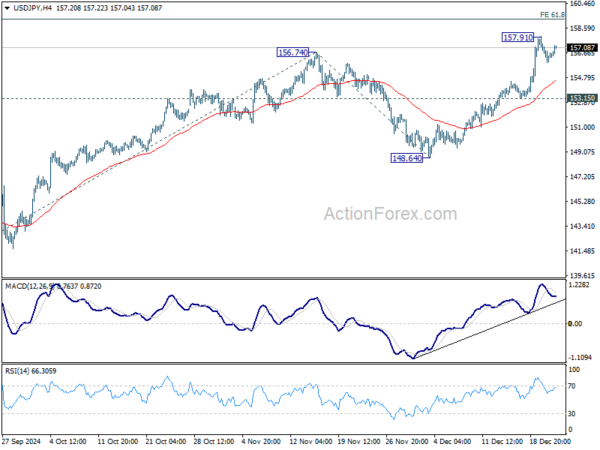

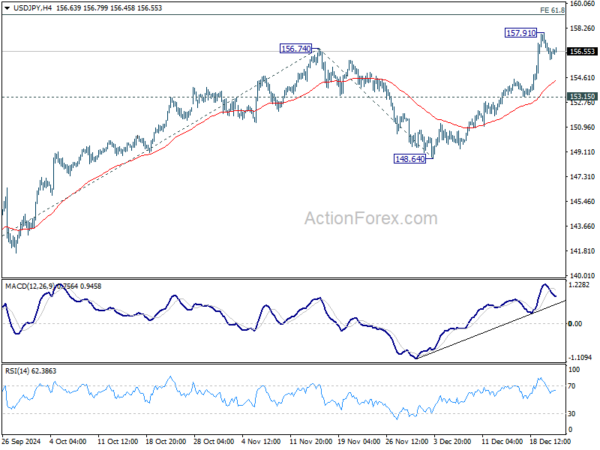

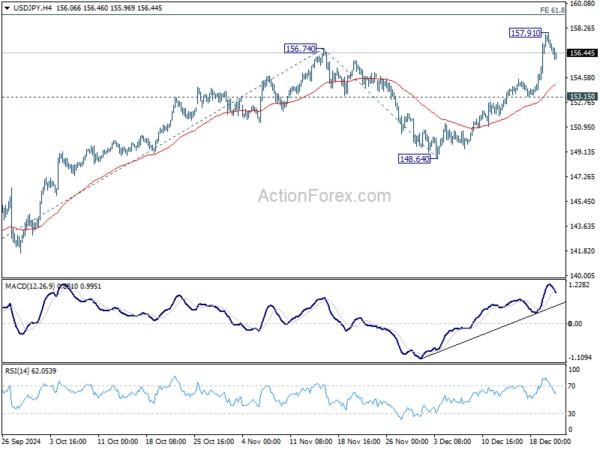

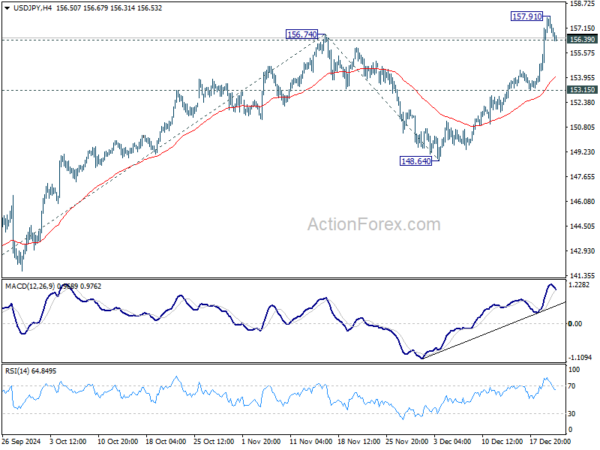

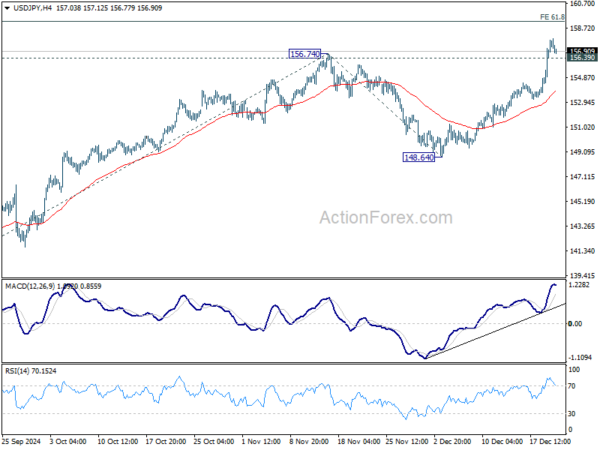

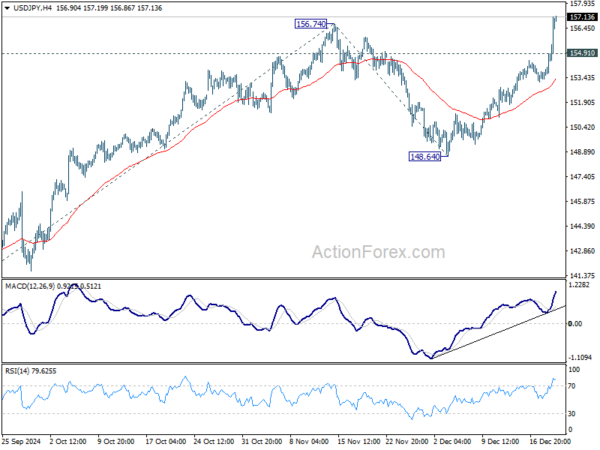

Daily Pivots: (S1) 155.64; (P) 156.78; (R1) 157.61; More…

