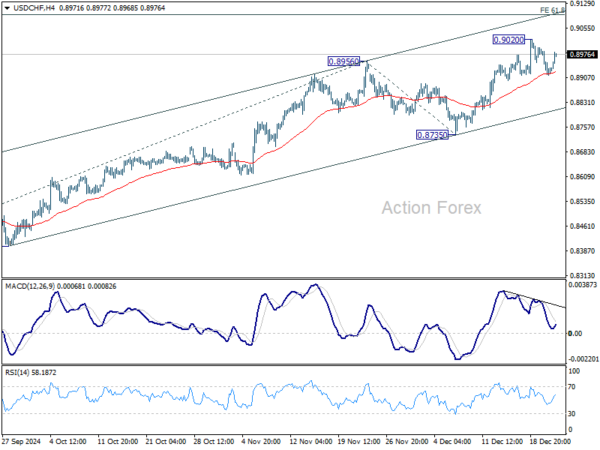

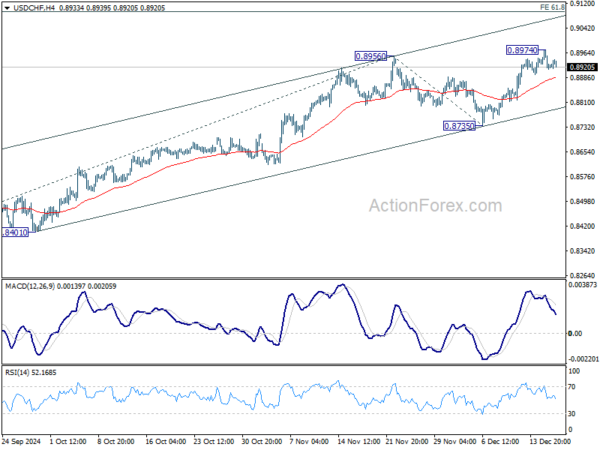

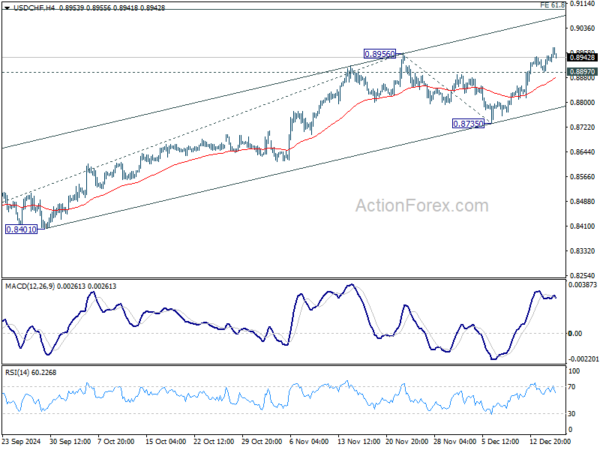

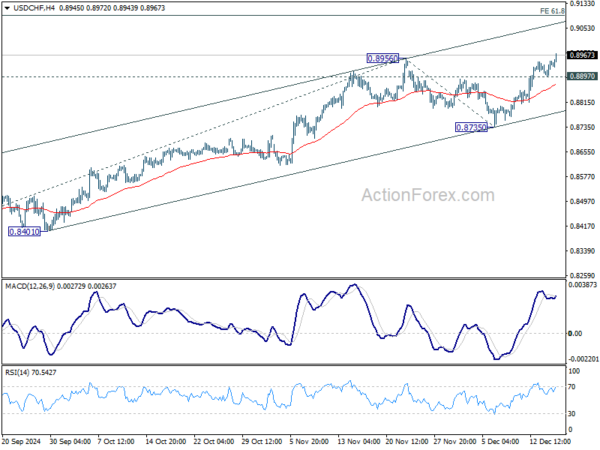

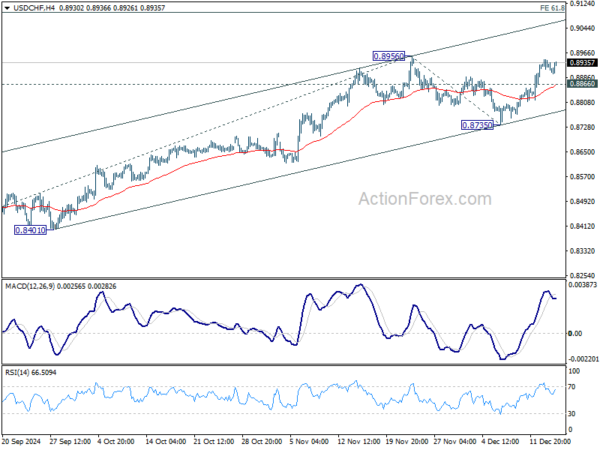

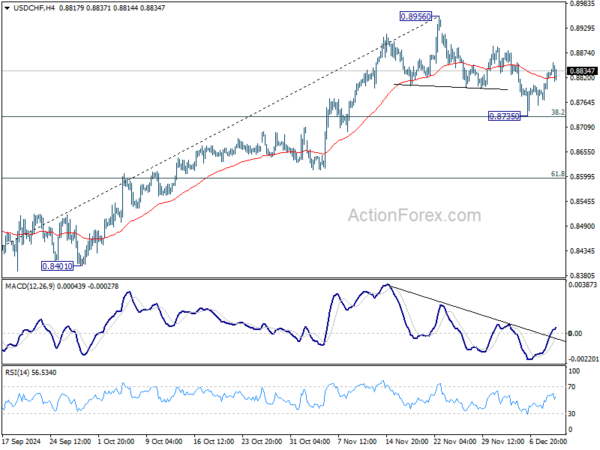

