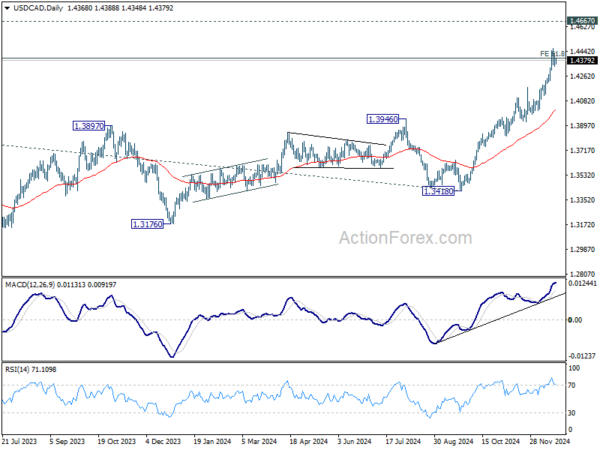

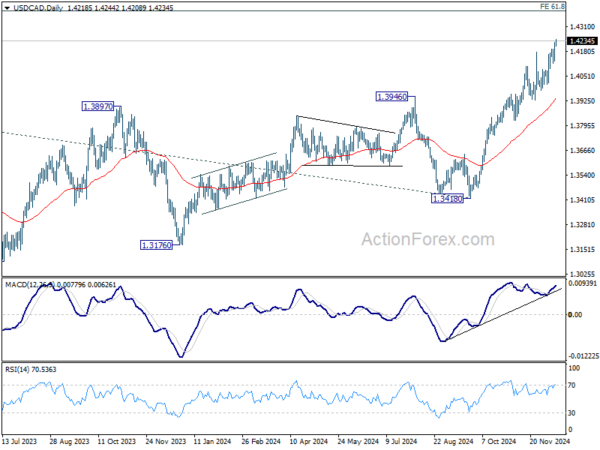

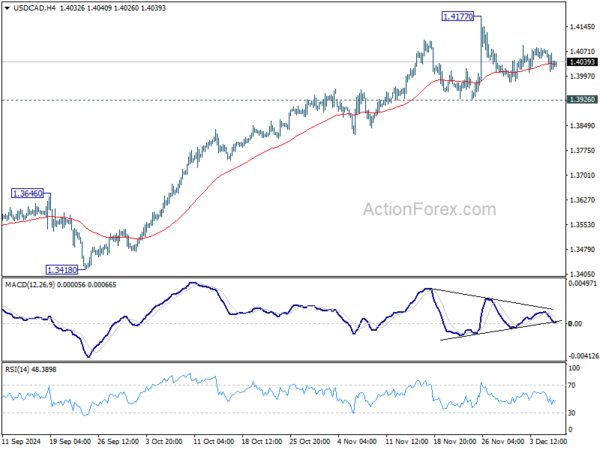

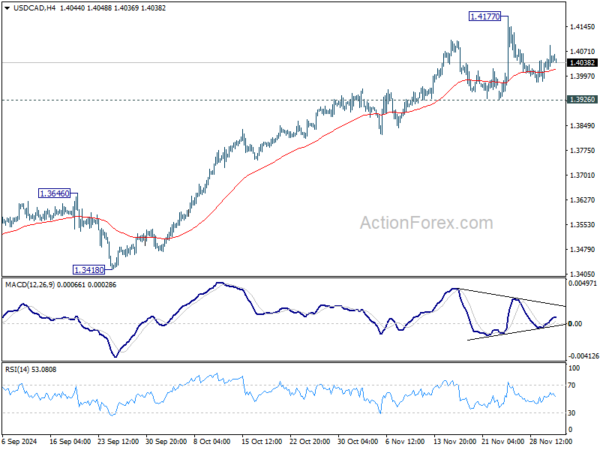

Daily Pivots: (S1) 1.4328; (P) 1.4382; (R1) 1.4428; More…

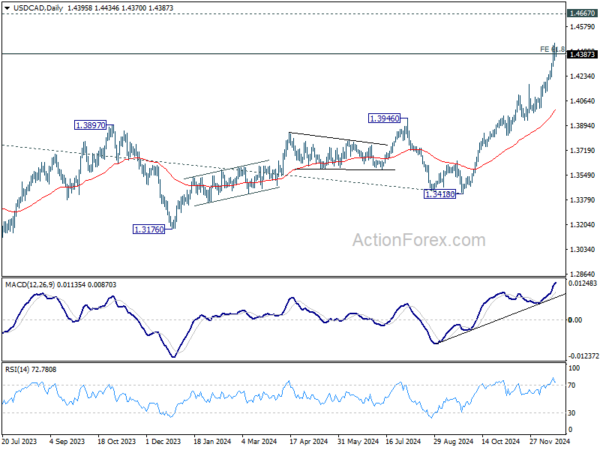