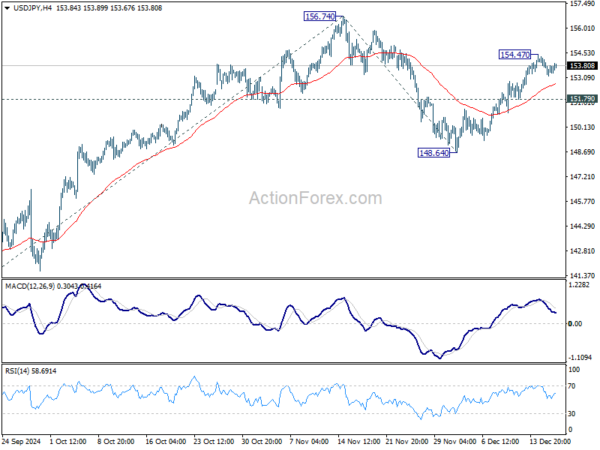

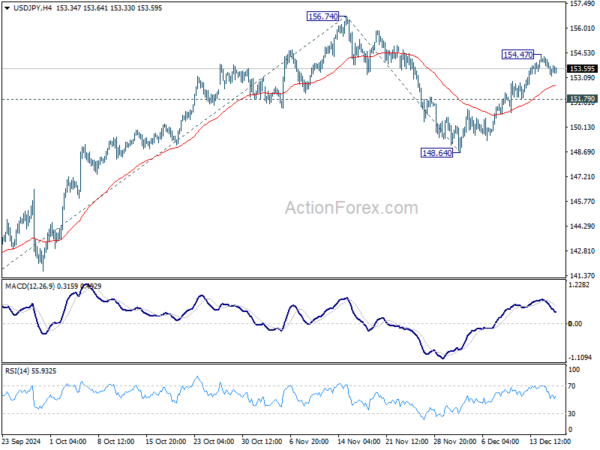

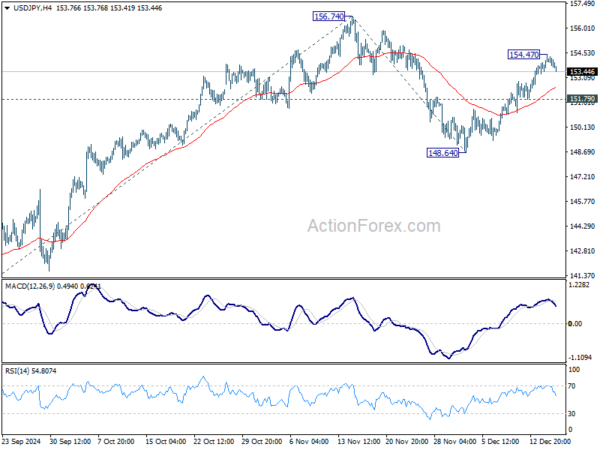

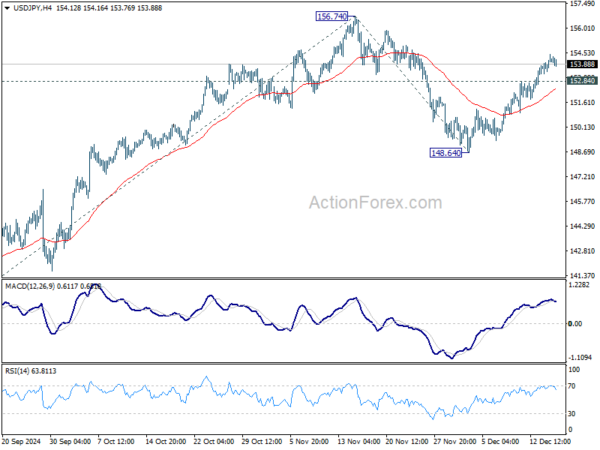

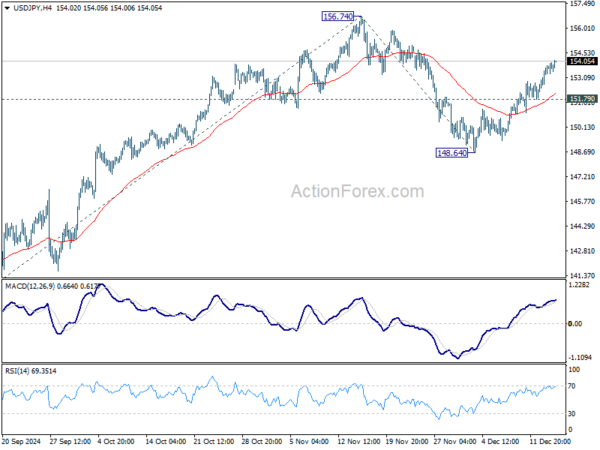

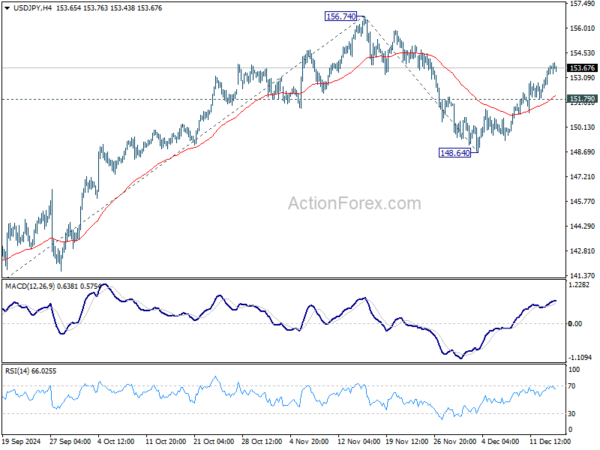

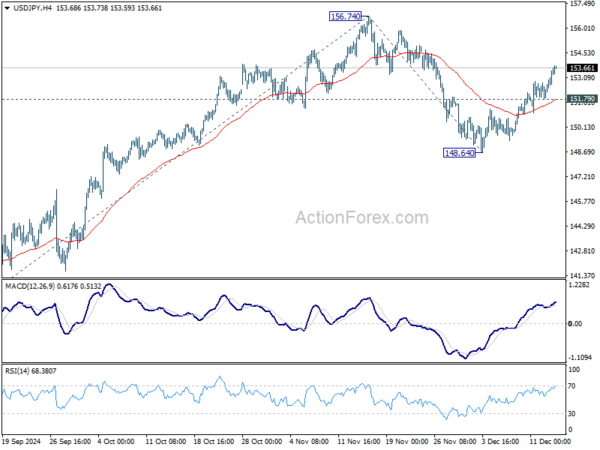