Daily Pivots: (S1) 0.8898; (P) 0.8946; (R1) 0.8979; More…

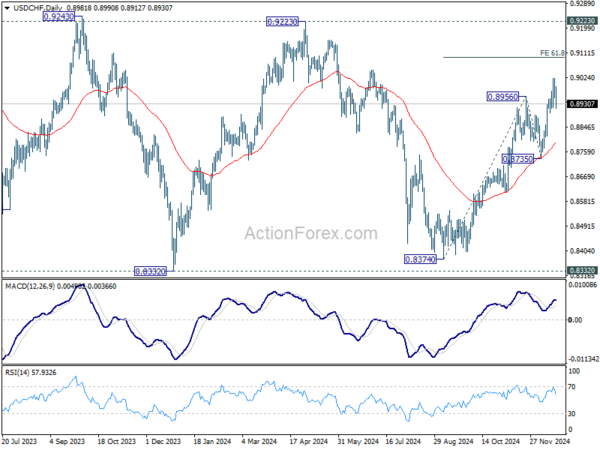

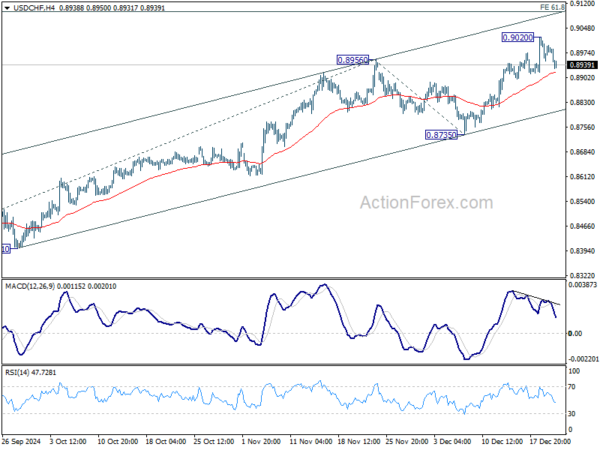

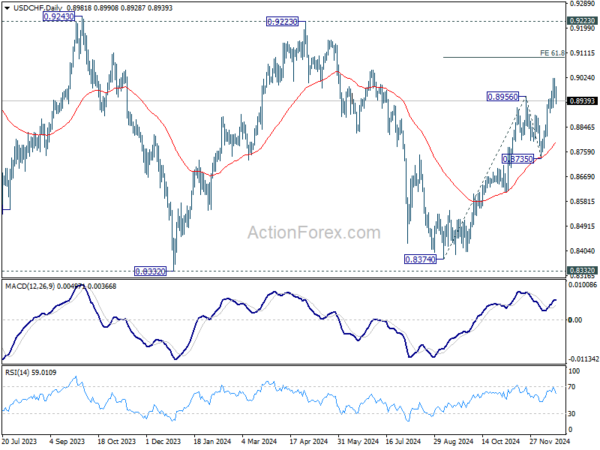

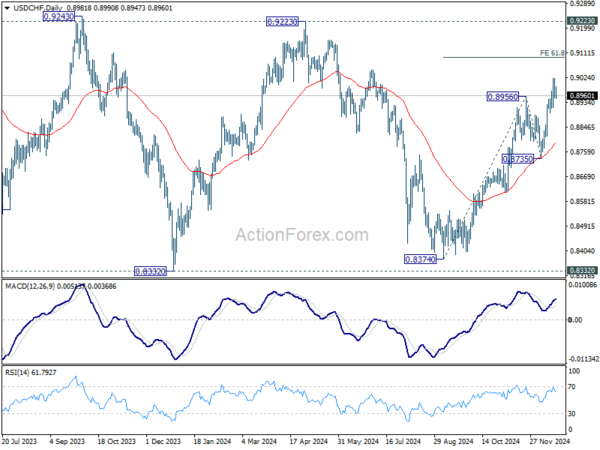

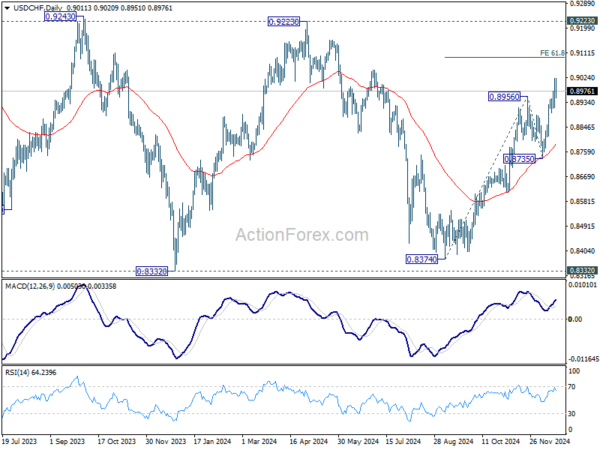