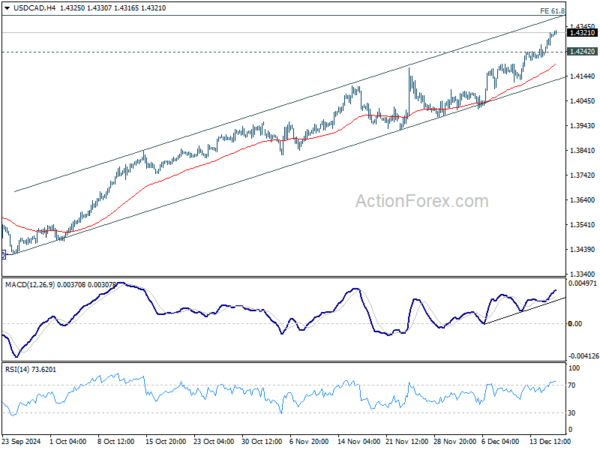

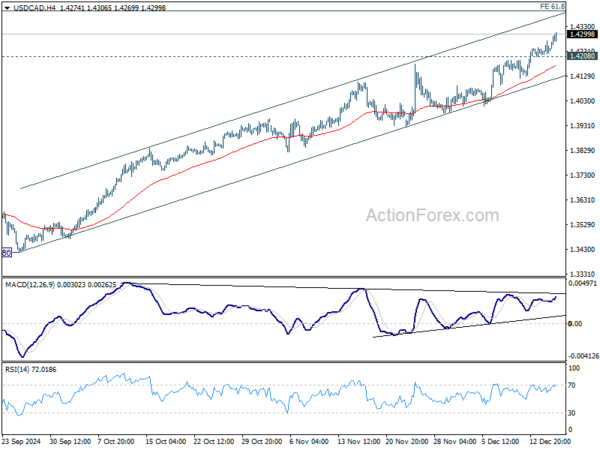

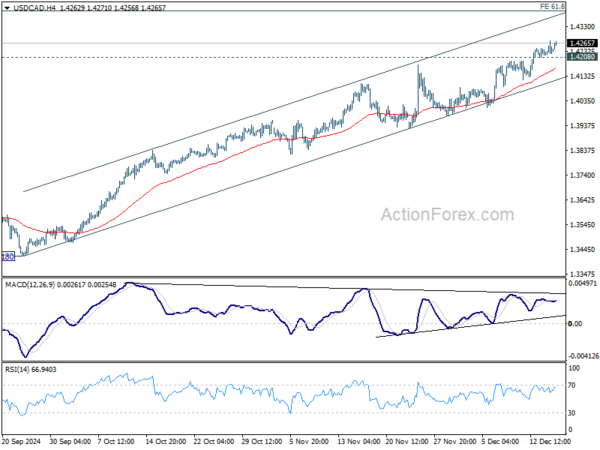

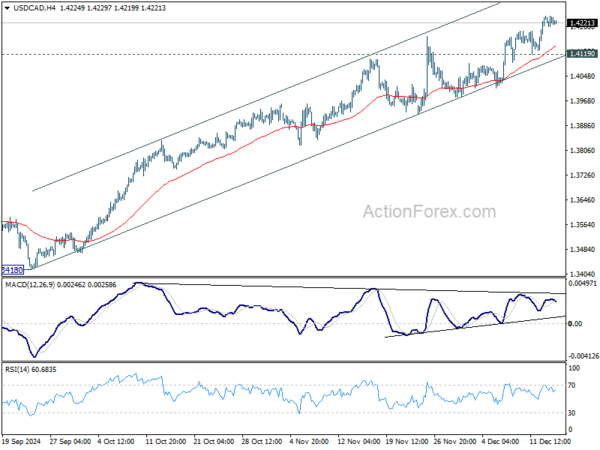

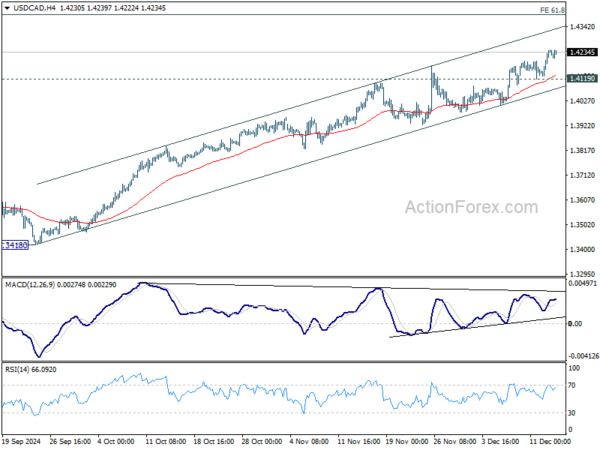

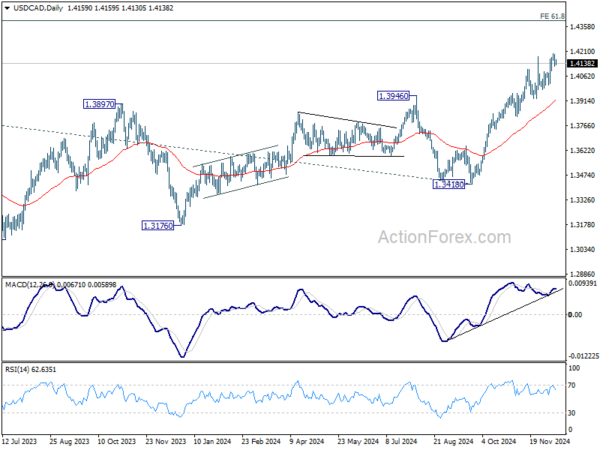