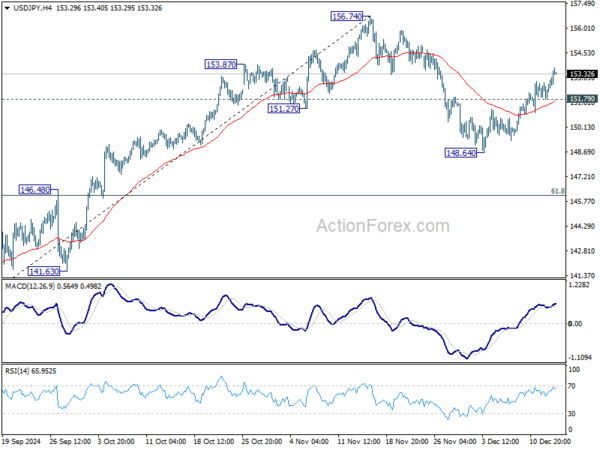

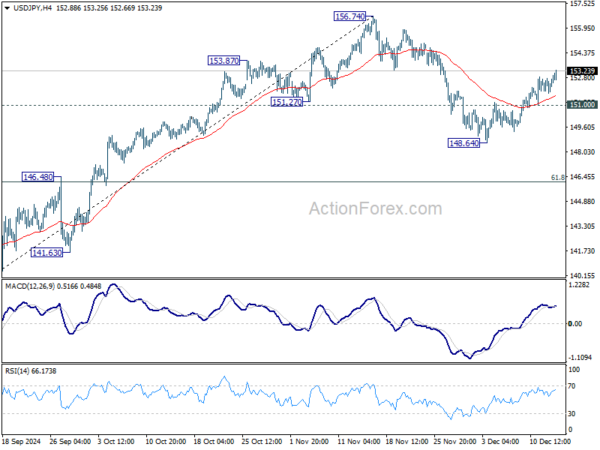

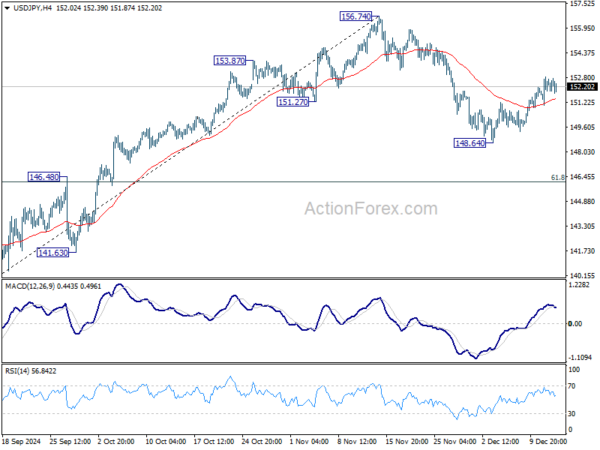

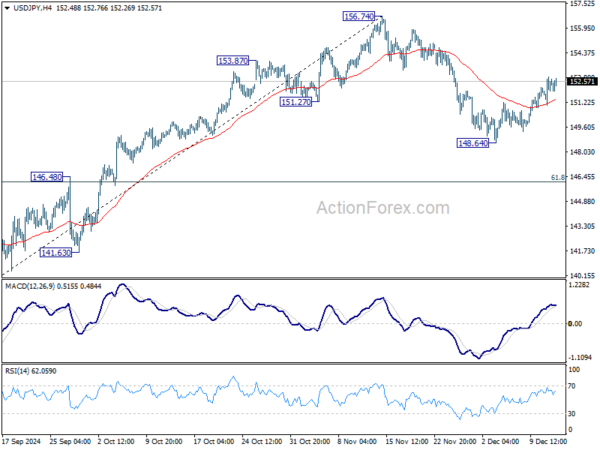

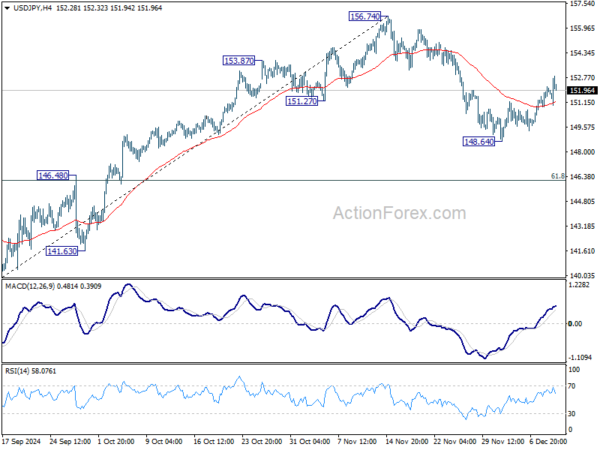

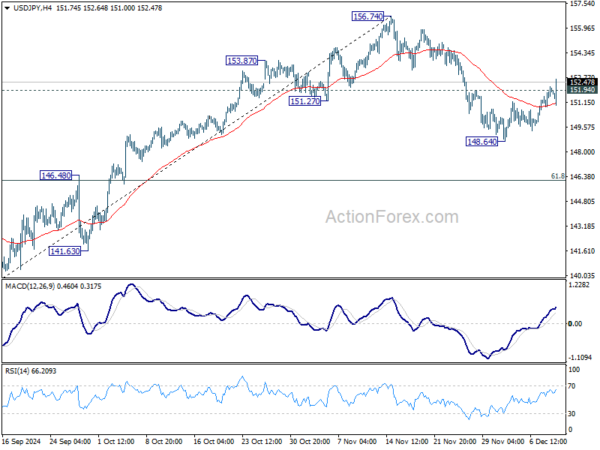

USD/JPY is staying in consolidation below 157.91 temporary top and intraday bias stays neutral. Deeper pull back cannot be ruled out, but outlook will stay bullish as long as 153.15 support holds. On the upside, break of 157.91 will resume the rally from 139.57 to 61.8% projection of 139.57 to 156.74 from 148.64 at 159.25 next.