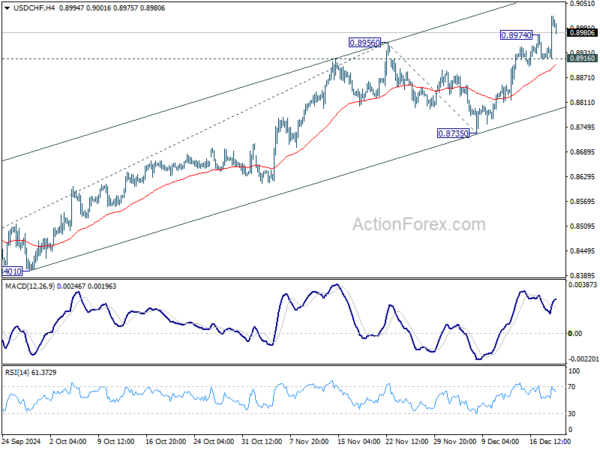

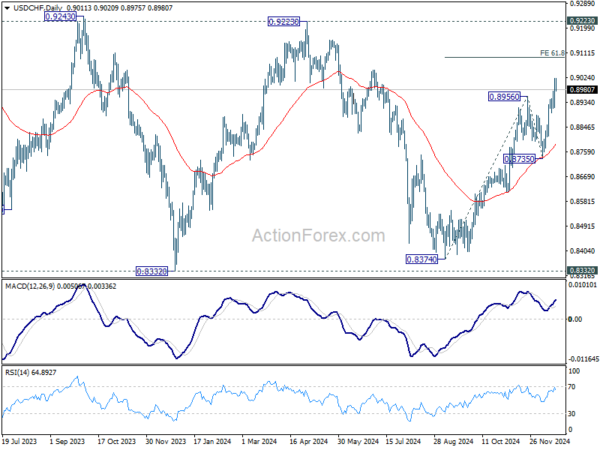

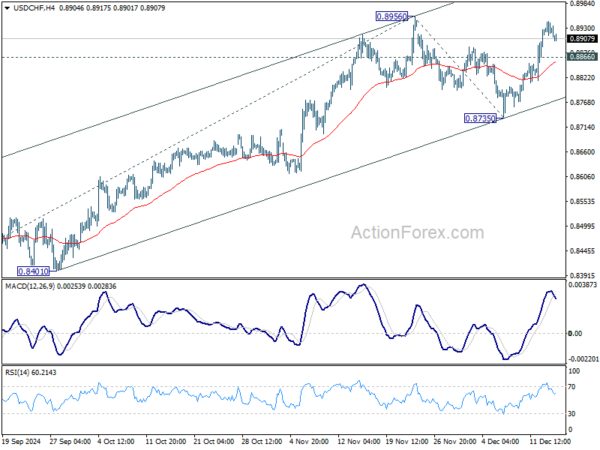

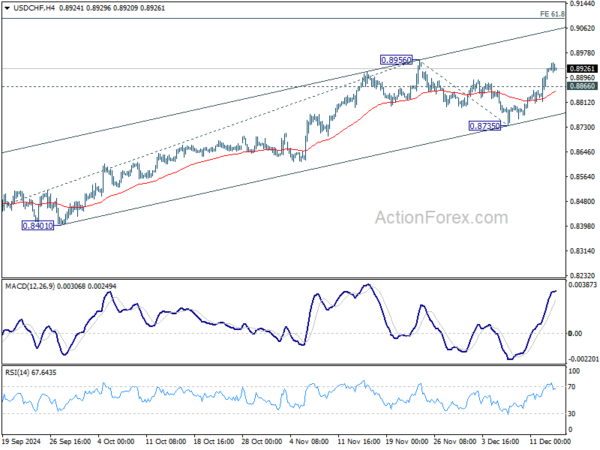

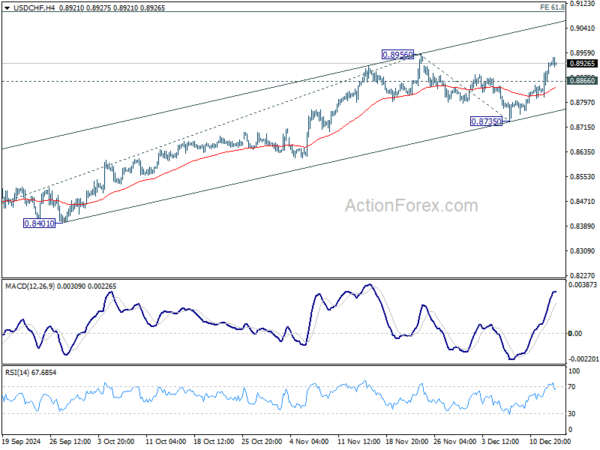

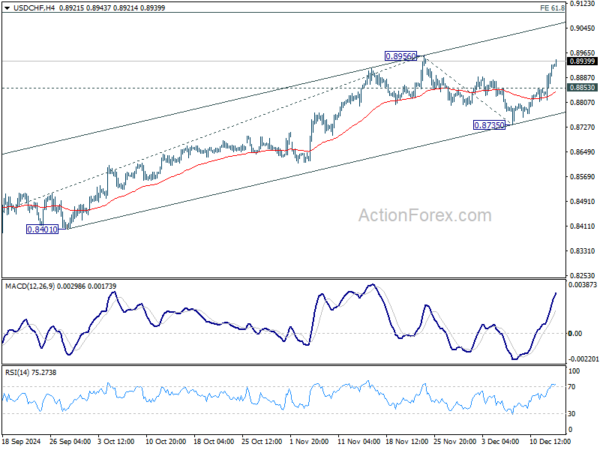

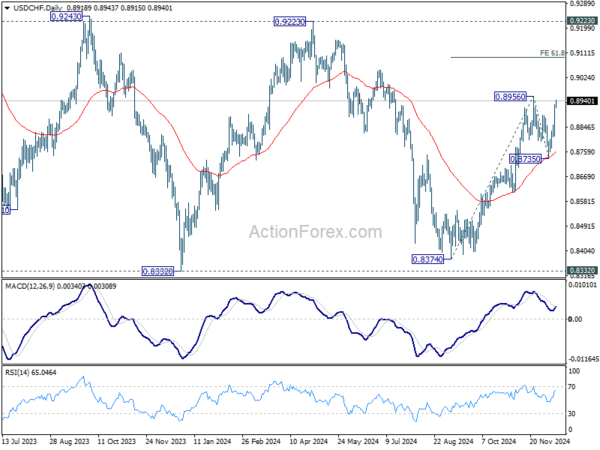

