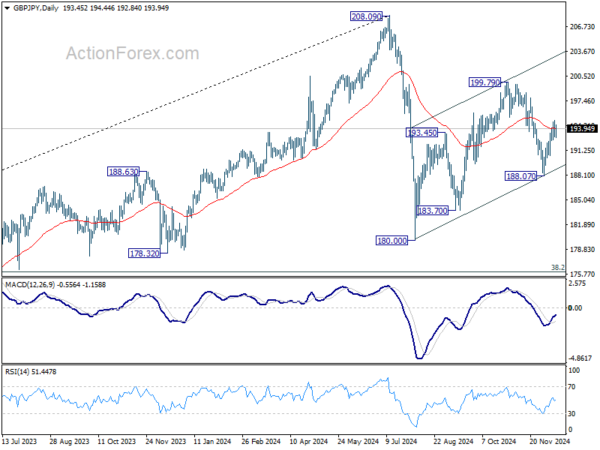

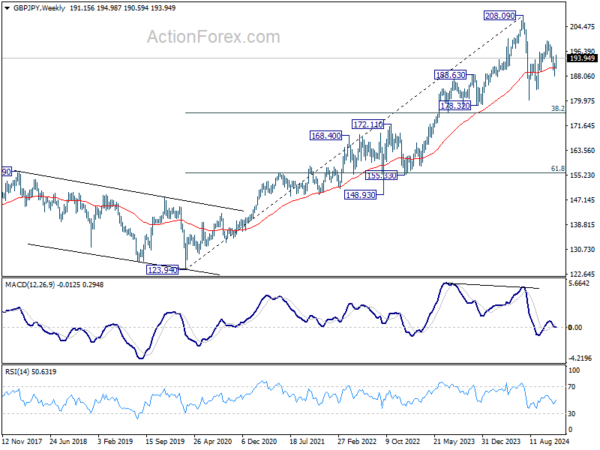

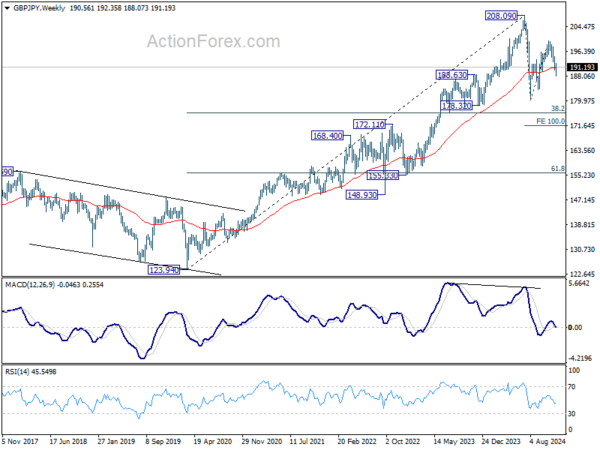

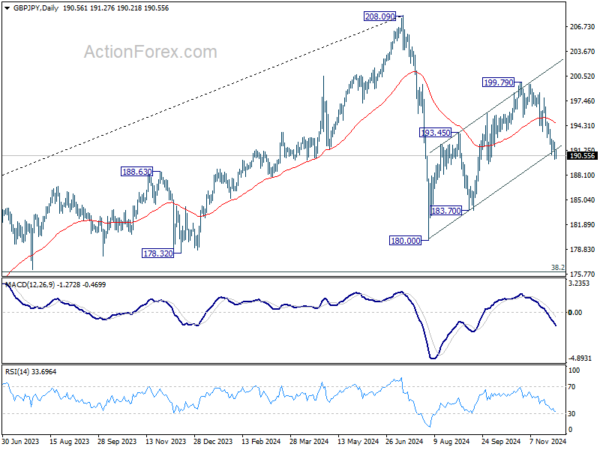

In the bigger picture, price actions from 208.09 are seen as a correction to whole rally from 123.94 (2020 low). The range of consolidation should be set between 38.2% retracement of 123.94 to 208.09 at 175.94 and 208.09. However, decisive break of 175.94 will argue that deeper correction is underway.