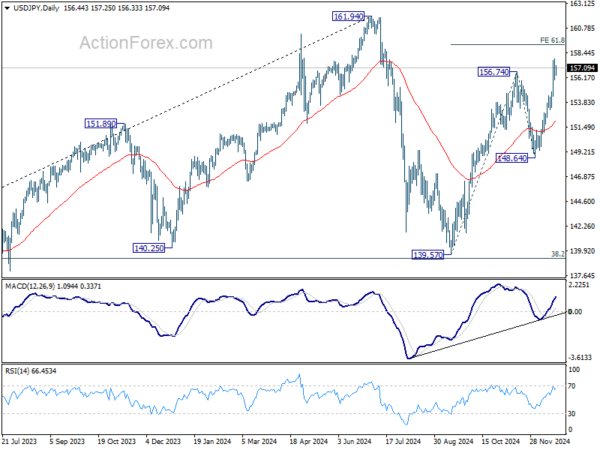

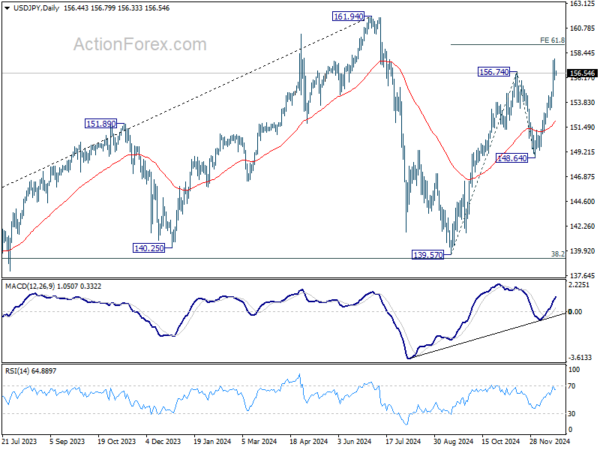

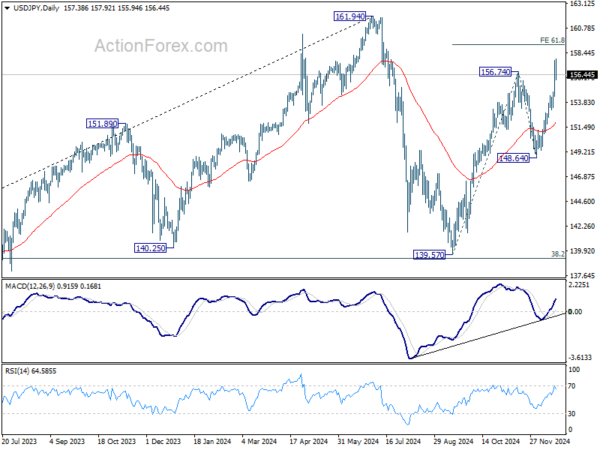

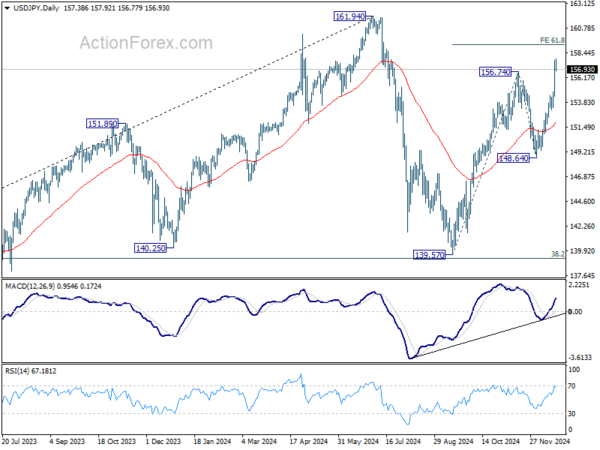

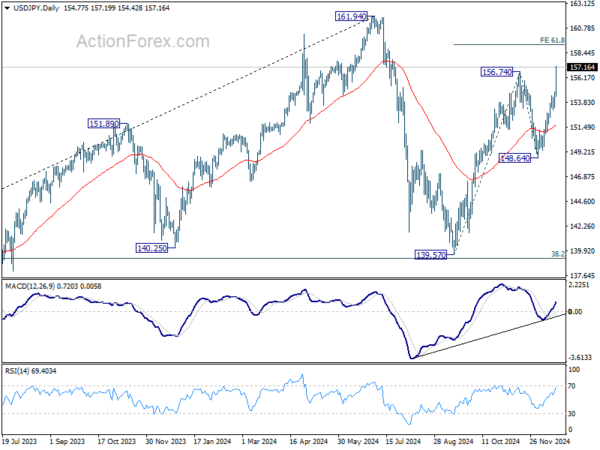