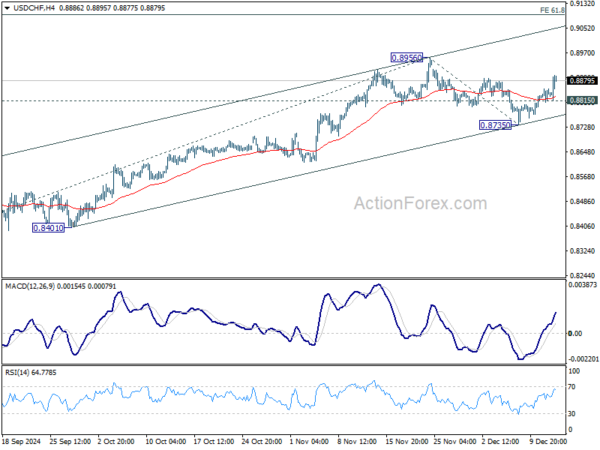

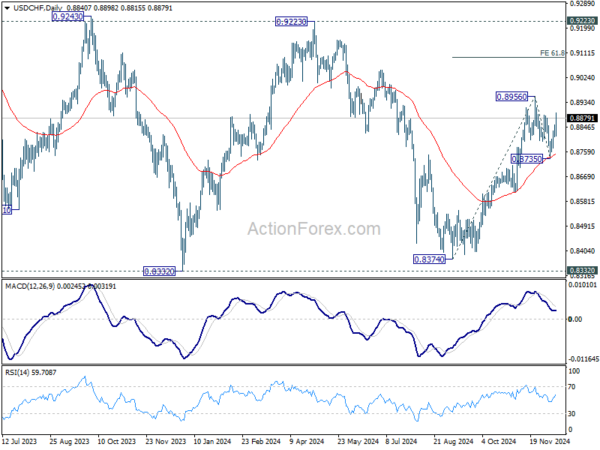

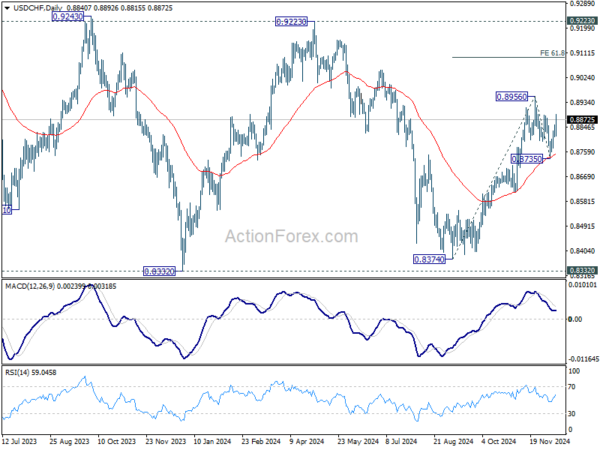

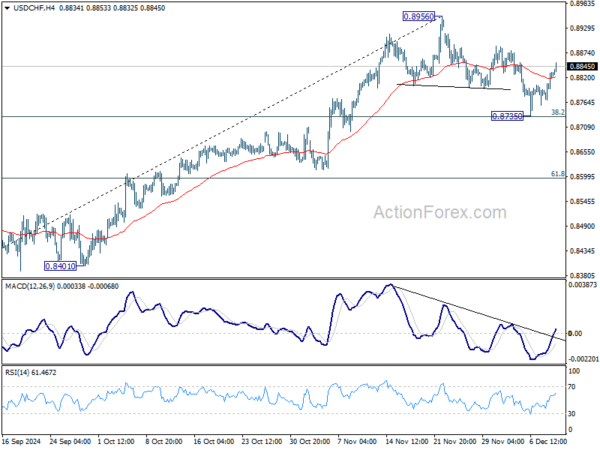

USD/CHF bounces after drawing support from 55 4H EMA, but stays below 0.9020 temporary top. Intraday bias remains neutral at this point. While deeper pull back might be seen, downside should be contained above 0.8735 support to bring another rally. Above 0.9020 will resume the rise from 0.8374 and target 61.8% projection of 0.8374 to 0.8956 from 0.8735 at 0.9095.

