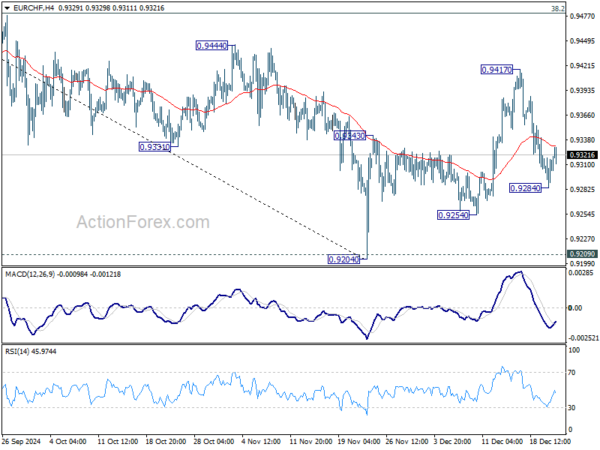

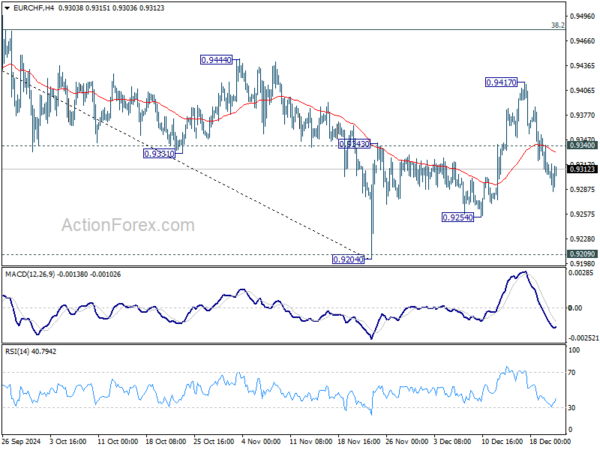

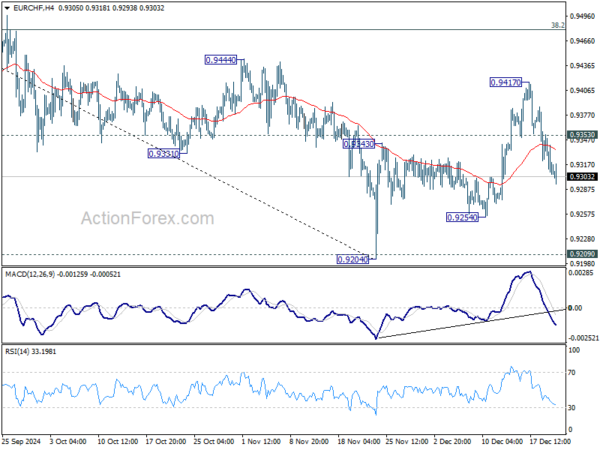

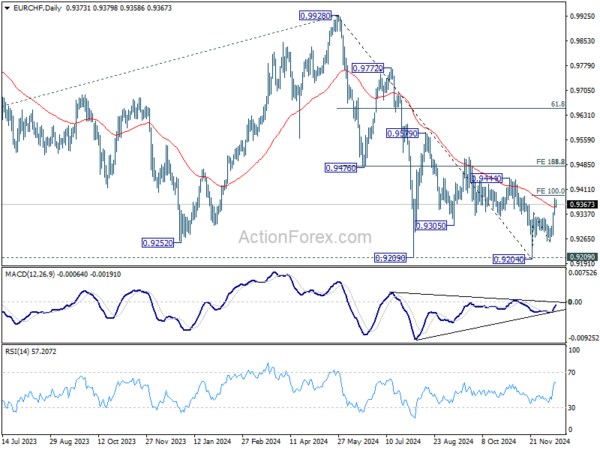

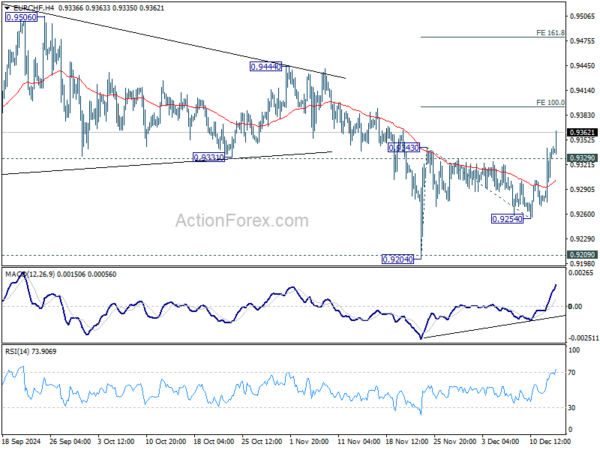