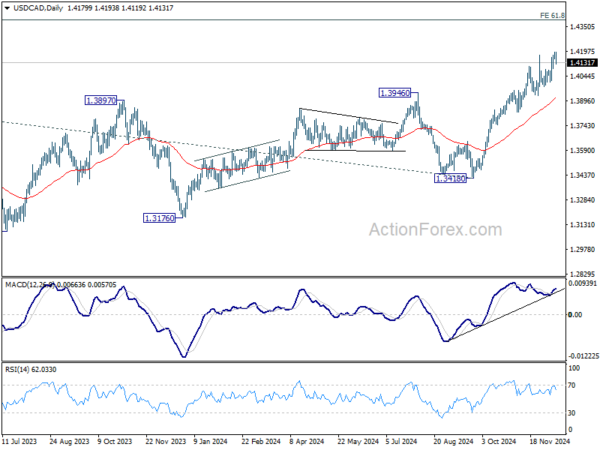

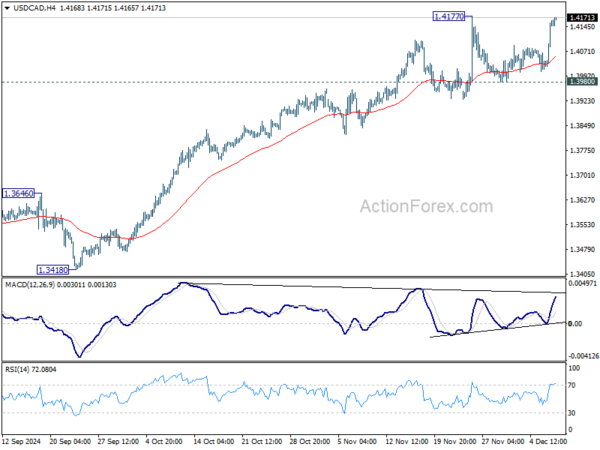

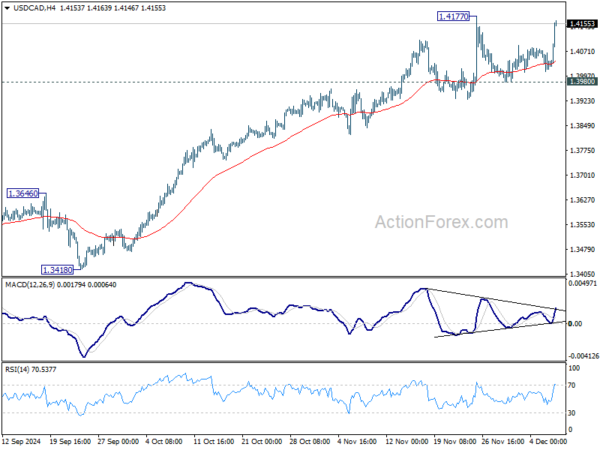

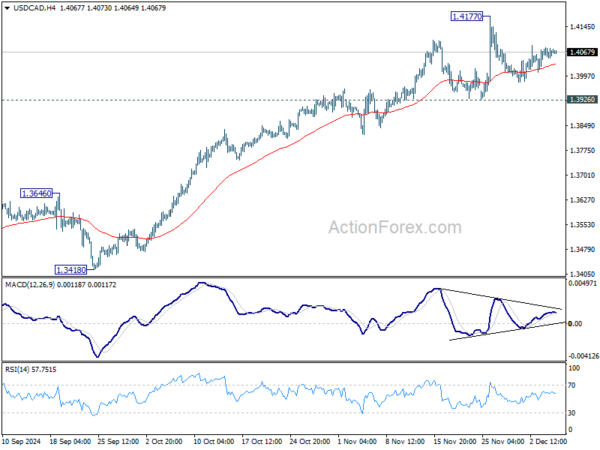

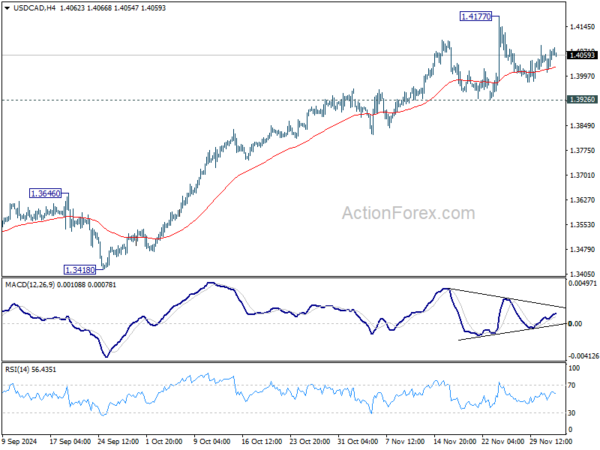

Intraday bias in USD/CAD stays neutral as consolidation continues below 1.4466 temporary top. While deeper pull back cannot be ruled out, outlook will stay bullish as long as 1.4177 resistance turned support holds. On the upside, break of 1.4466 and sustained trading above 1.4391 will pave the way to retest 1.4667/89 long term resistance zone.