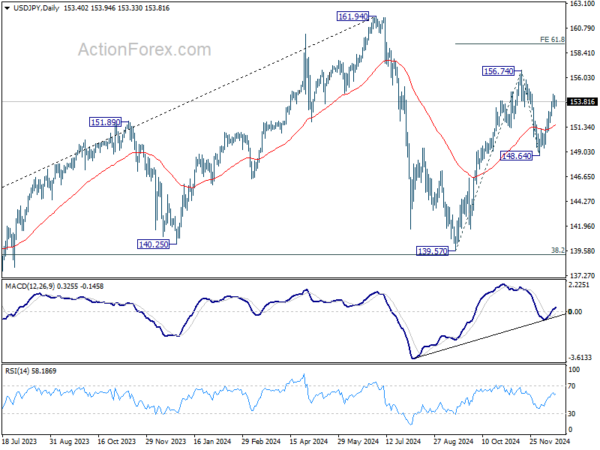

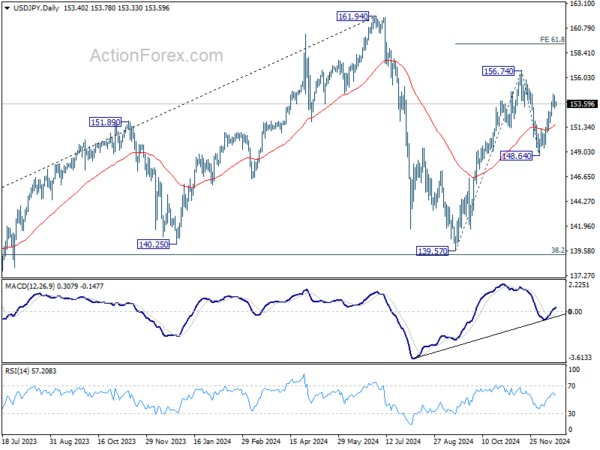

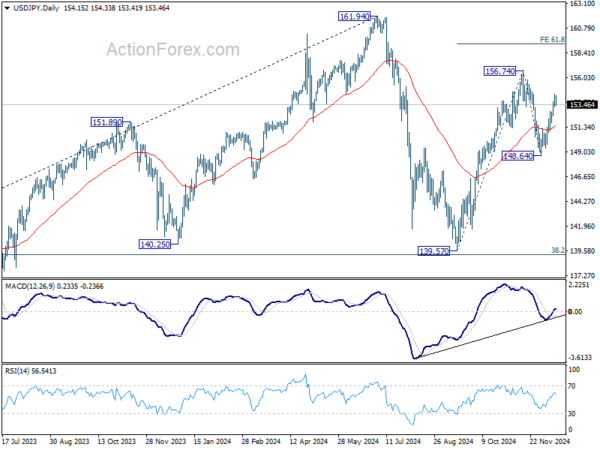

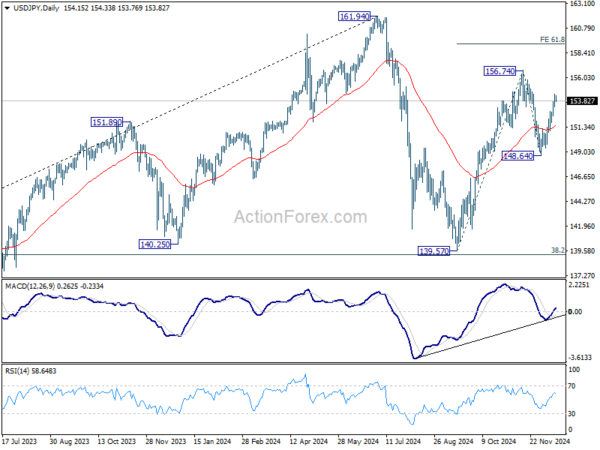