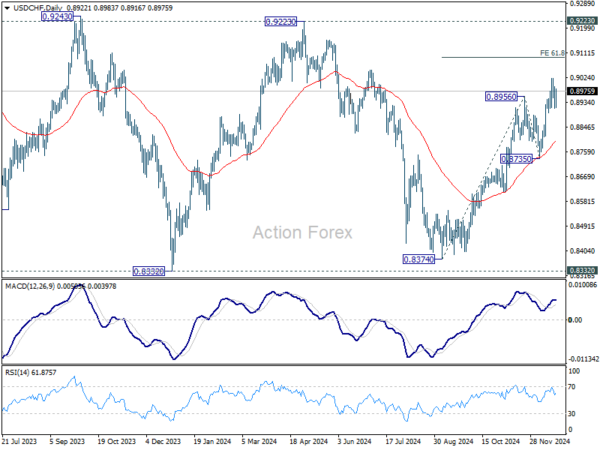

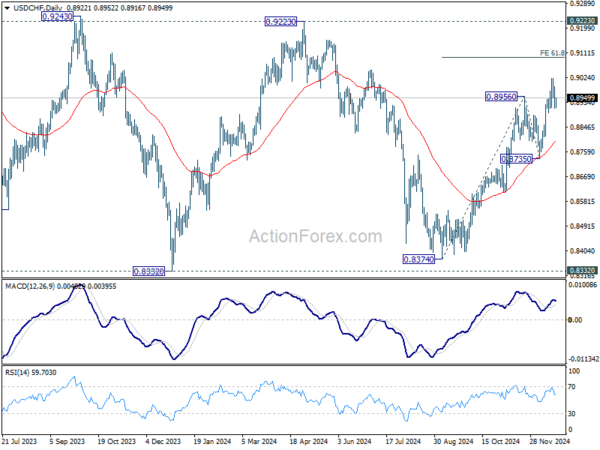

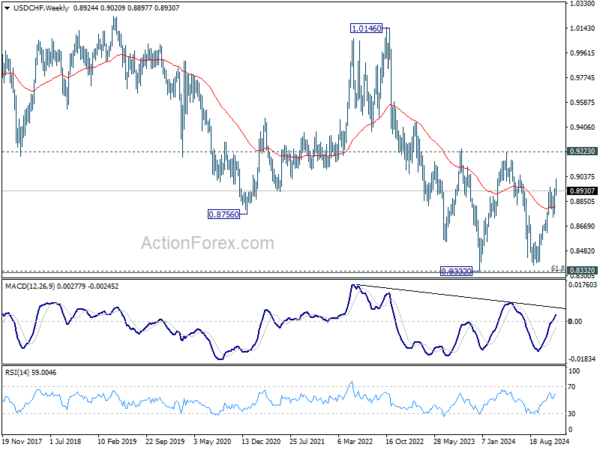

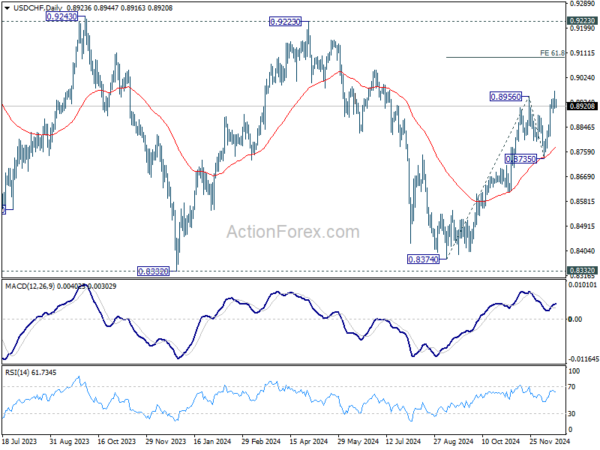

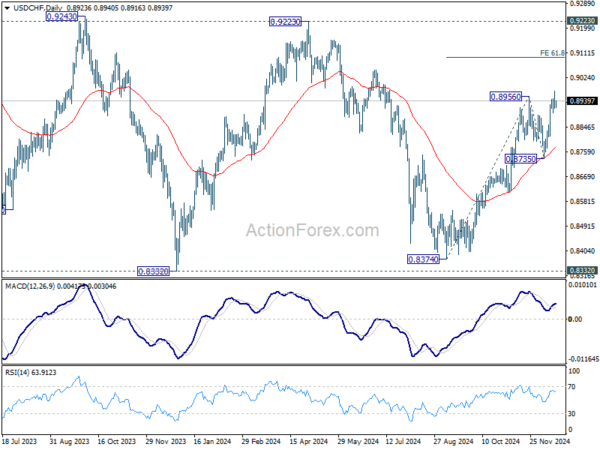