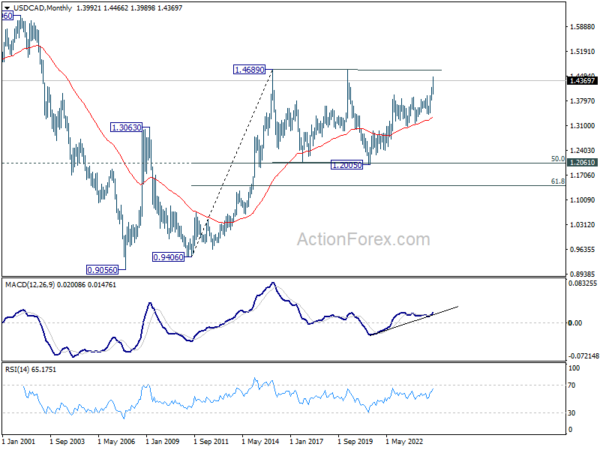

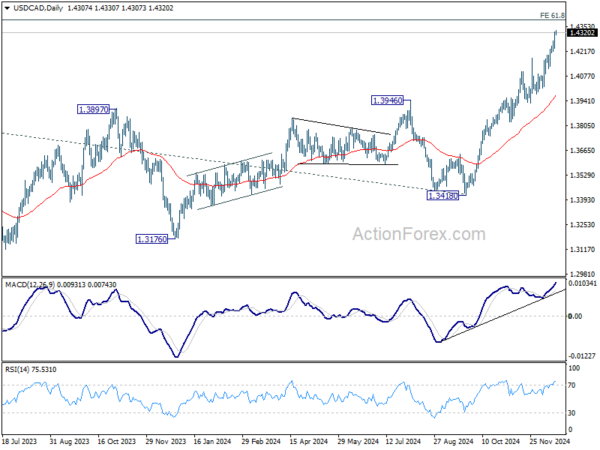

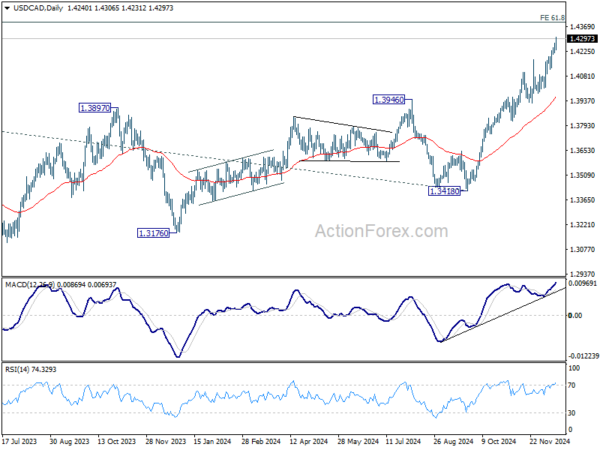

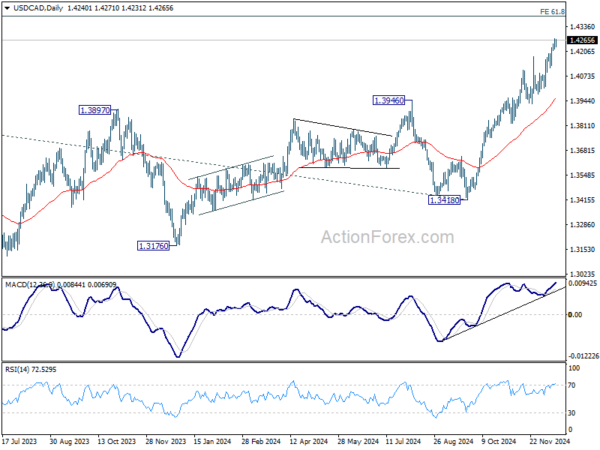

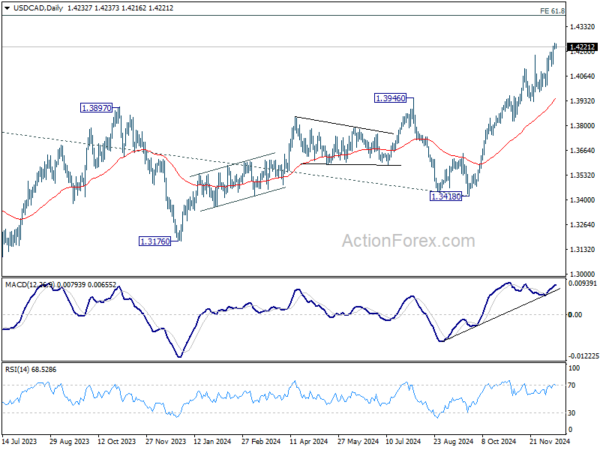

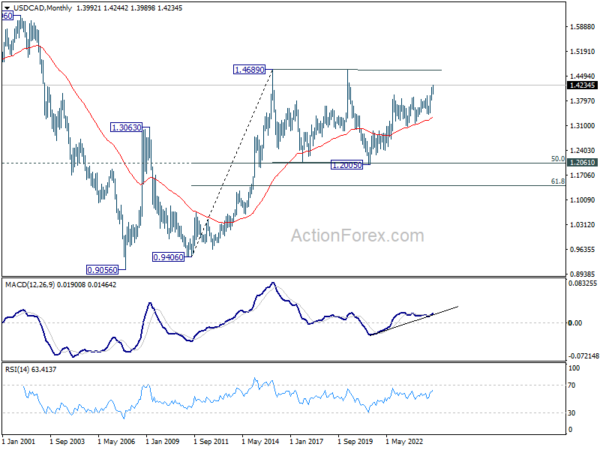

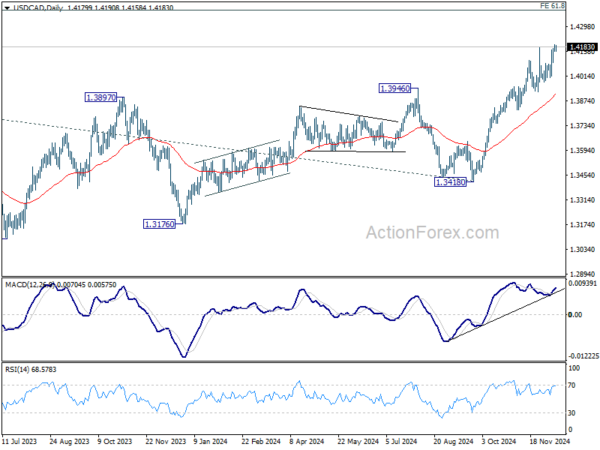

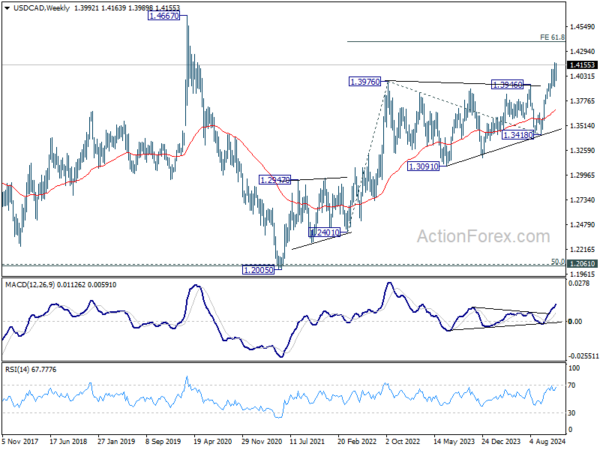

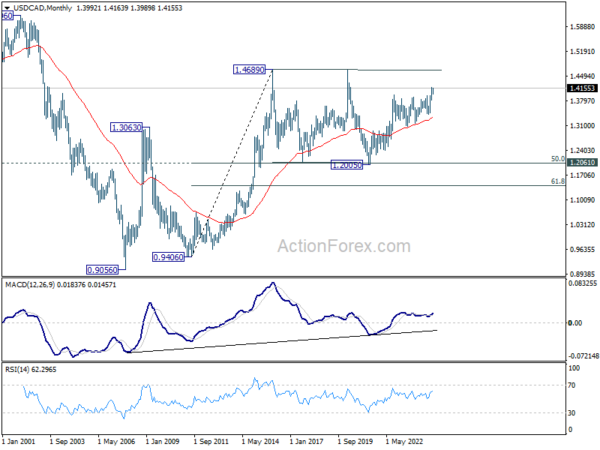

In the bigger picture, up trend from 1.2005 (2021) is in progress and met 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391 already. Sustained trading above there will pave the way to 1.4667/89 key resistance zone (2020/2015 highs). Medium term outlook will remain bullish as long as 55 W EMA (now at 1.3729) holds, even in case of deep pullback.