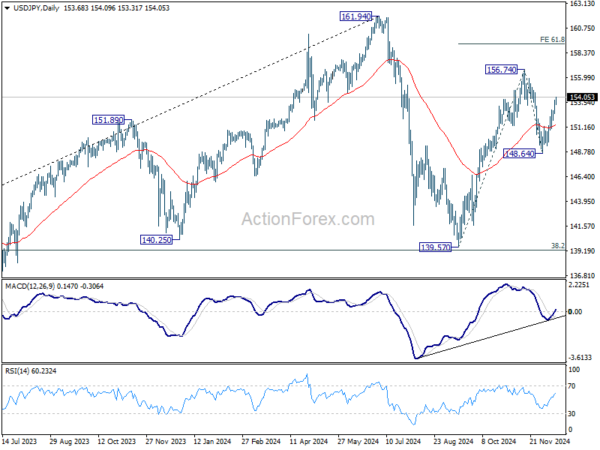

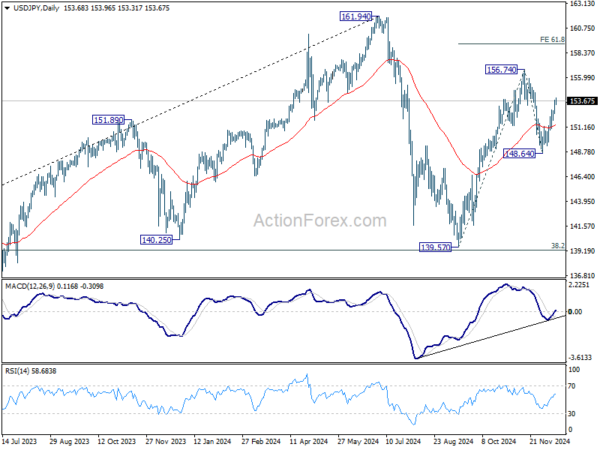

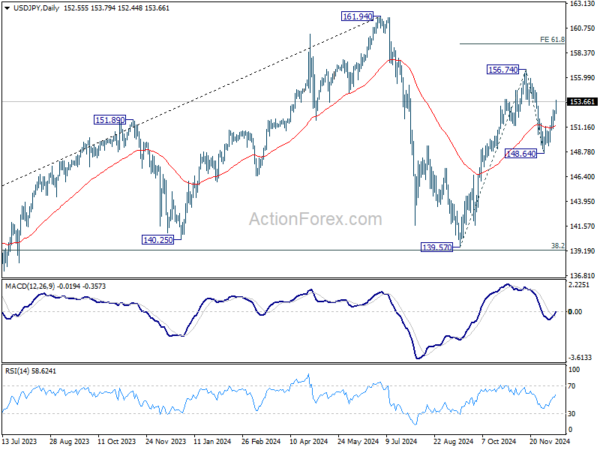

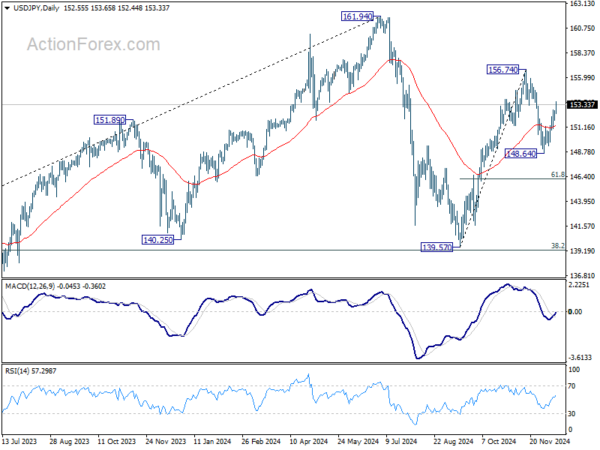

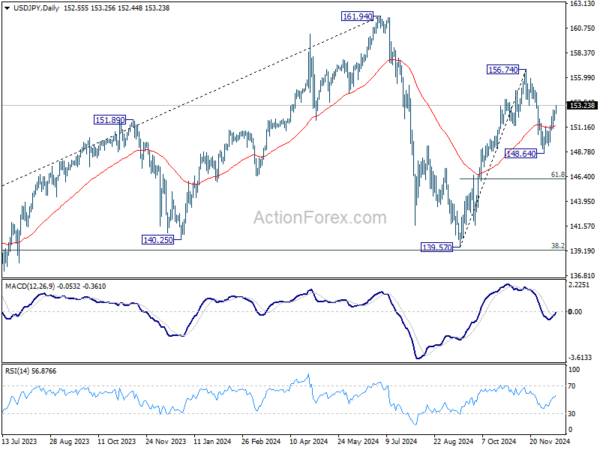