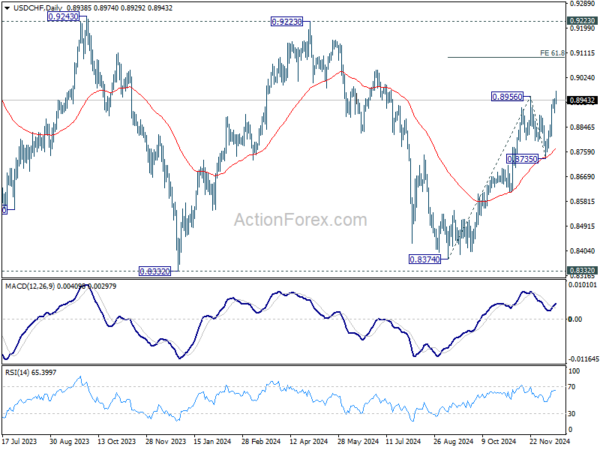

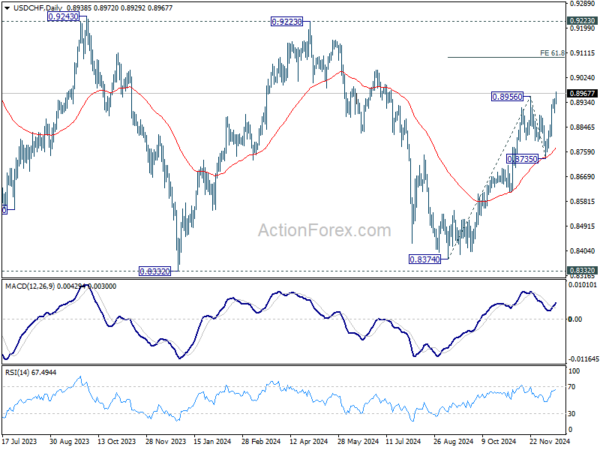

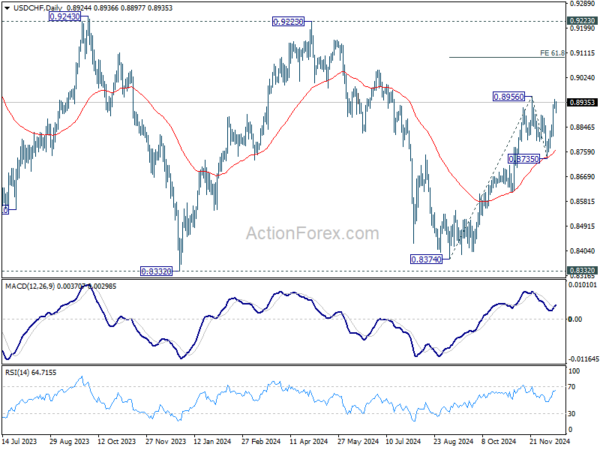

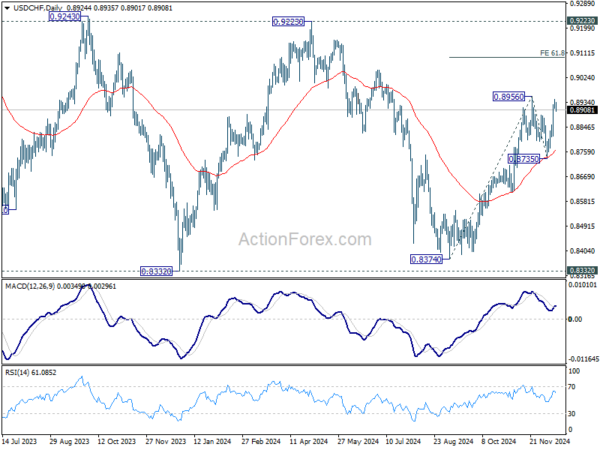

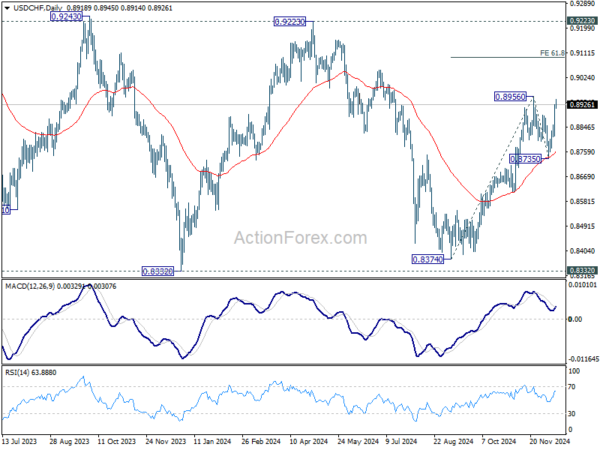