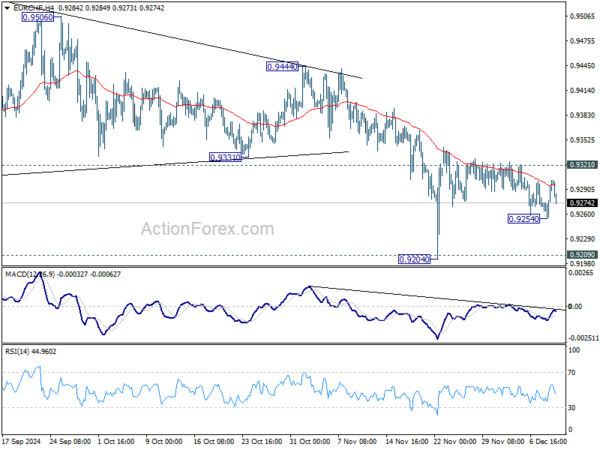

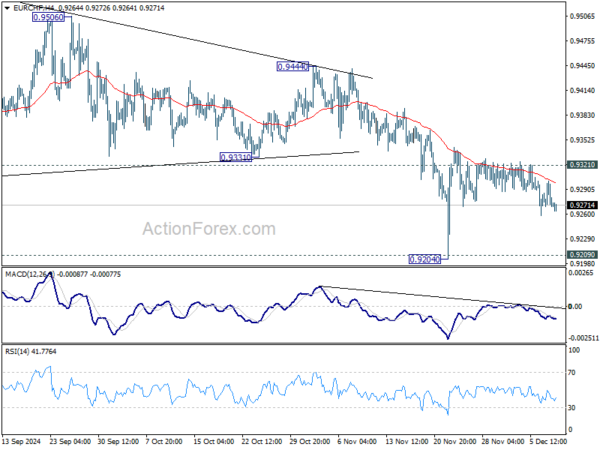

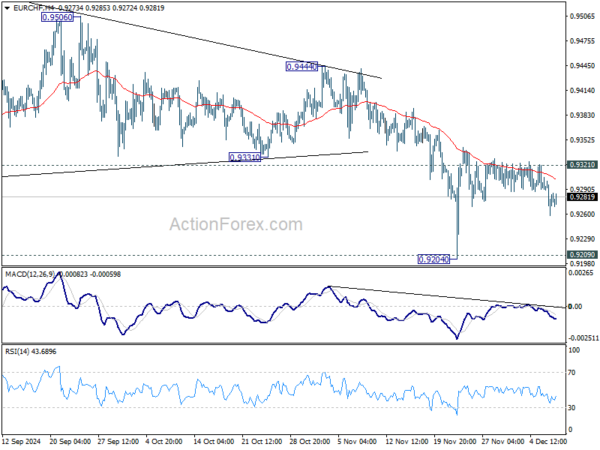

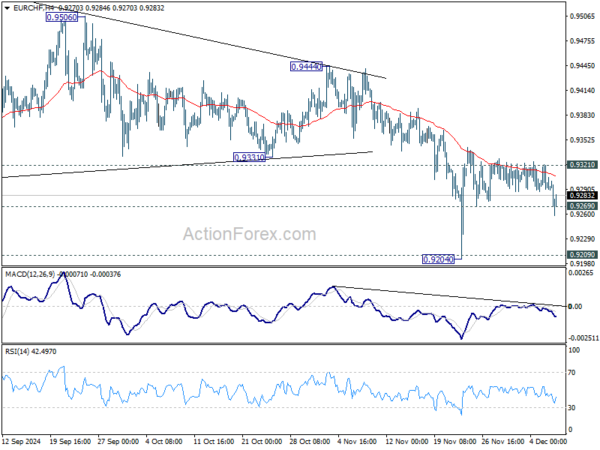

Daily Pivots: (S1) 0.9289; (P) 0.9311; (R1) 0.9336; More….