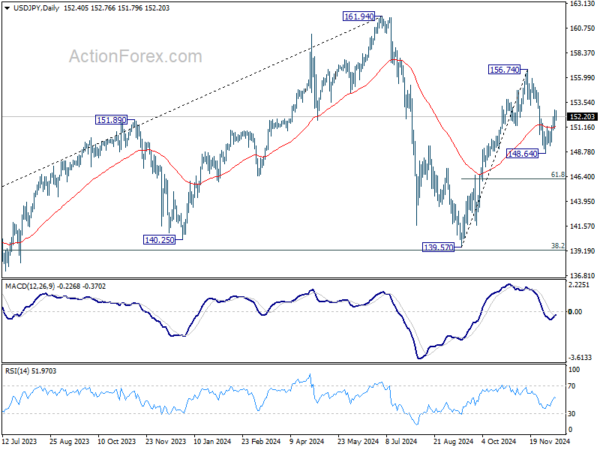

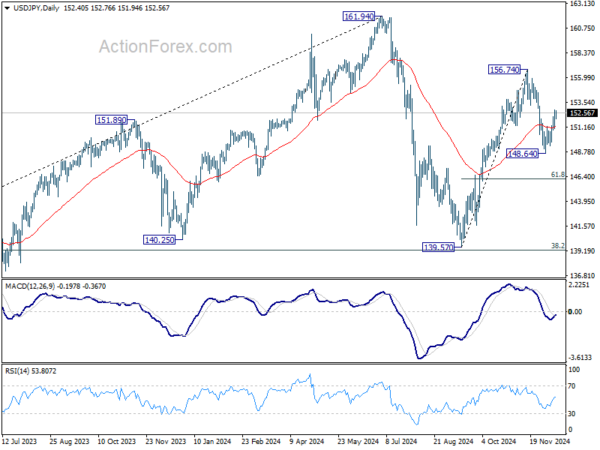

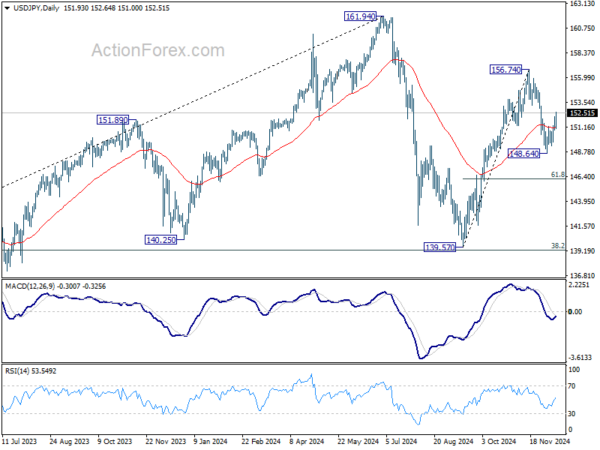

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.