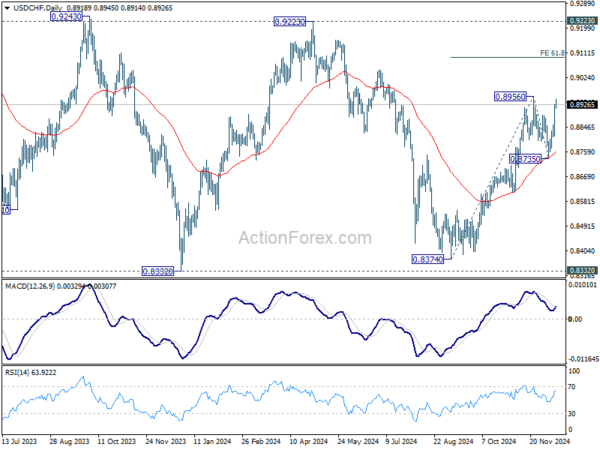

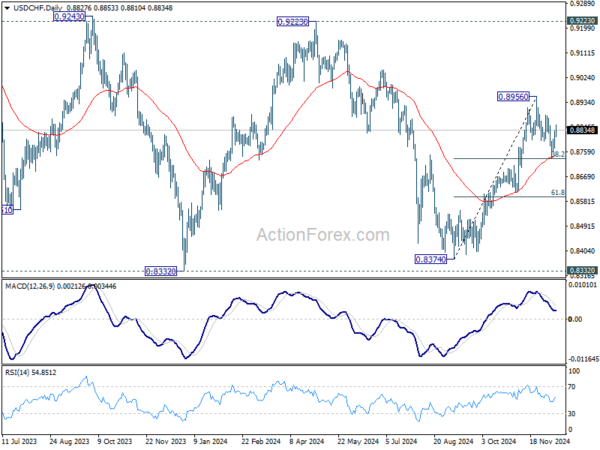

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with rise from 0.8374 as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.