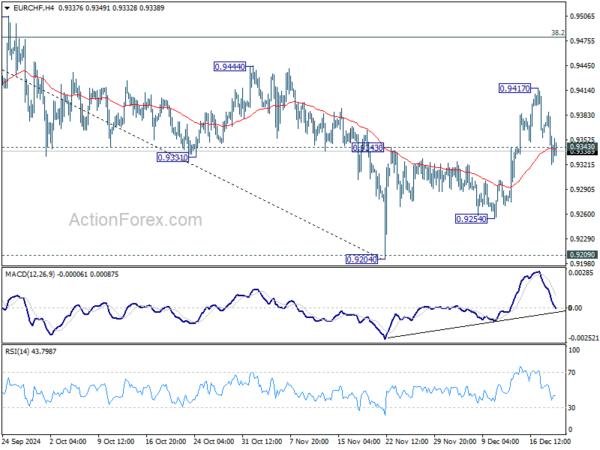

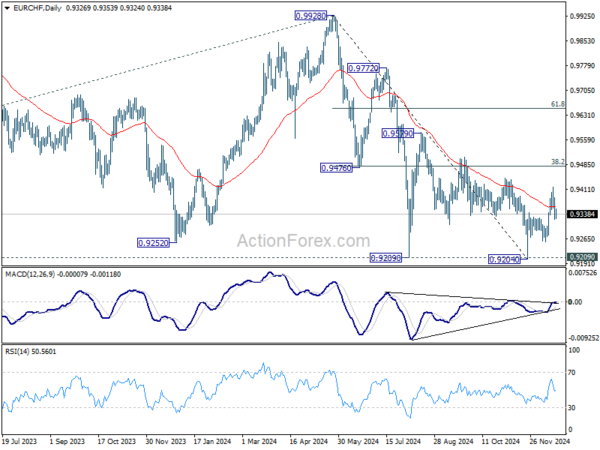

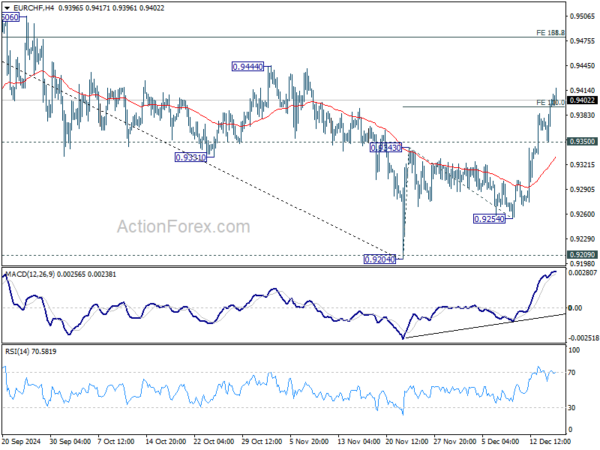

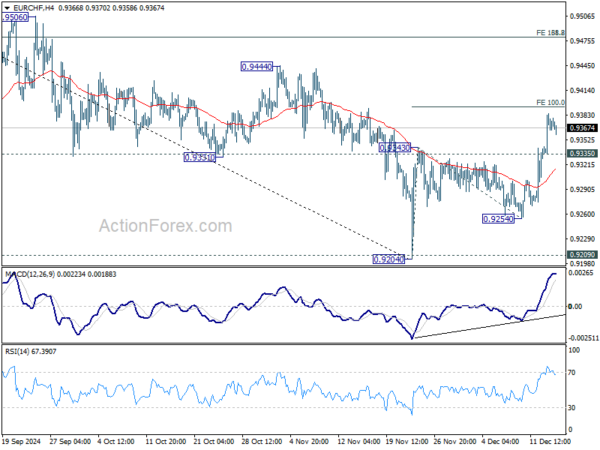

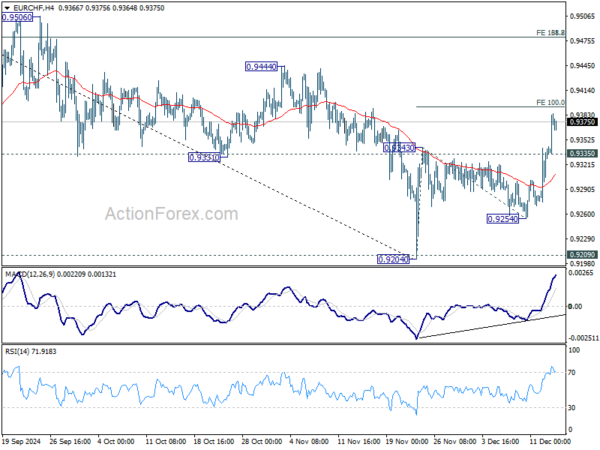

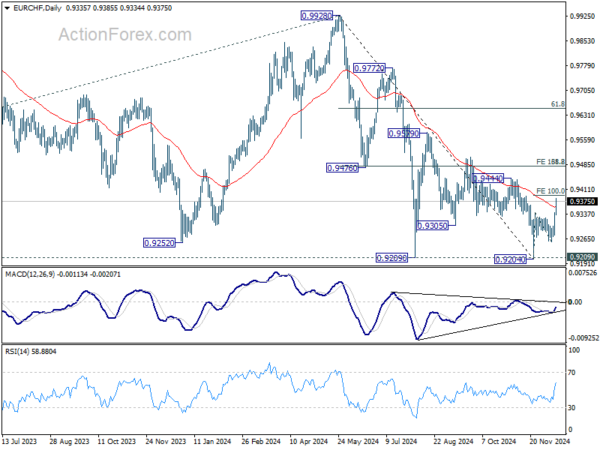

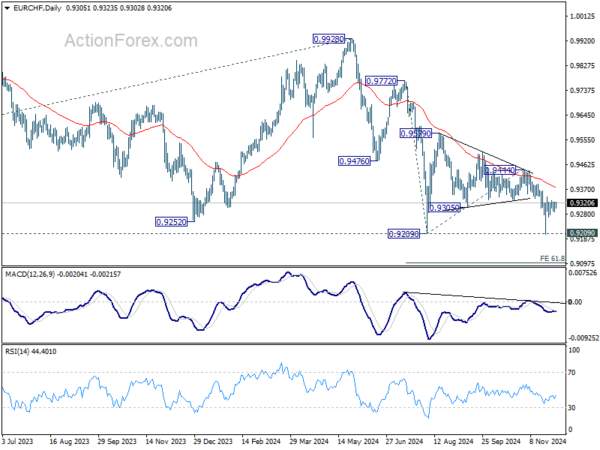

Intraday bias in EUR/CHF is turned neutral first with a temporary low formed at 0.9284. But outlook is unchanged that corrective rebound from 0.9204 should have completed with three waves up to 0.9417 already. Another fall is in favor and below 0.9284 will target 0.9254 support first. Break there will bring retest of 0.9204 low.

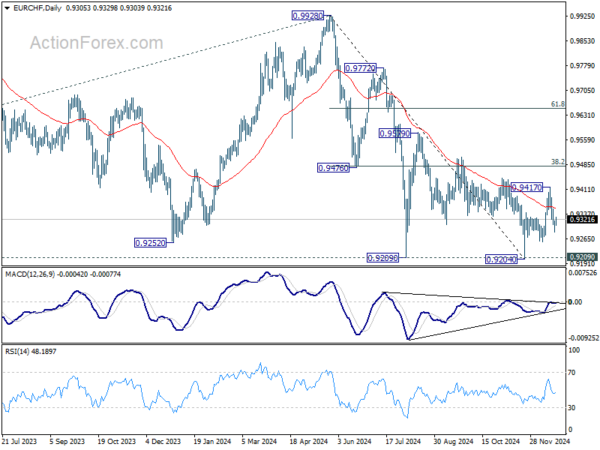

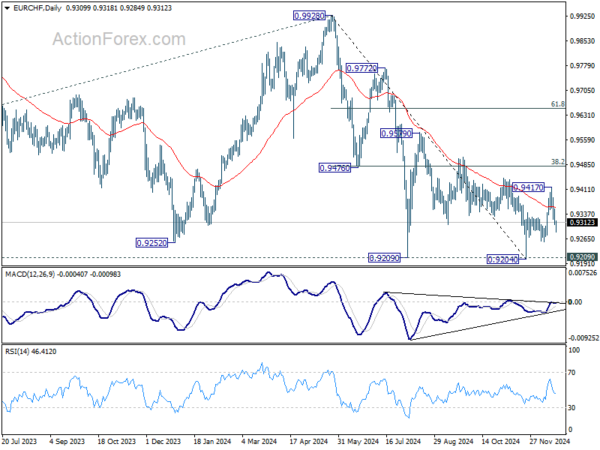

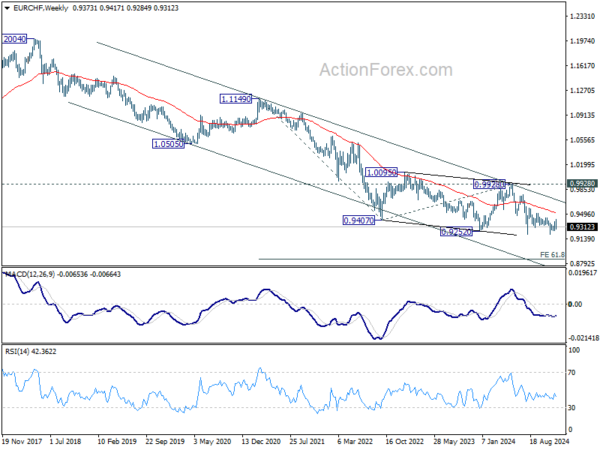

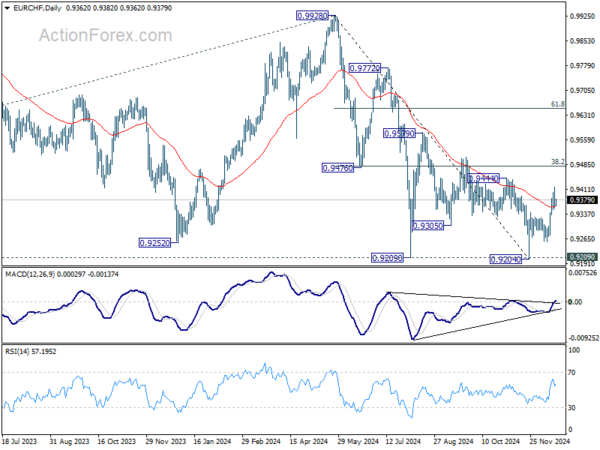

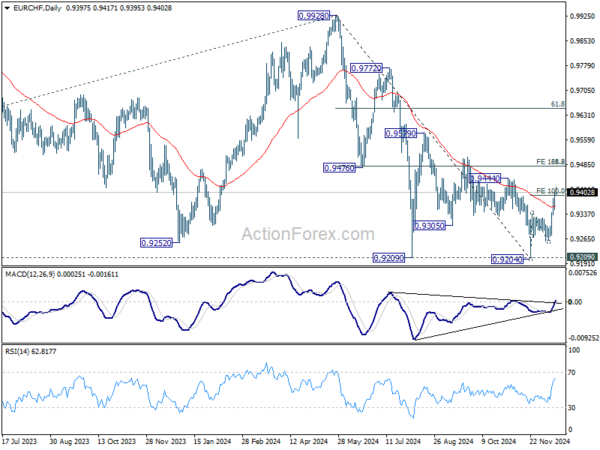

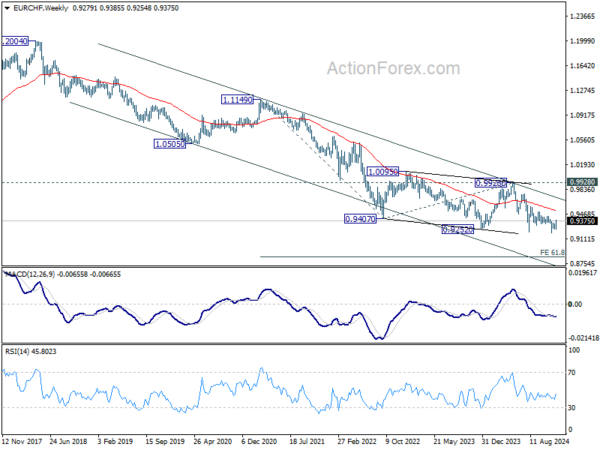

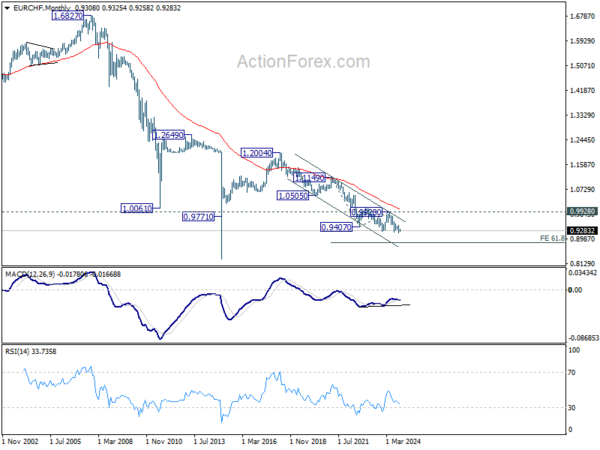

In the bigger picture, a medium term bottom is probably in place at 0.9204. More consolidations would be seen above there with risk of stronger rebound to 38.2% retracement of 0.9928 to 0.9204 at 0.9481. But outlook will remain bearish as long as 0.9481 holds and another fall through 0.9204 to resume larger down trend is in favor.